Rachel Reeves floats capital gains tax raid as Treasury faces £40bn fiscal black hole

Rachel Reeves says 'working people have more money in their pockets' thanks to GDP figures |

GB NEWS

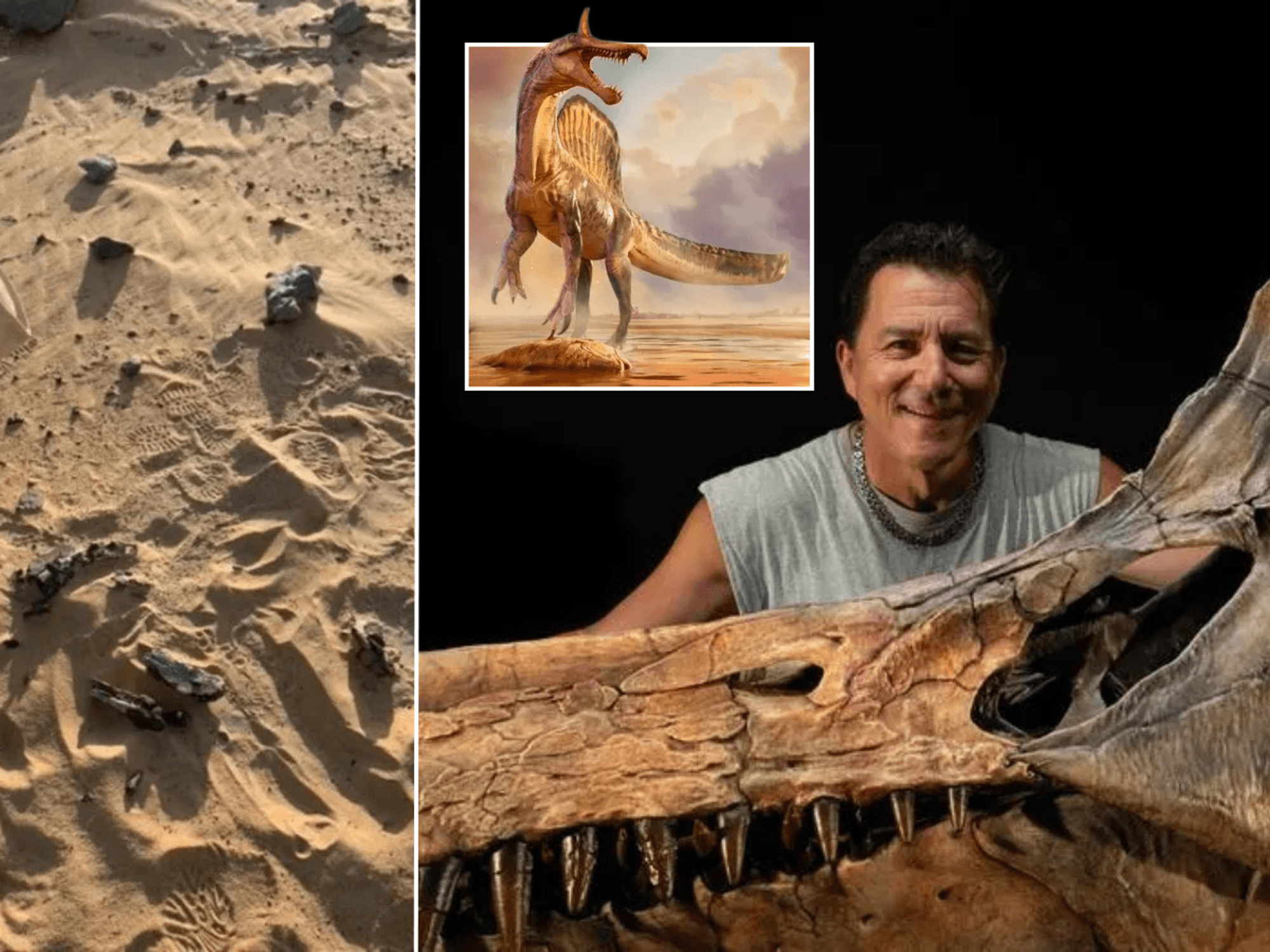

Capital gains tax is a levy on the profit when you sell an asset that has increased in value, which often includes properties

Don't Miss

Most Read

Treasury officials are exploring potential "mansion tax" on expensive properties as Chancellor Rachel Reeves seeks to address significant budget shortfalls.

It is understood that the Chancellor has instructed civil servants to investigate various methods of generating additional revenue from high-value properties, which may include possible modifications to capital gains tax regulations.

These deliberations come as the government grapples with a fiscal gap exceeding £40billion. Officials stress that these conversations remain preliminary, with no firm decisions reached regarding implementation or specific measures.

Currently, primary residences enjoy complete exemption from capital gains tax in the UK. The proposals under consideration would potentially eliminate this protection for properties exceeding a specific value threshold.

The Chancellor is reportedly exploring capital gains tax reform

|GETTY

Homeowners selling properties above this yet-to-be-determined limit would face CGT charges on their gains.

Present rates stand at 24 per cent for higher-rate taxpayers and 18 per cent for basic-rate taxpayers on property disposals.

An alternative approach being evaluated involves implementing an annual charge on high-value properties, similar to a mansion tax concept. This would represent a recurring levy rather than a one-time payment upon sale.

The Treasury confirmed its commitment to maintaining low taxes "for working people", reaffirming promises not to increase income tax, national insurance or VAT rates.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Expensive properties could be slapped by a capital gains tax raid

| PASuch measures would prove particularly challenging for residents who possess valuable properties but limited regular earnings.

Elderly homeowners who have occupied their residences for extended periods whilst living on modest pensions face especially severe consequences.

The proposals have sparked expectations of significant opposition from those affected by potential changes.

Many individuals residing in expensive homes lack substantial income streams to cover additional tax burdens.

MEMBERSHIP:

- Bournemouth is just the beginning. Vigilante groups are coming to a town near you - Renee Hoenderkamp

- Rachel Reeves' deceitful tax will leave you £82k poorer. And that's not even the worst of it - Kelvin MacKenzie

- Three SHOCK graphs expose who is REALLY crossing the Channel in small boats - and it's NOT women and children

- Trigger warning: What I have to say about Notting Hill Carnival will deeply upset the woke - Peter Bleksley

- POLL OF THE DAY: As the Chancellor eyes a property tax raid, do you fear further hikes in the Autumn budget? VOTE NOW

The Treasury acknowledged that discussions remain in their initial phases. "The best way to strengthen public finances is by growing the economy which is our focus.

Changes to tax-and-spend policy are not the only ways of doing this," officials stated.

LATEST DEVELOPMENTS:

Rachel Reeves is preparing for her Autumn Budget statement

| PAProperty wealth taxation has featured prominently in Labour discussions for years. The Liberal Democrats advocated similar measures during their coalition government in the early 2010s.

In her 2018 publication "The Everyday Economy", Reeves criticised the current council tax regime for its apparent unfairness.

"We should also consider the case for its overhaul and replacement with a property tax, levied on property owners. It would be more equitable and it would place the burden on landlords and not tenants," she wrote.

Deputy Prime Minister Angela Rayner previously suggested various wealth taxes in an internal document before the Spring Statement. Her proposals aimed to generate £3-4 billion annually but weren't adopted then.

More From GB News