Britons urged to act now as Rachel Reeves eyes 'targeted moves' on pensions and property to plug £50bn black hole

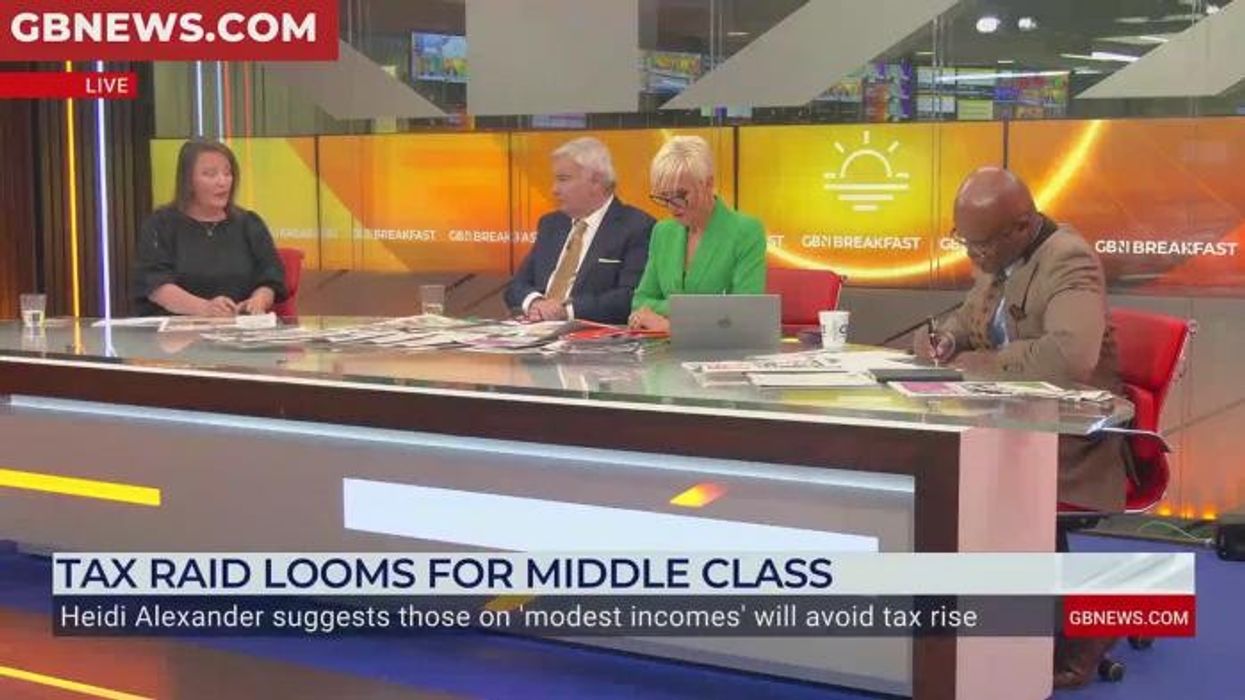

Eamonn Holmes sends warning to Keir Starmer as Rachel Reeves mulls stealth tax raid |

GBNEWS

Wealthier households could face new tax rules as experts warn the Treasury will go where the money is

Don't Miss

Most Read

Britons are being urged to act now as Chancellor Rachel Reeves is expected to target pensions, property and investment assets to fill the £50billion gap in the public finances.

The shortfall follows a Government U-turn on welfare and growing pressure from higher borrowing and weak economic growth.

Finance expert Nigel Green, CEO of the deVere Group, warned that "the question is no longer if taxes will rise in the UK, but how quickly and how sharply".

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

He said this is the time for anyone with UK-based assets to take action, as the Treasury is likely to focus on capital, investment income and property to raise revenue.

He added that wealth holders should expect "real, very targeted moves" on portfolios, pensions, business assets and property.

With Labour promising not to raise income tax on "working people", experts believe capital gains, dividends and inheritance could be next in line for reform.

Taking action before the autumn Budget, Green said, will give people the best chance to protect and grow their wealth.

His comments come as economists warn that the Chancellor is facing difficult choices after a Government U-turn on welfare created an unexpected £3billion hit to public finances.

Combined with higher borrowing costs and sluggish growth, the National Institute of Economic and Social Research (NIESR) now estimates a deficit of £41.2billion.

Wealth holders should expect "real, very targeted moves" on portfolios, pensions, business assets and property

|GETTTY

To meet her self-imposed fiscal targets and restore a £9.9billion buffer maintained since the 2023 Budget, Rachel Reeves will need to find £51.1billion by 2029.

Green explained Labour’s pledge not to raise income tax on "working people" leaves room for other tax changes.

He said: "They have been careful with the language and the definition. This leaves scope for significant moves on capital gains tax, dividend income, inheritance thresholds and so-called 'wealth loopholes'."

"This is where the money will come from and not just for the shortfall, but to fund public services and keep the bond markets happy.

"When Governments feel cornered, they move fast. The people who protect their wealth are the ones who plan early."

The Chancellor is facing difficult choices after a Government U-turn on welfare created an unexpected £3billion hit to public finances

| GETTYNIESR's deputy director for macroeconomics, Stephen Millard, told the BBC that Reeves may have no choice but to raise a major tax.

He said: "If she [Rachel Reeves] wants to raise £40billion then I think one of the big taxes is going to have to be raised. If she does that then it will break the Labour promise about raising taxes on working people."

A Treasury spokesperson said: "As set out in the plan for change, the best way to strengthen public finances is by growing the economy which is our focus."

But leading economists say Reeves is now facing an "impossible trilemma" - raise taxes, cut public spending or tear up her own borrowing rules, ahead of the autumn Budget.

However, not all experts agree that tax increases are inevitable.

Arjun Kumar, who leads Taxd and previously worked at PwC, contended that "the idea that Labour's only option to fill the £41billion black hole is to hike taxes is simply not true".

He pointed out that with Total Managed Expenditure at £1,285 billion, a comprehensive spending review could address the fiscal deficit without imposing additional levies on taxpayers.

Kumar argued: "Punishing hardworking people with higher taxes won't fix the economy; it will kill the growth we desperately need."

Experts have said taking action before the autumn Budget will give people the best chance to protect and grow their wealth

| PAHe advocated for "smart, targeted spending cuts and creating an environment where businesses can thrive" rather than pursuing tax increases.

The Taxd chief warned that "higher taxes will just send entrepreneurs and investment abroad, grinding our economy to a halt".

With targeted tax rises potentially on the table, those with savings, investments and property are being warned that now is the time to seek advice and make plans.

More From GB News