SHOCK graphs expose how Rachel Reeves's 'deceitful' tax could hobble homeowners - will YOU be stung?

Pensions will be considered part of someone's estate for inheritance tax under the Chancellor's reforms

Don't Miss

Most Read

Latest

GB News has crunched the numbers to determine the homeowners most at risk of being stung by Chancellor Rachel Reeves's planned inheritance tax (IHT) raid.

The planned overhaul sparked furore, with GB News columnist Kelvin MacKenzie branding it 'deceitful'.

In last year's Autumn Budget, the Chancellor announced pension savings would become liable for the HM Revenue and Customs (HMRC) levy from April 2027.

IHT is a tax charged on the estates of people who have passed away, which is charged at 40 per cent on asserts collectively valued above £325,000.

Based on research conducted by Quilter and NFU Mutual, GB News has created three shocking graphs breaking down how homeowners could be hit hard by Ms Reeves's inheritance tax raid.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

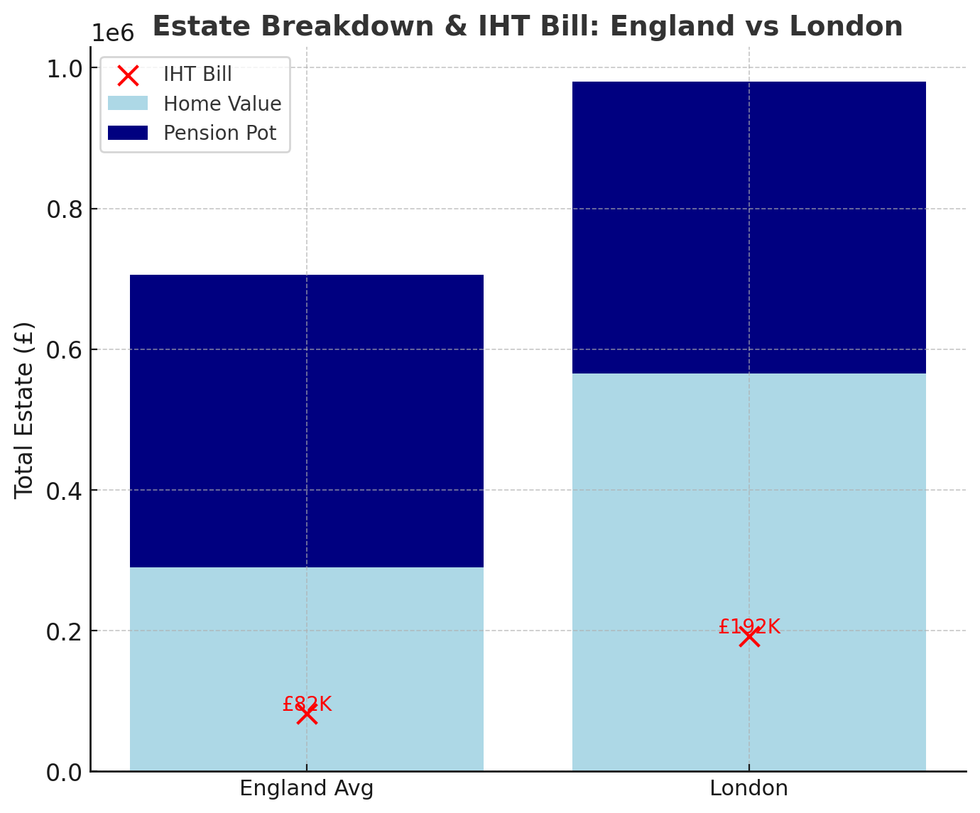

Under the Chancellor's IHT changes, London estates will pay significantly more than the rest of the country

|QUILTER / CHATGPT / HMRC

Research from Quilter highlighted that the average person impacted by these changes will be slapped with a £82,000, while living in London will be stung with a £192,000.

A working-age single homeowner in England with an average-priced home of £290,395 and a "moderate" pension pot of £415K would face an IHT bill of £82K.

With the same size £415,000 pension pot, a Londoner’s family would have to cough up £192,000 because house prices are double the national average at £565,637.

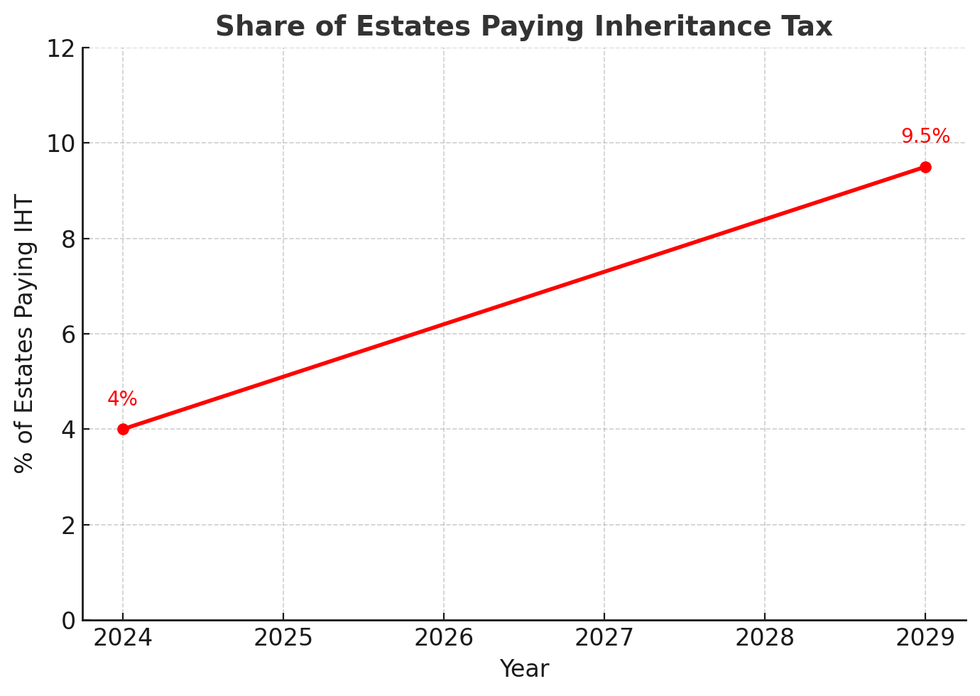

Due to this tax raid, the number of households paying death duties in Britain will jump from four per cent o 9.5 per cent by the end of this Parliament.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The percentage of households paying inheritance will jump to 9.5 per cent by the end of this parliament

|HMRC / QUILTER / CHAT GPT

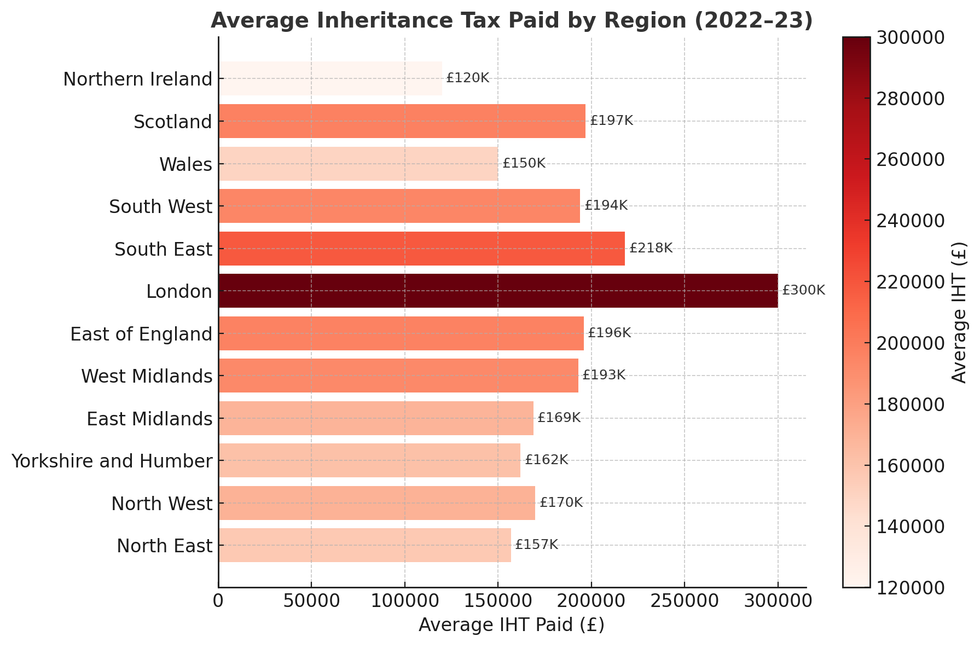

Analysis of HMRC figures conducted by NFU Mutual found that London paid almost three times more inheritance tax than Scotland, Wales and Northern Ireland combined in 2022-23.

Estates in London and the southeast paid £2.98billion of the £6.7billion raised in the UK by inheritance tax for the tax year ended April 2023.

As such, London and the south east accounted for 44 per cent of all UK inheritance tax in the tax year 2022-2023 and the average taxpayer in London was charged £300,000 from the levy.

Sean McCann, chartered financial planner at NFU Mutual, the financial advisory firm, said: "The proposal to bring pensions into the Inheritance tax net from April 2027 will only accelerate the number of families impacted.’’

MEMBERSHIP:

- Bournemouth is just the beginning. Vigilante groups are coming to a town near you - Renee Hoenderkamp

- Three SHOCK graphs expose who is REALLY crossing the Channel in small boats - and it's NOT women and children

- Trigger warning: What I have to say about Notting Hill Carnival will deeply upset the woke - Peter Bleksley

- POLL OF THE DAY: As the Chancellor eyes a property tax raid, do you fear further hikes in the Autumn budget? VOTE NOW

‘"We are seeing a sharp increase in calls from those seeking inheritance tax advice, particularly in light of proposed changes to Agricultural Property relief and Business Property relief from April next year which will have a huge impact on farming and business communities."

The financial planner gave advice to households looking to reduce their IHT liability before the Chancellor's change to the tax regime comes into effect.

LATEST DEVELOPMENTS:

How much is London paying in inheritance tax compared to the rest of the country

|GETTY

Mr McCann added: "One way to reduce the problem is to make gifts during your lifetime. While for most gifts you need to survive seven years to ensure they are tax free, there are some gifts which are exempt immediately.

“Each tax year you can give away gifts totalling £3,000 immediately free of inheritance tax. If you haven’t used the previous year’s allowance, you can go back one year and get it.

"For example, a couple could potentially give away £12,000 without having to worry about the seven-year clock.

"Regular gifts from your income which don’t impact your normal standard of living are also immediately exempt from Inheritance tax."

More From GB News