Rachel Reeves on hunt for Budget buffer as wealthy Britons face calls to 'contribute more' in tax

Rachel Reeves rules out VAT on private healthcare as Autumn Budget looms |

GB NEWS

The Chancellor will outline her fiscal vision for the country during her Autumn Budget on November 26

Don't Miss

Most Read

Chancellor Rachel Reeves is understood to be on the hunt for a bigger Budget buffer ahead of November 26 as she attempts to keep to her strict fiscal rules and bolster the economy.

Wealthy Britons are reportedly set to be urged to "contribute more" in tax to address the £30billion "black hole" in the public finances as part of plans being drawn up by the Treasury.

The move comes as Reeves aims to strengthen the government's defences against bond market turbulence and escalating borrowing costs by creating a larger fiscal buffer than previously planned.

Economic analysts anticipate the Chancellor will need to secure approximately £30billion through tax increases when she delivers her Autumn Budget next month.

It is understood Rachel Reeves is looking for Budget buffer to create for fiscal headroom ahead of her fiscal statement

|GETTY / PA

Treasury sources have confirmed to The Telegraph that Reeves will neither reduce public spending nor substantially expand government borrowing.

This strategic decision effectively leaves tax increases as the sole mechanism for closing the financial gap.

Sources familiar with the Treasury's thinking emphasised that any additional contributions would be sought fairly, with those requesting higher payments being asked to help "rebuild our public services"

The Chancellor's revised fiscal strategy involves expanding the financial cushion beyond the £9.9billion buffer she outlined in her March spring statement.

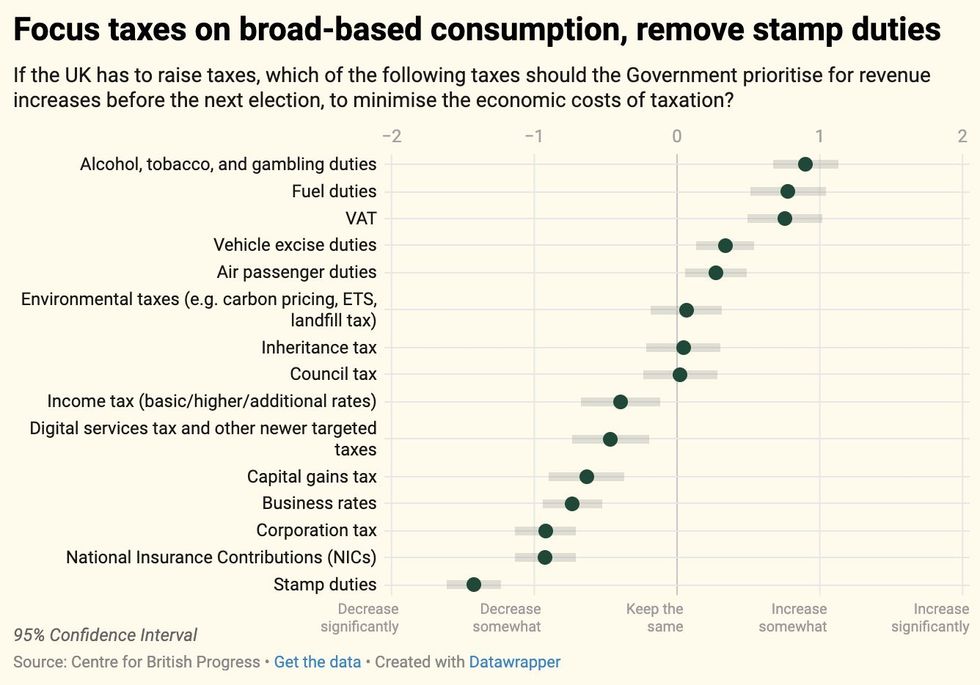

Which taxes do economists believe the Chancellor should target?

|CENTRE FOR BRITISH PROGRESS

Treasury sources have shared plans to establish greater protection for Government finances against potential economic shocks.

This enhanced buffer would serve as insurance against bond market instability and increasing borrowing costs that have affected Government finances since March.

A Treasury spokesperson confirmed the fiscal rules aim to maintain low interest rates whilst prioritising investment for sustained economic growth.

Plans to achieve £5billion in annual welfare savings have been abandoned, whilst government borrowing costs have exceeded expectations.

The Office for Budget Responsibility (OBR), Britain's fiscal watchdog is expected to revise growth forecasts downward, further complicating the fiscal outlook.

Economic think tanks have cautioned that maintaining minimal fiscal margins could trigger market speculation about future tax rises or spending reductions, potentially dampening economic activity.

George Williamson, the CEO of Level Group, previously broke down the levies the Treasury will likely target next month to address the Government's fiscal woes.

He explained: "It is predicted that the autumn budget will include a tax increase for higher earners and include decisions that might not be favourable for welfare and public welfare.

LATEST DEVELOPMENTS:

The Treasury is looking for ways to improve its fiscal headroom

| GETTY"It is imagined that further changes will be made regarding inheritance tax (IHT) too, in addition to the updates which are to come in April 2027 regarding pensions being included as part of the deceased’s estate. As it stands, IHT currently raises £7billion per annum for the Treasury and only four per cent of deaths currently result in an IHT charge.

"The current IHT threshold is £325,000 for the value of an estate, and it has been at this figure since 2009. However, the increase in property prices is already likely to lead to an increase in the number of estates subject to Inheritance Tax. With this in mind, there’s wide speculation that the budget will see increases to the amount of Inheritance Tax raised through variety of methods.

"One could be lowering of the £325,000 threshold to increase number of deaths incurring IHT, while another option could be the abolition of Residence Nil Rate Band when a property is left to children or grandchildren. Another potential change could see an update to the ‘seven-year rule’, where any gifts to relatives must be seven years in advance of death, otherwise the gift will be subject to tax."

The Treasury spokesperson stated: "This is the responsible choice - to reduce our levels of borrowing in the years ahead, so we can spend more on our public services, more on the priorities of working people and less on servicing debt."

More From GB News