Pension 'tax trap' could cost YOUR retirement up to £250,000 in savings

Analysts are urging Britons to make a 'modest sacrifice' to bolster their pension savings in retirement

Don't Miss

Most Read

Taxpayers earning just over £100,000 annually could forfeit more than £250,000 as part of a pension "tax trap" if they neglect to claim what they are owed, fresh research reveals.

Analysis from Rathbones, a major UK wealth management firm, demonstrates that individuals caught in the so-called £100,000 tax trap stand to lose £255,358 over two decades by failing to reclaim additional relief on their pension contributions.

The findings come as the self-assessment deadline draws near, prompting warnings that many higher earners remain unaware of the substantial sums they could recover.

Beyond pension losses, those affected also risk forfeiting valuable childcare support, according to the Rathbones study. The punishing 60 per cent marginal tax rate applies to anyone with earnings between £100,000 and £125,140, a consequence of the personal allowance being gradually withdrawn at these income levels.

Britons are at risk of a pension "tax trap" - how can you avoid it?

|GETTY

While basic rate relief of 20 per cent is automatically added to private pension contributions such as SIPPs, those in this income bracket can reclaim an additional 40 per cent through their tax return.

Based on annual pension contributions of £10,000, the cost of not claiming this extra relief amounts to £5,000 in a single year.

Over a decade, the missed opportunity grows to £89,666, assuming the unclaimed relief would have been reinvested at five per cent annual growth with contributions rising two per cent yearly.

Should investment returns reach seven per cent net of fees, the 20-year loss climbs to £318,825.

Rachel Reeves delivered the Budget in the Commons on November 26 | PA

Rachel Reeves delivered the Budget in the Commons on November 26 | PAEd Wood, a senior financial planner at Rathbones, said: "Earning just above £100,000 puts people in one of the most punitive tax positions in the UK but it also creates an opportunity.

"By giving up a small slice of heavily taxed income, individuals can not only stay eligible for important childcare support but also supercharge their retirement savings."

He added: "The numbers speak for themselves a modest sacrifice today can snowball into a sizeable sum tomorrow thanks to investment growth and compounding."

For those who have overlooked claiming relief in previous years, there remains an opportunity to recover funds.

HM Revenue and Customs (HMRC) permits taxpayers to back-claim for up to four tax years, which for someone facing the 60 per cent marginal rate could result in a refund of approximately £20,000.

Mr Wood notes that the tax authority has simplified the recovery process, making it more straightforward to reclaim what is owed.

With the self-assessment deadline fast approaching, Wood urges taxpayers to examine whether they have claimed their full entitlements.

The same principle extends to charitable giving through Gift Aid, he pointed out.

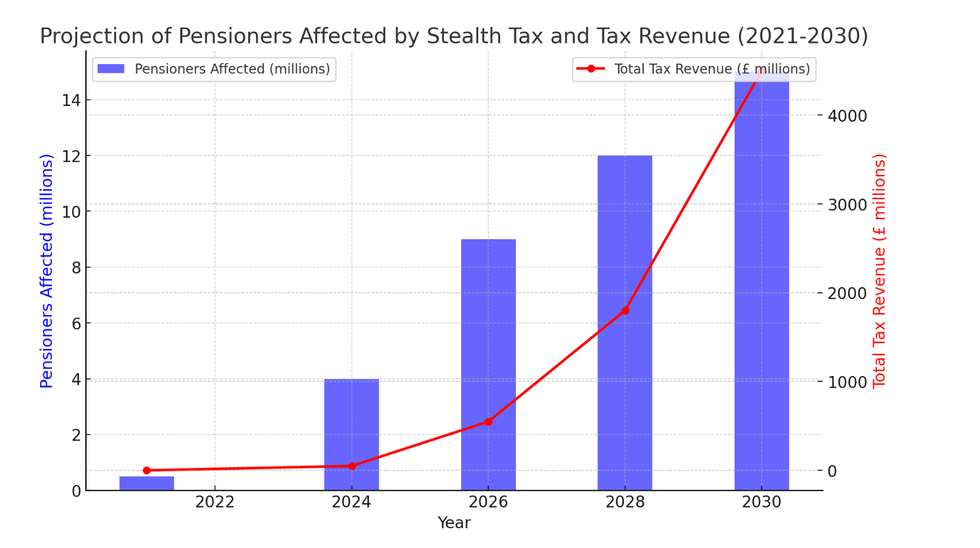

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT The same principle extends to charitable giving through Gift Aid, he points out.

Mr Wood said: "Even if you haven't made large charitable donations, you may have sponsored friends, colleagues or family members over the years.

"If the Gift Aid box was ticked, higher rate and additional rate taxpayers can reclaim extra relief on those contributions too."

He recommends checking fundraising platforms, which often retain records of past donations, to determine what can be recovered.

Higher rate taxpayers making £10,000 pension contributions could boost their retirement pot by £127,679 over 20 years by claiming the additional relief, while additional rate taxpayers could gain £159,599 over the same period.