Pension tax raid options REVEALED as Rachel Reeves could 'reduce' HMRC relief - full list here

Finance expert discusses how Reeves should deal with rising pension costs

|GB NEWS

Retirement experts are urging Rachel Reeves to avoid slashing tax-free relief attached to pension savings

Don't Miss

Most Read

Latest

Tax analysts are revealing the four ways in which Chancellor Rachel Reeves will likely target pension savings during her Autumn Budget if she decides to boost HM Revenue and Customs (HMRC) receipts via retirement pots.

Treasury figures reveal that higher and additional rate taxpayers received nearly 70 per cent of all pension tax relief during 2023-24, prompting speculation about potential reforms in the Chancellor's fiscal statement on November 26.

The chancellor faces pressure to address the substantial cost of pension relief, which reached £78.2billion in the last financial year, rising from £72.1billion during the previous 12 months..

Analysis by NFU Mutual shows that taxpayers paying the 40 per cent higher rate captured 55 per cent of relief, while those on the 45 per cent additional rate secured 13 per cent.

NFU Mutual is sharing how the Chancellor could tax pensions in her upcoming Budget

|GETTY / PA

Basic rate taxpayers received just one-third of the total relief, which the financial services highlighting evidence of the system disproportionately benefiting wealthier individuals.

In preparation for Ms Reeves's Budget, NFU Mutual broke down the likely ways pension savings could be taxed:

- Reduce the amount that individuals can pay into pensions each year

- Charge employer National Insurance contributions (NICs) on money paid into employees’ pensions

- Charge income tax on all pension death benefits

- Cut maximum tax-free lump sum limit to £150,000.

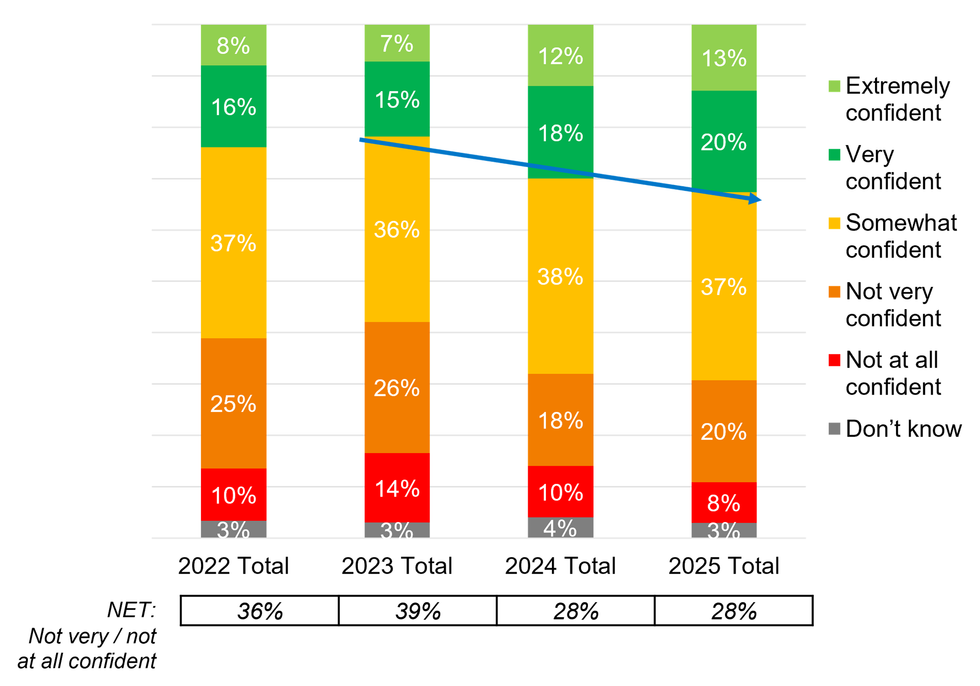

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON One significant option under consideration involves slashing the yearly pension contribution cap from its current £60,000 threshold to £25,000.

This would particularly affect those earning 40 and 45 per cent tax rates, as well as individuals approaching retirement who are attempting to boost their pension savings.

Sean McCann, chartered financial planner at NFU Mutual, said: "This change has the advantage of being simple to introduce from an administrative perspective - unlike the introduction of a flat rate of tax relief on all pension contributions which would bring complexity, particularly for employers and employees."

The current £60,000 threshold was raised from £40,000 in March 2023 during previous Chancellor Jeremy Hunt's tenure under the Conservative Party-led Government.

A second proposal involves introducing National Insurance charges on employer pension contributions, which currently escape such levies. HMRC estimates that National Insurance relief on these contributions cost £24billion in 2023-24.

"The Chancellor could levy NIC at a lower rate of five per cent on employer pension contributions to clawback some of this cost, this would still make it attractive for employers to pay money into their employees pensions," Mr McCann said.

Additionally, the Treasury might eliminate the tax exemption on pension death benefits for those dying before 75.

Mr McCann warned: "Coupled with the government's proposal to include unspent pensions in IHT calculations from April 2027, this would be a double blow for some bereaved families."

LATEST DEVELOPMENTS:

The Treasury is looking for ways to improve its fiscal headroom | GETTY

The Treasury is looking for ways to improve its fiscal headroom | GETTYThe final measure being considered would reduce the tax-free cash allowance from £268,275 to £150,000.

This change would affect individuals whose pension pots exceed £600,000, as they can currently withdraw 25 per cent tax-free from age 55.

On this option, the retirement expert added: "Reducing the tax-free cash limit to £150,000 would impact those who have or are likely to have in the future pension savings of more than £600,000 by exposing more of their funds to tax when they take the benefits."

He noted: "Given that most people have pensions valued at significantly less than £600,000 it would be viewed as a tax raising measure focused on wealthier investors."

More From GB News