Retirees face 'paying back their state pension to HMRC' under Winter Fuel Payment tax rule change

GB NEWS

Pensioners could be entitled to hundreds of pounds in energy bill support thanks to the Winter Fuel Payment scheme

Don't Miss

Most Read

Thousands of state pensioners could forced to pay £200 to the tax man under new Winter Fuel Payment rules after last year's U-turn from the Labour Government.

Financial advisory firm Quilter has calculated that retirees on the full new state pension could see their energy bill support effectively wiped out through income tax payments by the 2029/30 tax year if ministers continue the current freeze on tax thresholds.

The firm's research indicates that those with total earnings under £35,000 would begin paying income tax on their state pension from the 2027/28 tax year.

Analysis demonstrates how the combination of static tax thresholds and regular state pension increases under the triple lock guarantee creates a situation where pensioners' tax bills would equal the value of their winter heating support by the end of the decade.

Will you need to pay back your Winter Fuel Payment?

|GETTY

It should be noted that assumes a three per cent rise in state pension for 2027/28, based on Bank of England inflation forecasts, followed by the minimum 2.5 per cent annual increases guaranteed under the triple lock system.

This would push the full new state pension to £13,623.83 by 2029/30. HMRC's (HM Revenue and Customs) calculation method combines one week at the previous year's rate with 51 weeks at the new rate when determining taxable income.

For the 2026/27 tax year, this formula would produce a taxable figure of £12,536.55, remaining just below the personal allowance threshold.

However, if the £12,570 personal allowance stays frozen until 2029/30, retirees would face a tax bill of £200.17.

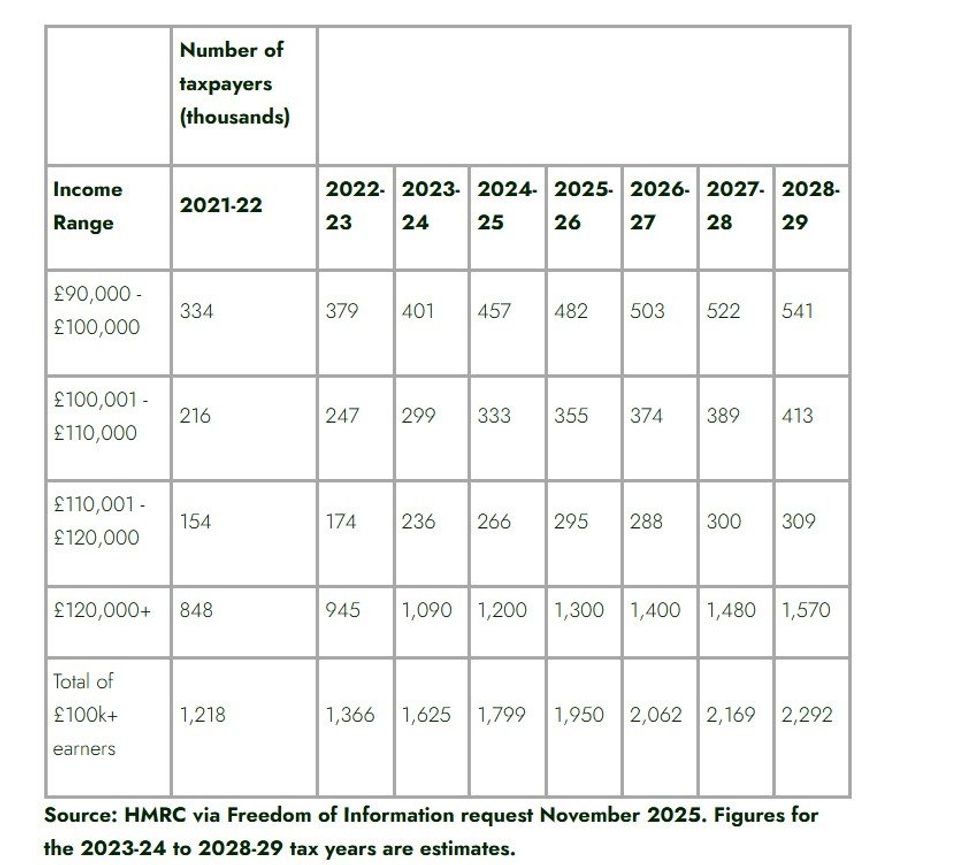

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC The analysis highlights that the £35,000 income ceiling for Winter Fuel Payment eligibility remains static, meaning retirees with approximately £22,000 in additional income could lose the benefit entirely as state pension rises push their total earnings above the threshold.

The firm's projections represent conservative estimates, as the 2.5 per cent figure is the minimum guaranteed increase under the triple lock mechanism.

Higher inflation or wage growth would accelerate the timeline, potentially causing pensioners to forfeit their Winter Fuel Payment through taxation before 2029/30.

This creates an additional form of fiscal drag beyond the frozen income tax thresholds.

Adam Cole, a retirement specialist at Quilter, warned: "Should the Government opt to extend the freeze on income tax thresholds, we will soon be in a perverse situation where pensioners will have to start paying back their state pension to HMRC."

He noted that the Chancellor had previously described threshold freezes as harmful to working people during her 2024 budget announcement.

"Had the basic rate threshold increased in line with inflation since it was first frozen in 2021, it would now be worth £15,656," Mr Cole explained.

He suggested the Chancellor faces difficult choices whilst attempting to address fiscal challenges without breaking Labour's manifesto commitments.

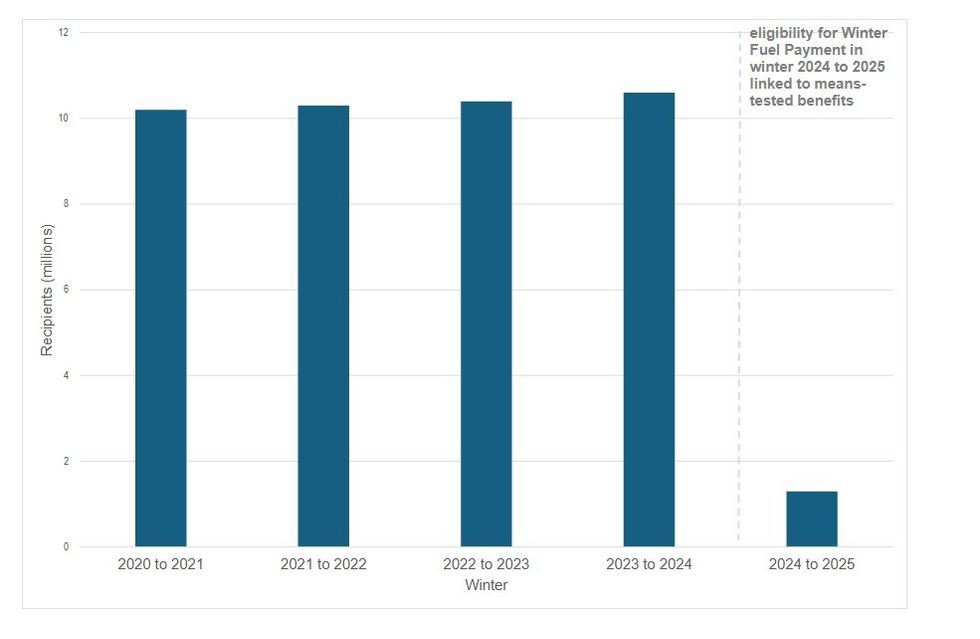

Eligibility of Winter Fuel Payment in winter 2024 to 2025 linked to means-tested benefits | DWP

Eligibility of Winter Fuel Payment in winter 2024 to 2025 linked to means-tested benefits | DWPLast year, ministers means-tested Winter Fuel Payments by linking eligibility to benefit payments from the Department for Work and Pensions (DWP), such as Pension Credit.

However, from this year, the majority of pensioners will be entitled to the energy bill support if they their annual earnings are below the £35,000 taxable income threshold.

Once someone's income crosses this amount, their Winter Fuel Payment will be clawed back by HMRC through tax.

Chancellor Rachel Reeves will provide a further update on potential changes to energy bill support and the tax regime in tomorrow's Budget statement.