Rachel Reeves 'controversial plan' to cost working-age Britons extra £250 a year

The decision to freeze the student loan repayment threshold has come under fire

Don't Miss

Most Read

Chancellor Rachel Reeves has sparked widespread criticism following her Budget announcement to hold the student loan repayment threshold at £29,385 until 2030, a move affecting approximately four million graduates across the country.

The freeze means those with outstanding student debt could face roughly £250 in additional annual deductions from their wages by the time the threshold begins rising again.

According to Charlene Young, senior pensions and savings expert at AJ Bell, the lifetime cost of this policy shift could reach nearly £10,000 in extra repayments for graduates making deductions across the full 30-year term, though this figure remains uncertain due to inflation variables.

"It has led to accusations Government has unfairly reneged on the terms school-leavers signed up to," Young said, noting that some have gone as far as comparing the Chancellor's approach to that of a loan shark.

Graduates are losing out due to the Chancellor's decision to freeze student loan repayments

|GETTY

Those earning below the threshold remain unaffected, paying nothing towards their loans. However, the frozen repayment trigger will pull some graduates into making contributions who would otherwise have stayed beneath it as wages naturally increased.

Higher earners face a particularly punishing combination of deductions. Graduates on elevated salaries already surrender more than half of every pay rise once income tax at 40 per cent, National Insurance at two per cent, and the nine per cent student loan contribution are combined.

Ms Young explained: ""They lose £51 from a £100 pay. To put things pounds and pence figures for recent graduates aspiring to a successful career, median pay in London is on course to exceed £60,000 by 2030 when the student loan repayment freeze ends.

"A graduate who went to Uni during the pandemic and took a plan 2 loan, who now works in London and progresses their way up to a £60,000 salary around their 30th birthday will be looking at income tax of around £11,500, National Insurance of £3,200 and student loan deduction of £2,800.

He slammed both Rachel Reeves and Sadiq Khan on business rates | GETTY

He slammed both Rachel Reeves and Sadiq Khan on business rates | GETTYLATEST DEVELOPMENTS

Plan 2 student loans will remain frozen at £29,385 for three years | GETTY

Plan 2 student loans will remain frozen at £29,385 for three years | GETTY"Once you factor in a modest five per cent personal pension contribution take home income slips below £40,000 a year." Ms Young offered a practical benchmark for those weighing their options.

He said: "As a rough guide, around the £60,000 salary mark, graduates with a £50,000 balance on a plan two loan start paying back the capital on the loan."

Once earnings surpass this level, the likelihood of repaying before the 30-year write-off increases substantially, strengthening the argument for voluntary overpayments.

Ms Young suggested that many will opt to have children take out student loans initially while maintaining cash reserves to assess whether voluntary overpayments make sense once careers develop.

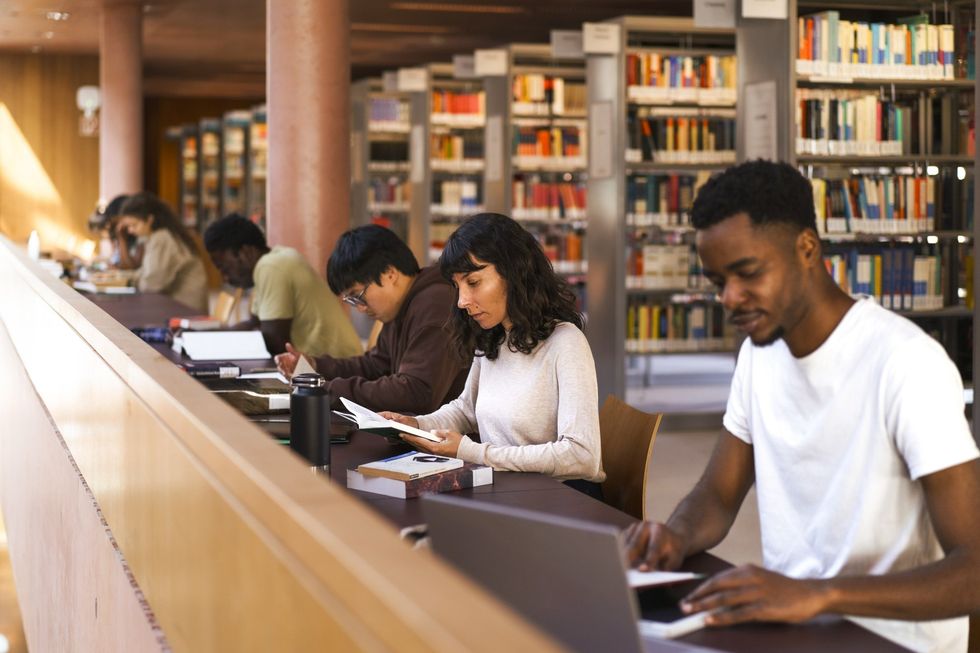

There are concerns graduates aren't receiving the proper skills to gain employment | GETTY

There are concerns graduates aren't receiving the proper skills to gain employment | GETTY"If by their mid 20s it seems that clearing the loan early would be a sensible move then parents could gift children the cash to make voluntary overpayments and clear the debt," she advised.

Last month, Ms Reeves claimed the Labour Government's decision to freeze the repayment threshold for some student loan borrowers was "fair and proportionate".

More From GB News