Pension system overhaul confirmed as Labour to force workers to save more for retirement under 'reforms'

Keir Starmer refuses to rule out taxing pension contributions in Autumn Budget |

GB NEWS

Labour is looking to get Britons saving more money into their private and workplace pension pots

Don't Miss

Most Read

Latest

The Labour Government is preparing to launch a major pension review as part of efforts to bolster peoples' retirement savings but what does it mean for your money? Labour is reintroducing the Pensions Commission amid growing anxiety that working-age people are at greater risk of poverty in retirement than their parents.

Analysts have warned that those looking to retire in 20250 are line to claim £800 a year less than current pensioners. According to the Department for Work and Pensions (DWP), 45 per cent of working-age people are not putting any cash into their pension pots.

Work and Pensions Secretary Liz Kendall has claimed the Pensions Commission will "tackle the barriers that stop too many savings in the first place". Under the previous commission, auto-enrollment was suggested, which has seen the number of eligible employees saving rise from 55 per cent in 2012 to 88 per cent.

However, DWP figures suggest that DWP around 15 million people continue to undersave for retirement, with the self-employed, low paid and some ethnic minorities particularly affected. Furthermore, around three million self-employed people are believed to be saving nothing for their retirement.

Labour are unveiling their Pensions Commission later today

|GETTY

What are Labour's pension reforms?

As part of the Commission, led by Baroness Jeannie Drake, ministers are set to compel working-age Britons to save more into their workplace and private pension schemes.

Workers could potentially be forced to pay thousands more in savings every year with money from their wages being funneled into stocks and shares run by City of London money managers.

Companies are also expected to be asked to pay out millions more in worker pension contributions to match the employee increases. As it stands, at least eight per cent of salaries are paid into pension pots with employees required to save a minimum five per cent and firms paying three per cent.

Previously, the Government has pledged to not hike the rate paid by employers during this Parliament, which means that any increase is more likely to be introduced gradually in the 2030s.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

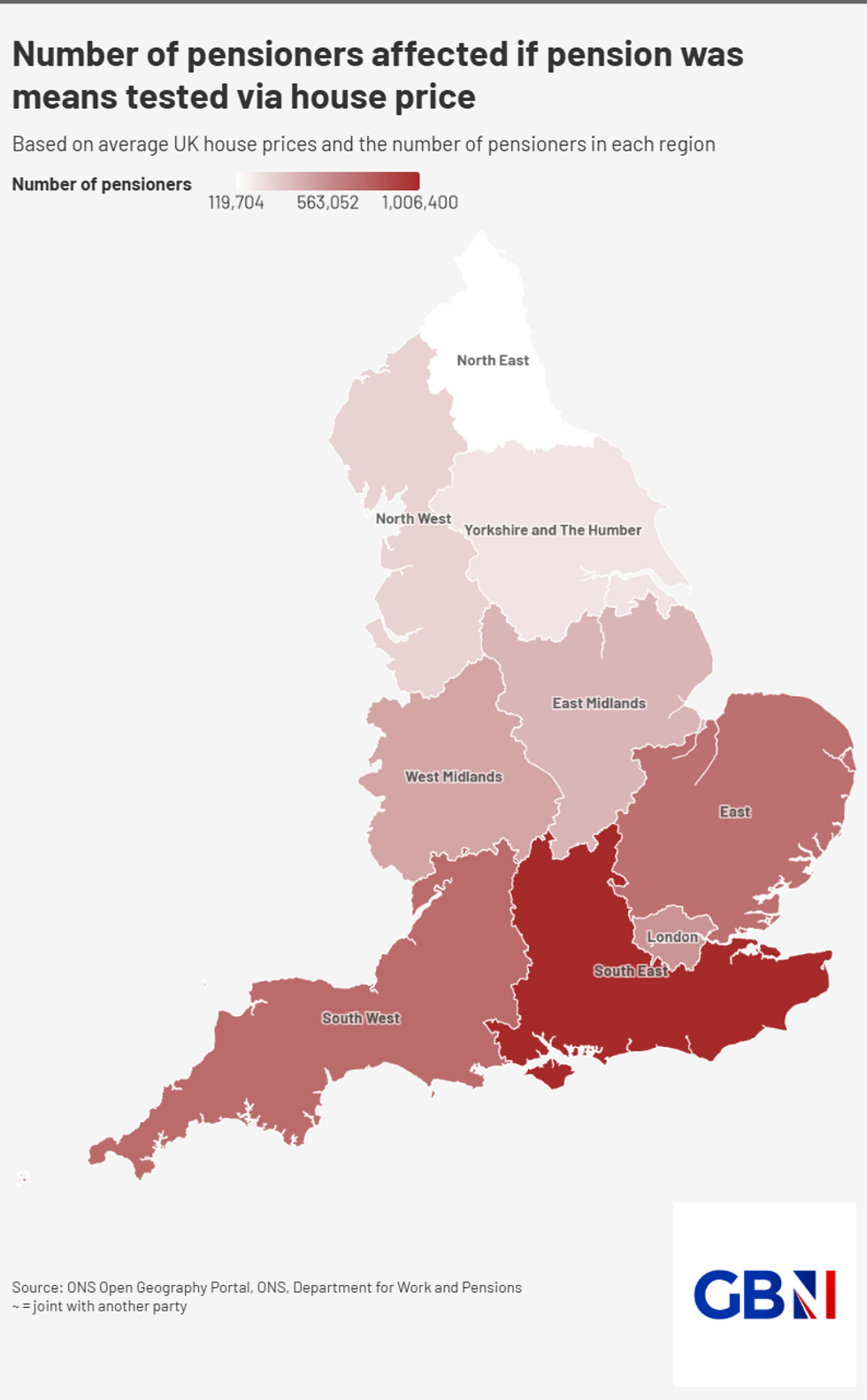

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNHow will your money be impacted?

The Commission's primary goal is to ensure more people are saving into a pension pot, which will likely impact those on a defined contribution (DC) schemes. These schemes give someone a retirement income based on how much they put in the pot.

Many workers are also enrolled in "defined benefit" schemes, which instead gives workers a guaranteed income in retirement based on their years of service. Likely reforms coming out of the Commission will likely see people paying more to their retirement savings from their wages, meaning less take-home-pay.

As well as this, the Commission's purview is expected to look into the role of the state pension in helping people through retirement.

It should be noted that any changes are rolled out as part of the looming reforms will likely not come into effect from after 2029 at the earlierst.

On the Pensions Commission, Caroline Abrahams, charity director at Age UK said: "We warmly welcome the Pensions Review, which has the potential to lay the foundations for a system of retirement saving that's fit for the future.

"If we’re to avoid future generations of pensioners experiencing financial hardship, we need reforms that enable more people to build a decent standard of living, and we need them sooner rather than later to maximise the numbers who can be helped.

LATEST DEVELOPMENTS:

DWP minister Liz Kendall has spearheaded drastic reform to the welfare system | PA

DWP minister Liz Kendall has spearheaded drastic reform to the welfare system | PA "Income for pensioners in the UK is based around both State and private pensions working together to help people enjoy a decent lifestyle once retired. The current system of saving has some significant gaps which have left many current pensioners struggling to make ends meet.

"Hopefully this can be avoided in future and particularly disadvantaged groups, including low-paid women and self-employed people on low incomes, can be helped to put money aside when appropriate for them to do so."

Catherine Foot, the director of the Standard Life Centre for the Future of Retirement, added: "It’s positive to see that the Commission will be made up of those from the previous review as well as experts from business and policy which will help forge a common view on the way forward, given the complexity of our pensions system.

"This independence has worked well in the past with the Turner Commission which laid the important foundations for automatic enrolment. This successfully laid the groundwork for higher participation, but current minimum rates will not provide enough savings for most people to achieve an adequate retirement income."

More From GB News