State pension proposal calls for triple lock to be axed as 'working-age people face low living standards'

GB NEWS

The state pension triple lock is under threat

Don't Miss

Most Read

The Institute of Fiscal Studies (IFS) has called for the abolition of the triple lock on state pensions, proposing a new four-point pension guarantee to address mounting sustainability concerns.

These recommendations from the think tank comes as the retirement benefit's costs are expected to triple by the end of the decade, placing significant pressure on Government finances.

This proposal from the IFS was published in its final assessment of the Pensions Review earlier this month, warning that the ageing population is straining the state pension system.

According to the organisation, there is currently "low confidence in how much the state pension will provide in the future" and urged decisive action to reform the current system.

The state pension triple lock is under threat

| GETTYUnder the proposed four-point guarantee, the Government would set a target level for the new state pension as a percentage of economy-wide average earnings, currently worth 30 per cent of median full-time earnings.

The triple lock mechanism could be used to reach this target, but once achieved, the state pension would rise in line with average earnings growth over the longer term.

As such, the pension would always increase at least as fast as inflation, with temporary above-target rises when earnings growth falls below inflation, following the Australian model until returning to target.

Furthermore, the IFS recommends the Government commit to never means-testing the state pension and link pension age rises to longevity increases, though by less than those increases.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

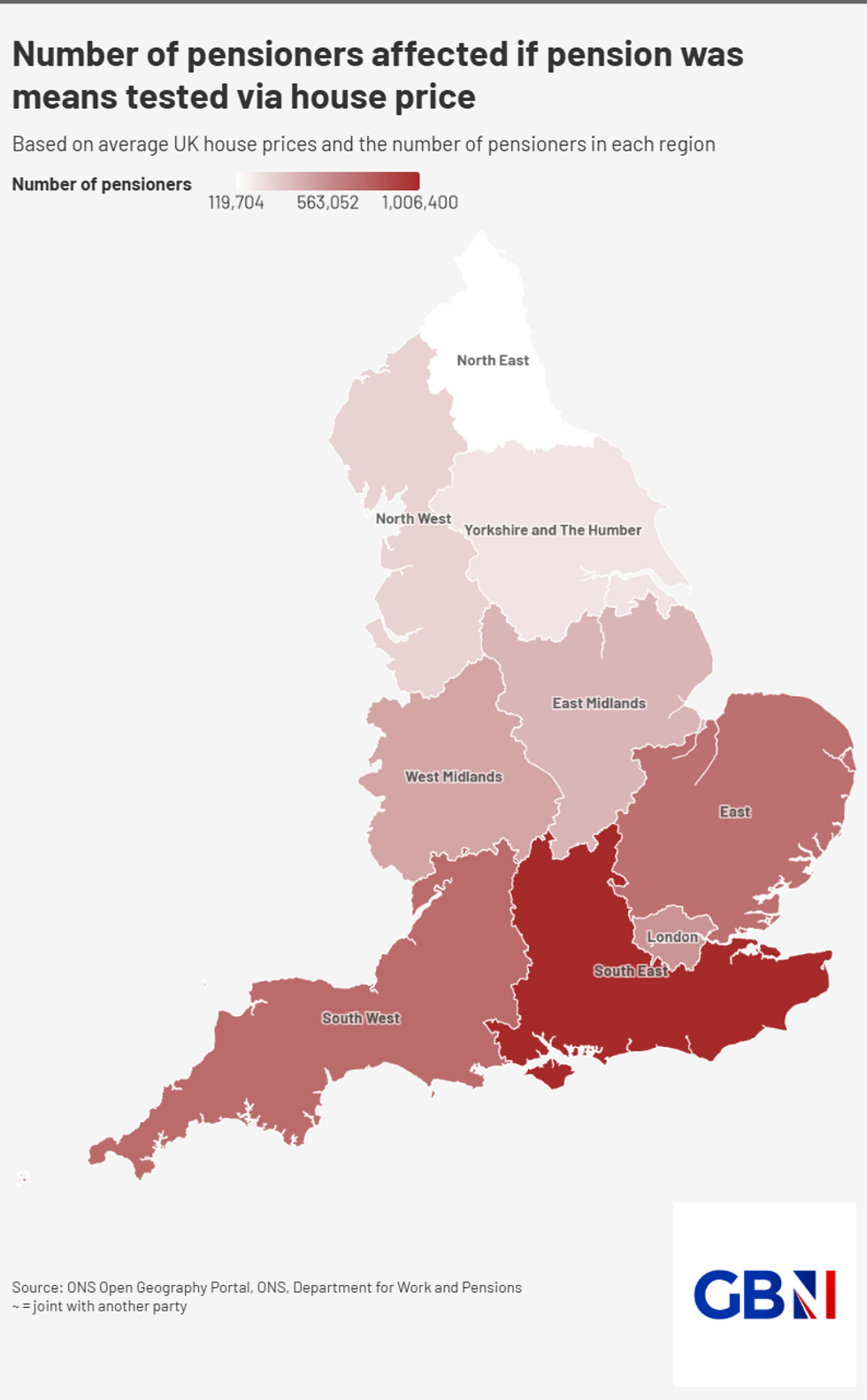

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNCurrently, the triple lock guarantees state pension payment rates increase every year by either the rate of inflation, average earnings or 2.5 per cent; whichever is the highest figure.

Will Stevens, the head of wealth planning at wealth firm Killik & Co, warned that reform may become inevitable despite Government commitments to supporting pensioners.

"While the triple lock has provided valuable protection for pensioners experiencing higher living costs, as shown by this year's 4.1 per cent uplift, its long-term sustainability needs careful consideration," he said.

"The Government has continued to claim it's committed to supporting pensioners, but the cost of the triple lock is expected to be three times higher by the end of the decade, so we might be approaching a juncture where reform becomes inevitable."

David Gauke, former Secretary of State for Work and Pensions and Chair of the Steering Group of the Pensions Review, said the IFS report comes "at the perfect time" with the Government's own review expected to commence imminently.

"Pensions need long-term planning and, ideally, a broad consensus," he said, adding that the proposals maintain "an important balance between the state, employers and workers."

LATEST DEVELOPMENTS:

Paul Johnson has shared his concerns for the UK economy | GB NEWS

Paul Johnson has shared his concerns for the UK economy | GB NEWSPaul Johnson, the former director of IFS and co-Director of the Pensions Review, warned that "without decisive action, too many of today's working-age population face lower living standards and greater financial insecurity through their retirement."

"‘There is much to celebrate about the current UK pensions system. The current generation of retirees is, on average, doing much better than any previous generation. Pensioner poverty is way down on the very high levels in the 1970s and 1980s, and is indeed below that for other demographic groups.

"The state pension has been simplified and is now much more generous to many women than in the past. Many more employees have been brought into workplace pensions by the successful roll-out of automatic enrolment."