'Huge failing of current system' could see pensioners hit with extra tax when accessing pensions

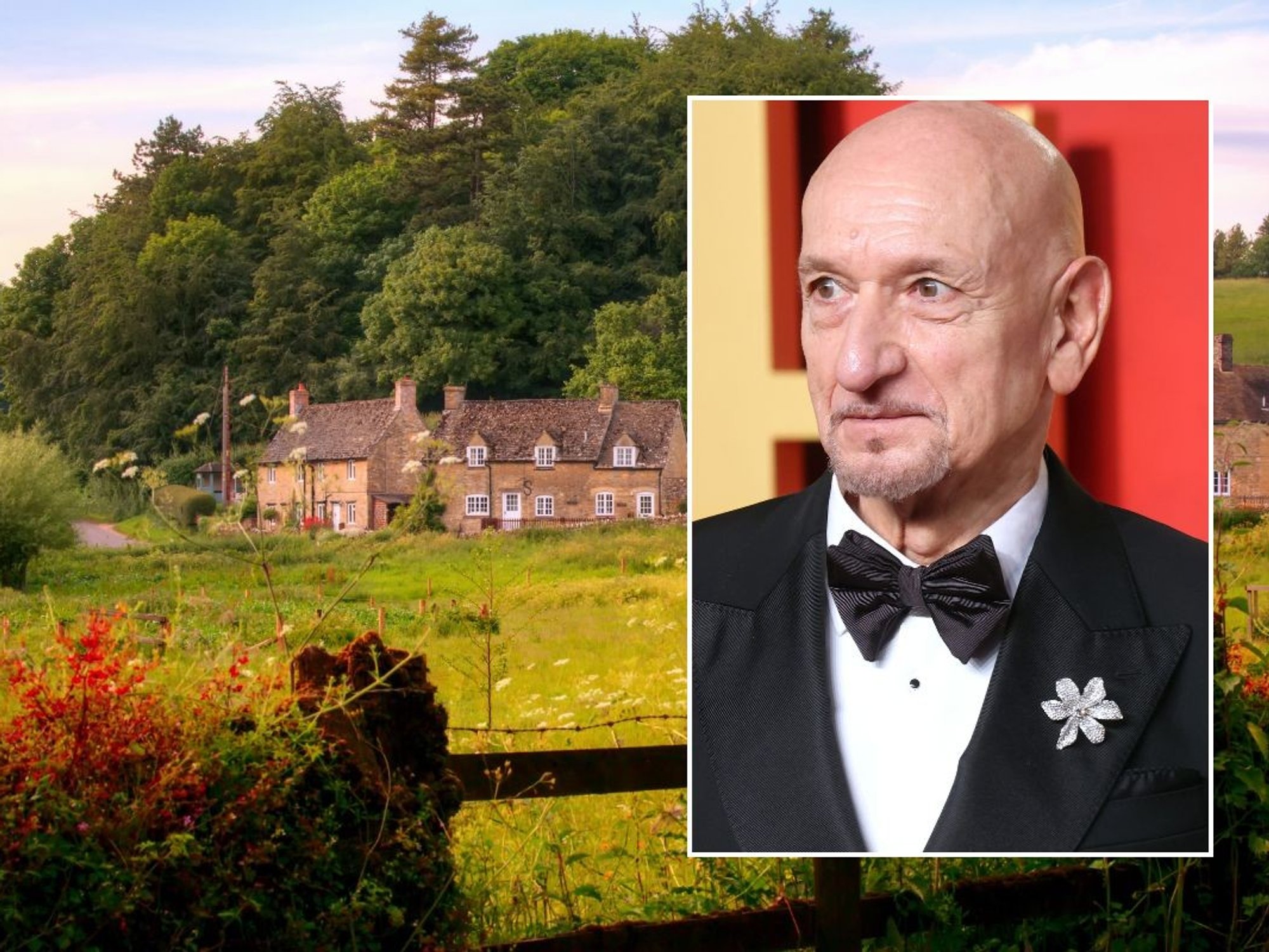

Pension freedoms provide people with options when they take their benefits from their pension plan

|GETTY

A review of the pensions freedom act could be “inevitable” if the Labour party win at the upcoming elections, it’s suggested

Don't Miss

Most Read

The process of pensioners accessing their pension pots needs to be examined as there is no analysis of if they are making good decisions with their savings, an expert has warned.

Tom McPhail, director of public affairs at consultancy firm Lang Cat, said the behavior of retirees around their pensions is a “real failing” of the current system.

During a discussion - hosted by Pension Playpen - on how Labour may approach the topic of pensions if they win the upcoming general election, McPhail said his views were “quite speculative” but warned hundreds and thousands of retirees may not be taking pension advice, which in turn could see them lose out on thousands in retirement.

He said: “What we lack at the moment is a really comprehensive, authoritative analysis of the decision making processes that people are going through and how they use their pension freedoms.

“If they are taking financial advice, we can be reasonably confident they are getting a decent outcome.

“But there are hundreds of thousands of people every year who access their pension pots and we have no idea whether or not they are making good decisions.

Pensioners can access 25 per cent of their pension tax free with drawdown

|GETTY

“To me that is a huge failing of the current system.”

Pension freedoms provide people with options when they take their benefits from their pension plan.

Individuals can usually choose to take a quarter (25 per cent) of their pension pot as a tax-free lump sum.

They can also enter drawdown which allows them to make withdrawals from the remaining balance as they need it. Alternatively, they can buy a secure income (known as an annuity). However, these will be subject to income tax.

When taking money from the remaining 75 per cent, savers may be pushed into a higher income tax bracket if they also earned money from a salary or other income.

This means they may need to pay more tax.

McPhail warned the lack of knowledge of how pensioners use their pension freedoms means the Government can’t offer the necessary help needed to avoid paying extra tax.

He suggested if Labour wins the election, the party may implement a “gentle rethink” around pensions freedoms generally.

He pointed out that initially Labour opposed the pension reforms but it then “read the room” and saw it was a popular idea.

LATEST DEVLOPMENTS:

Nevertheless, it was never that enthusiastic about it, McPhail said.

Before making any final decision on how to access the money in one’s pension, people are encouraged to book an appointment with a financial advisor.