Nationwide Building Society's mortgage lender slashes interest rates ahead of Bank of England decision

Nationwide's mortgage lender is slashing rates

|GETTY/NATIONWIDE

Mortgage rates are being reduced ahead of an expected decision from the Bank of England

Don't Miss

Most Read

Latest

Nationwide Building Society's mortgage lender has slashed interest rates once again across its range of products in a boon for prospective property buyers.

The Mortgage Works' (TMW) is reducing rates across its buy-to-let (BTL) offering in another sign lenders are making products more accessible.

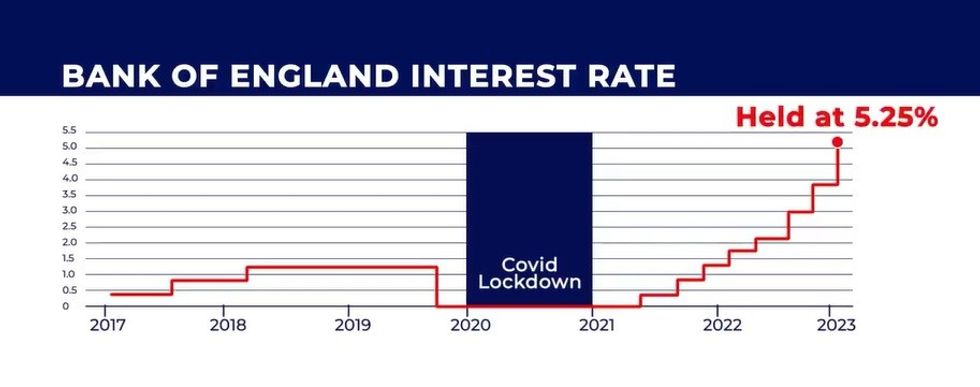

Mortgage rates have been bolstered by the Bank of England's decision to raise the base rate in its fight against inflation.

The central bank's Monetary Policy Committee (MPC) has raised and held the base rate at 5.25 per cent since August 2023.

With the consumer price index (CPI) easing to the Bank's desired target of two per cent, analysts are pricing in a rate cut from the MPC in the later half of the year.

This would offer much needed relief for homebuyers and those hoping to get on the property ladder.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The building society is known for offering competitive deals to customers

| NATIONWIDE BUILDING SOCIETYHere is a full list of the new business BTL mortgage rates from Nationwide Building Society:

- Two-year fixed rate (purchase and remortgage) at 3.54 per cent with a three per cent fee, available up to 65 per cent LTV (reduced by 0.15 per cent)

- Five-year fixed rate (purchase and remortgage) at 3.94 per cent with a three per cent fee, available up to 65 per cent LTV (reduced by 0.10 per cent)

- Five-year fixed rate (purchase and remortgage) at 3.99 per cent with a three per cent fee, available up to 75 per cent LTV (reduced by 0.15 per cent)

- Five-year fixed rate (purchase and remortgage) at 4.44 per cent with a £1,495 fee, available up to 65 per cent LTV (reduced by 0.25 per cent).

Here is a full list of the new buy-to-let switcher mortgage rates from Nationwide Building Society

- Two-year fixed rate at 3.84 per cent with a three per cent fee, available up to 55 per cent LTV (reduced by 0.05 per cent)

- Two-year fixed rate at 3.84 per cent with a three per cent fee, available up to 65 per cent LTV (reduced by 0.05 per cent)

- Five-year fixed rate at 4.74 per cent, with no fee, available up to 55 per cent LTV (reduced by 0.05 per cent).

Jonathan Samuels, the CEO of Octane Capital, broke down how the greater number of mortgage products on the market is giving lenders more of a choice.

He explained: "We’re yet to see interest rates fall despite inflation now seemingly under control, but given the prolonged period of economic uncertainty that has enveloped the nation and the Bank of England’s cautious approach in managing it, it’s no surprise that it’s been deemed too early to cut rates.

LATEST DEVELOPMENTS:

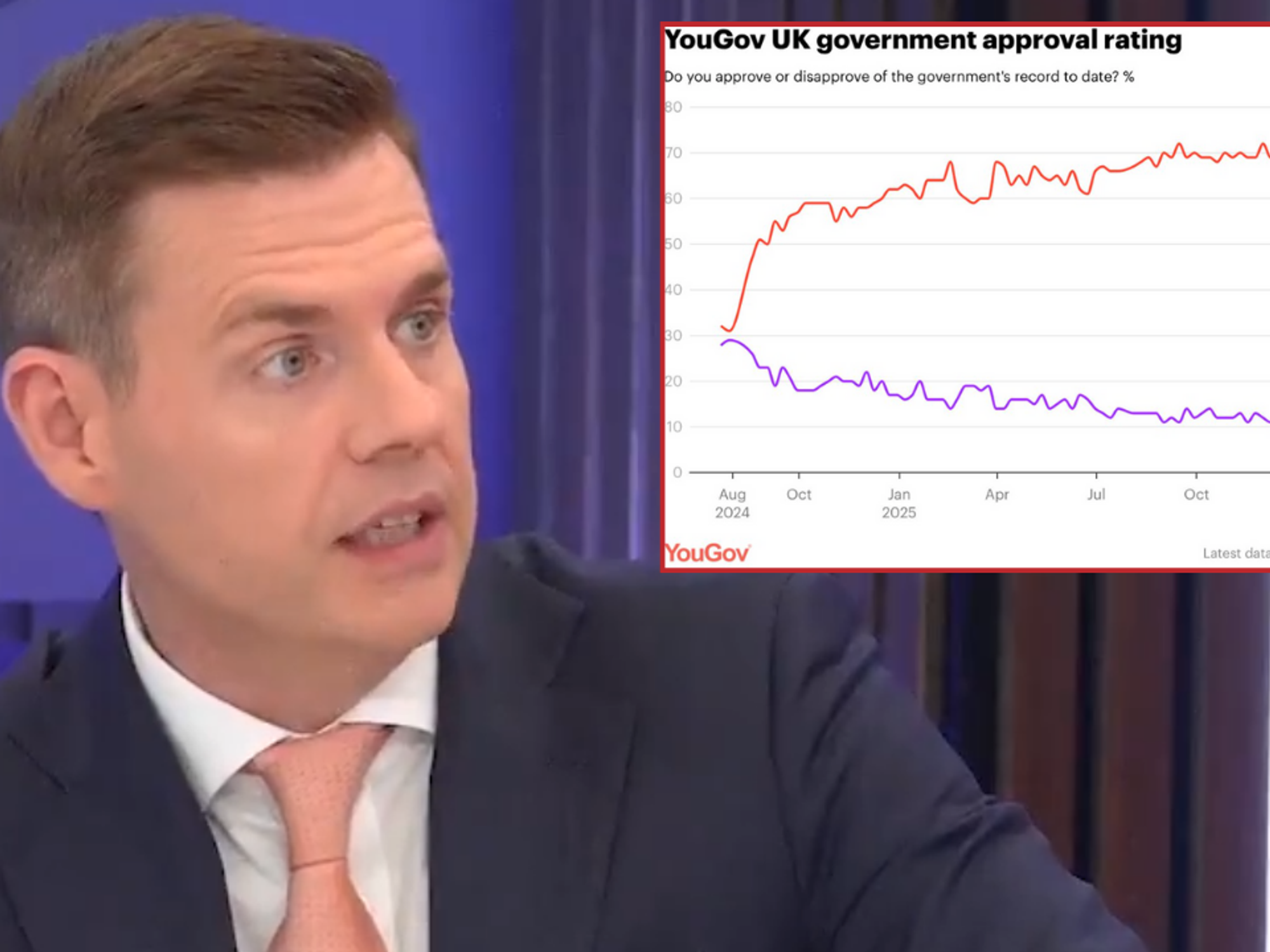

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWS"The good news is that since the base rate has been held at 5.25 per cent, a greater degree of stability has returned to the mortgage sector and the wider property market.

"As a result, lenders have been increasing the number of products available to all buyer segments and this greater level of choice not only benefits buyers, but demonstrates confidence in the market.

"With a rate cut on the horizon, it’s shaping up to be a far stronger year for the property sector and we’ve already seen signs of a return to form emerging since the start of the year.”

The Bank of England's next MPC meeting is due to take place on August 1, 2024.