Rachel Reeves's car taxes could violate human rights as millions face daily road charges - 'Crossing the line'

Legal experts have warned the upcoming road charges could breach several human rights for drivers

Don't Miss

Most Read

Rachel Reeves has come under fire for proposing a pay-per-mile tax on electric vehicles, which could breach motorists' human rights, according to legal experts.

The new scheme, due to begin in 2028, would charge drivers of fully electric cars 3p per mile, while plug-in hybrid drivers would pay 1.5p per mile.

The Chancellor introduced the policy at the Autumn Budget and warned that, due to all vehicles contributing to congestion and wear on Britain's roads, electric vehicles would need to pay their share.

But lawyers have raised serious concerns about how the tax would work in practice.

TRENDING

Stories

Videos

Your Say

Under the proposals, drivers would be charged for every mile on their car's odometer, including miles driven outside the UK.

The measures mean motorists could be taxed for journeys made in France, Spain or elsewhere – even though those roads are not maintained by the British Government.

Legal experts have now warned this could leave the policy open to court challenges.

The Government estimates the tax will raise £1.1billion in its first year.

Andrew Sanderson, a lawyer at Kingsley Napley, warned the scheme could be challenged through a judicial review.

He said taxing foreign miles appears to undermine the Government's own justification for the policy.

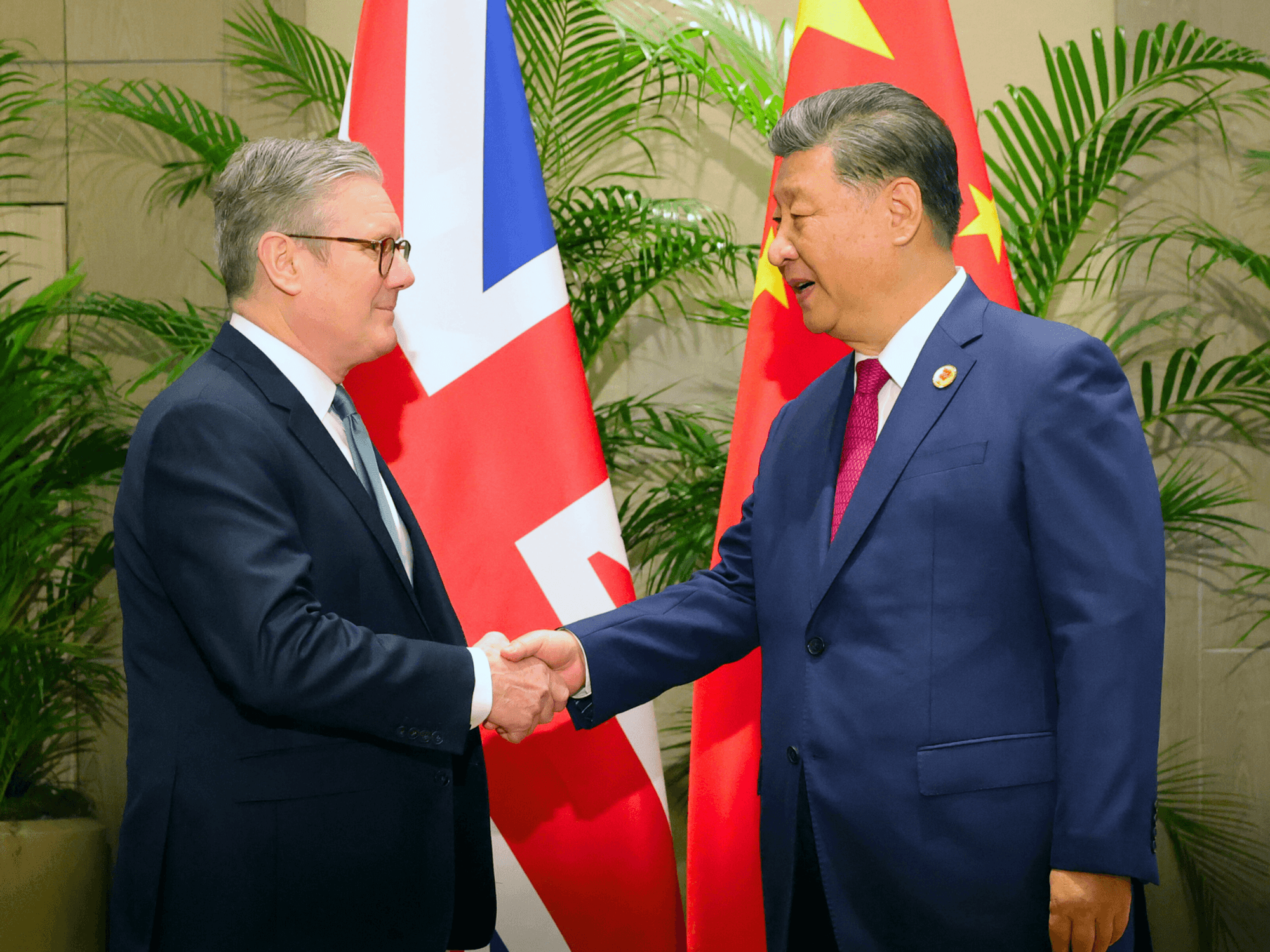

Chancellor Rachel Reeves confirmed the long-awaited pay-per-mile car taxes | GETTY/PA

Chancellor Rachel Reeves confirmed the long-awaited pay-per-mile car taxes | GETTY/PA"If the stated aim is to pay for UK roads, then charging for miles driven overseas makes little sense," he told The Telegraph.

"Taxing journeys in France or other countries, which have no impact on British roads, risks making the policy look arbitrary and unfair."

Mr Sanderson added that this could lead to legal challenges based on human rights and public law principles.

Under human rights law, people have the right to the peaceful enjoyment of their property.

While governments are allowed to tax, the tax must serve a legitimate purpose and strike a fair balance.

He said: "A system which charges drivers for foreign mileage, with no clear link to what the money is being spent on, could be seen as crossing that line."

As part of the new plans, electric and plug-in hybrid drivers will estimate their annual mileage in advance and pay the charge on top of standard Vehicle Excise Duty. This extra fee would be known as eVED.

LATEST DEVELOPMENTS

- Motorists to see new driving laws come in January impacting Vauxhall, Jaguar Land Rover and more car brands

- Labour urged to use Brexit freedoms to ignore EU amid major car ban decision - 'Risks slowing progress'

- Octopus vows to 'fully protect' thousands of UK drivers from new pay-per-mile car tax changes

Pay-per-mile road taxes were seen as a fairer measure than emissions-based levy

| PAOdometer readings would then be checked during annual MOTs or servicing, with garages required to report the figures to the DVLA.

But the Government has ruled out exemptions for overseas travel, arguing that allowing them would require tracking where people drive.

Ministers said they do not want to introduce in-car tracking technology because of privacy concerns.

Another lawyer, Adam Craggs from RPC, said motorists could still try to challenge the law under the Human Rights Act.

He explained that drivers could ask the courts to declare the legislation incompatible with the European Convention on Human Rights – the same legal route used by those challenging VAT on private school fees.

The new tax changes will see EV drivers pay 3p per mile and 1.5p per mile for plug-in hybrids | GETTY

The new tax changes will see EV drivers pay 3p per mile and 1.5p per mile for plug-in hybrids | GETTYHowever, he warned that courts are usually reluctant to interfere in tax policy, as Parliament is given wide freedom to decide how taxes are set.

Mr Craggs also suggested the scheme could cause problems if the UK ever rejoined the EU, as it may clash with EU rules on free movement and trade.

The Government's consultation on road pricing is open until the end of March. The per-mile rates are expected to rise each year in line with inflation.

But a Treasury spokesperson defended the policy, saying most UK driving happens domestically, with 336 billion vehicle miles recorded in Great Britain in 2024 alone.

Carwow's Iain Reid backed the decision not to exempt foreign miles, saying it avoids complicated checks and protects drivers' privacy.