Mortgage 'shock' as 350,000 households to be '£1,000s a year worse off' this winter

GB NEWS

Thousands of Britons on fixed-rate mortgage will see their deal come to an end by the end of the year

Don't Miss

Most Read

Britons are due to be "thousands of pounds a year worse off" due to their low-interest fixed-rate mortgage deal coming to an end in the months ahead, according to new analysis.

Research conducted by budget management app Nous found that approximately 350,000 households secured five-year fixed-rate mortgages between October 2020 and February 2023, when interest rates were at historic lows.

These borrowers managed to avoid the rate spike that occurred two years ago, but now face substantial payment increases as their agreements conclude this winter.

Nous conducted analysis revealing that nearly half of all mortgages arranged during this period were five-year fixed arrangements.

Mortgage 'shock' as 350,000 households to be '£1,000s a year worse off' this winter

|GETTY

Experts note the financial implications are severe for affected homeowners as interest rates on five-year fixed mortgages have surged from an average of 1.88 per cent in 2020 to five per cent currently.

For borrowers with standard £200,000 mortgages, monthly payments will increase by £333, reaching £1,169. This represents an annual cost increase of £3,996.

Those with larger mortgages face even steeper rises. Homeowners with £500,000 loans will see monthly payments climb by £833.

Greg Marsh, the chief executive of Nous, warned: "Hundreds of thousands of homeowners are in for an unpleasant shock this winter.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Economists are warning mortgage rates will not be 'reduced significantly' with current inflation figures | GETTY

Economists are warning mortgage rates will not be 'reduced significantly' with current inflation figures | GETTY "The era of ultra-cheap mortgages is over. For these households, it's leaving them thousands of pounds a year worse off."

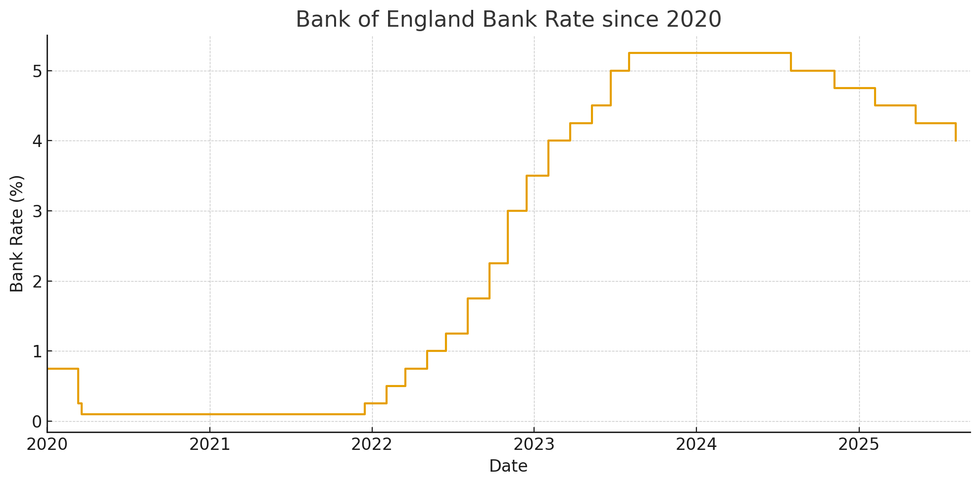

Despite the Bank of England reducing its base rate to four per cent in August, mortgage costs continue climbing.

Major lenders including Nationwide, Halifax and HSBC have recently increased their rates, typically adding 0.2 percentage points to fixed deals.

Adam French, the head of News at Moneyfacts, explained: "The Bank of England Base Rate may grab headlines, but there are many more rates and indices that influence the cost of borrowing."

MEMBERSHIP:

- REVEALED: How Nigel Farage could end Britain's migrant crisis within two weeks

- Saint Angela's humiliation has spawned an even worse nightmare - Kelvin MacKenzie

- Reform UK's popularity continues to grow as party predicted to win a majority for the first time - but have they won 'four years too early'?

- Interactive map reveals how many illegal migrants have entered on Keir Starmer's watch - find out the number in YOUR area

- POLL OF THE DAY: With strikes causing commuter chaos, is it time to strip unions of their power?

He highlighted that swap rates, which banks use to price fixed mortgages, experience approximately 500,000 changes annually compared to just eight base rate decisions.

Water and council tax bills have already risen this year, with energy prices set to increase in October.

LATEST DEVELOPMENTS:

How has the base rate changed since 2020? | CHAT GPT

How has the base rate changed since 2020? | CHAT GPT Hina Bhudia, a partner at Knight Frank Finance, noted that recent economic data has made further Bank of England rate cuts appear less likely.

Initial predictions of a November reduction have shifted to expectations of spring action.

Mr French suggested borrowers might see gradual cost reductions through year-end, though intermittent increases will occur as global economic factors increasingly influence lender pricing.

He advised that those seeking mortgages could monitor rates and potentially switch deals before completion if prices decline.