Mortgage hack could slash repayments for parents and 'avoid £100,000s in interest'

Britons have been forced to contend with record-high mortgage repayments in recent years

Don't Miss

Most Read

Parents are being urged to take advantage of a mortgage saving hack, which could come in useful when purchasing back-to-school essentials as the summer holidays come to an end.

Families across Britain face substantial costs as children return to school, with typical expenditure reaching approximately £350 for each child's essential supplies, according to research.

Analysts from mortgage repayment app Sprive note that this figure takes into account must-have items, including uniforms, footwear, school bags and stationery items.

Households with two children can expect to pay upwards of £600 for these necessary purchases, from basic school shirts to lunch containers.

Parents are being urged to consider a cost-cutting mortgage

|GETTY

However, the Sprive app, which facilitates mortgage overpayments at no cost, enables parents to convert their school shopping into long-term home loan savings through strategic cashback arrangements.

The platform distinguishes itself from conventional cashback schemes through its unique approach to mortgage reduction. Rather than simply returning a percentage of purchases, Sprive channels earnings directly towards mortgage overpayments, creating what the company terms a "supercharged" effect.

The service partners with over 85 UK retailers, allowing customers to accumulate cashback through routine purchases. These earnings, when applied to mortgage principal, generate compound savings by reducing the interest charged over the loan's duration.

This mechanism transforms modest cashback amounts into substantially larger savings, as each overpayment immediately decreases the outstanding balance on which future interest calculations are based.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Parents are looking for ways to manage having children and pay bills

| GETTYFor instance, purchasing £125 worth of uniform necessities at Marks & Spencer (M&S) generates £5 in cashback through the platform's four per cent return rate.

Applied to a standard £250,000 mortgage with five per cent interest over three decades, this modest sum prevents approximately £17.50 in interest charges whilst reducing the principal by the original £5.

"That £5 turns into £22.50. That's over four times the return just for buying what you need to buy anyway," explained Jinesh Vohra, Sprive's chief executive.

According to Sprive, parents typically accumulate £18.86 in cashback per child, which translates to roughly £85 in total mortgage savings when accounting for avoided interest payments.

Families with multiple children see proportionally greater benefits, with three-child households potentially converting £56.58 in cashback into £308 worth of mortgage savings.

It opportunity extends beyond seasonal school purchases to regular household spending.

"Overpaying is the single best way to become mortgage-free sooner and avoid the trap of paying hundreds of thousands in interest," Mr Vohra added.

"Compound interest usually works against you, adding tens of thousands in extra cost over the life of a mortgage - Sprive is flipping it on its head and making it work for you."

LATEST DEVELOPMENTS:

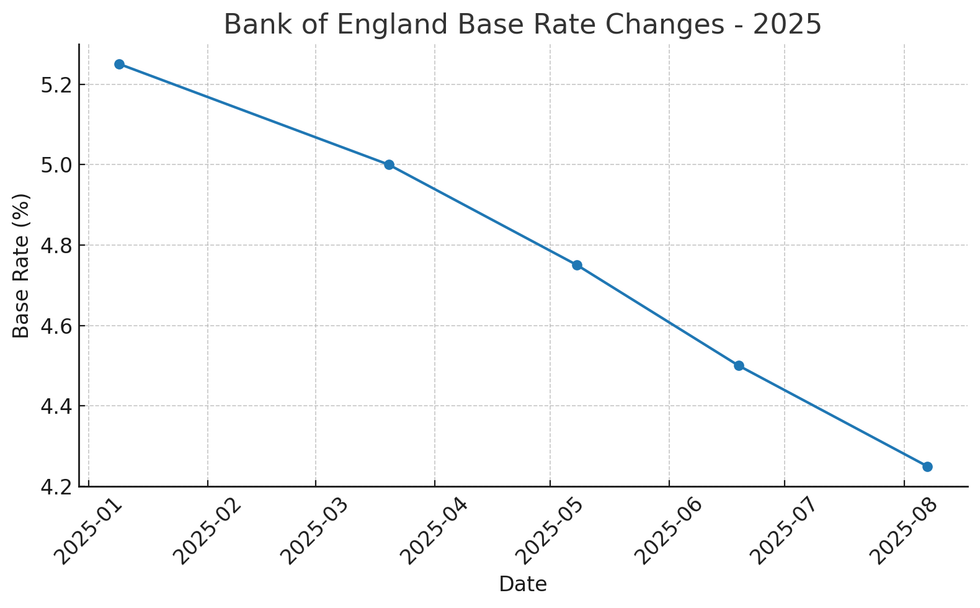

The Bank of England base rate has fallen dramatically this year | CHAT GPT

The Bank of England base rate has fallen dramatically this year | CHAT GPT The platform reports that users typically reduce their mortgage terms by nearly two and a half years whilst saving £11,697 in interest payments.

Mortgage expert Terry Higgins, the group managing director at The New Homes Group, previously broke down the importance of households coming to a decision whether overpaying is the right choice for them.

Mr Higgins said: "Overpaying your mortgage can be a smart move if you have the money to do so. It helps reduce your mortgage balance while also cutting down on the total interest you’ll pay over the life of the loan.

"For example, take someone with a £200,000 mortgage at a five per cent interest rate over 25 years. Paying just an extra £50 a month could save around £8,000 in interest and shorten the mortgage term by one year and ten months."