Good news for homeowners as Bank of England tipped to cut interest rates at fastest pace since financial crisis

The rate cuts are set to bring the cost of borrowing down to below three per cent for the first time since October 2022

Don't Miss

Most Read

Latest

The Bank of England is set to cut interest rates sharply in the coming months, in what could be the fastest round of cuts since the 2008 crash, economists have said.

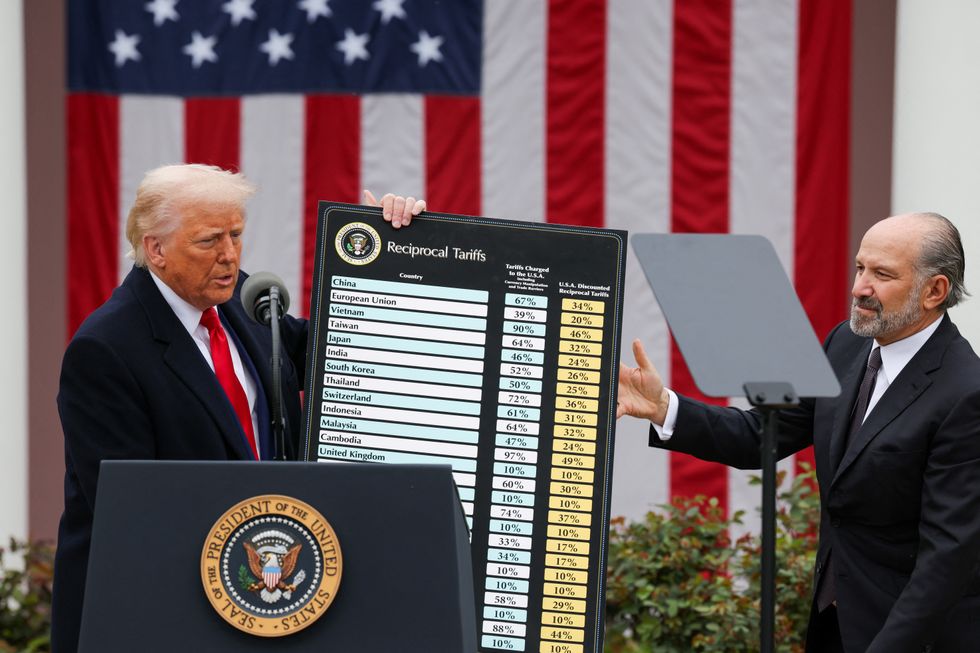

Experts say rates may drop by one percentage point within six months as the UK braces for economic fallout from Donald Trump’s trade war.

The central bank is likely to cut interest rates from 4.5 per cent to 4.25 per cent next week, marking the first in what analysts expect to be a series of back-to-back reductions.

The move comes as Britain's manufacturing sector continues to contract and global demand for UK goods weakens significantly.

Morgan Stanley predicts the central bank will lower borrowing costs by 0.25 percentage points at each of its next five meetings, taking rates down to 3.25 per cent by November.

The US investment bank's researchers noted that a larger 0.50 percentage point cut is now a "key" likelihood, adding that "the sooner" the Bank of England speeds up rate cuts, the "better".

Barclays expects the Bank's rate-setting monetary policy committee to vote for cuts at each of its next four meetings, bringing rates to 3.5 per cent by September.

Bank of England tipped to cut interest rates at fastest pace since financial crisis

| GETTYUBS predicted that if the Trump-induced growth hit proves substantial, the MPC would "increase the pace of cuts to every meeting rather than quarterly".

The rate cuts are expected to bring the cost of borrowing down to below three per cent for the first time since October 2022. Major banks have already slashed fixed mortgage rates in anticipation of lower interest rates.

Barclays, HSBC and NatWest have all cut mortgage rates this week by up to 0.25 percentage points. They join Halifax, Nationwide and Santander in offering fixed rates below four per cent.

The lowest two-year fixed rate has fallen from 4.22 per cent at the start of December to 3.79 per cent, which would cut monthly repayments on a £200,000 25-year mortgage from £1,080 to £1,033. This represents a reduction of £564 a year for homeowners.

The economic pressures driving these cuts are severe, with the UK's manufacturing sector now contracting for seven consecutive months.

There are many mortgage deals on the market | GETTY

There are many mortgage deals on the market | GETTYAccording to figures from S&P Global's purchasing managers' index, the sector recorded a reading of 45.4 for April, well below the 50-mark that separates growth from contraction.

The sector is also being squeezed by Labour's decision to hike employer national insurance and increase the minimum wage. Higher costs are resulting in increased selling prices and job cuts, with employment declining for the sixth month in a row.

Orders from the United States, Europe and China have all declined, the PMI data showed, following Trump's trade wars.

Rob Dobson, the director at S&P Global Market Intelligence said: "Overseas demand is especially weak. Manufacturers noted that US tariff announcements were having a noticeable impact on global markets as trading partners adapt to increased trade volatility."

The International Monetary Fund has already slashed its 2025 UK growth forecast to 1.1 per cent from 1.6 per cent.

LATEST DEVELOPMENTS:

Rates may drop by one percentage point within six months as the UK braces for economic fallout from Donald Trump’s trade war

| REUTERSThe Office for Budget Responsibility has warned that a global trade war could wipe off tens of billions of pounds worth of UK economic output.

Wood suggest the accelerated rate cuts are essentially "insurance against Donald Trump's erratic behaviour".

Morgan Stanley economists believe the Bank is likely to remove the term "gradual and careful" from its guidance on rate cuts "to leave itself space to accelerate cuts if needed".

Markets are betting on two consecutive interest rate cuts in May and June, followed by another two by year-end. While the cuts will provide relief to homeowners, analysts caution they are "not a panacea for all the UK's economic problems".

The biggest challenge remains improving Britain's anaemic growth rate amid increasing global economic uncertainty.