Martin Lewis praises Jeremy Hunt after Chancellor brokers bank deal to ease mortgage pain

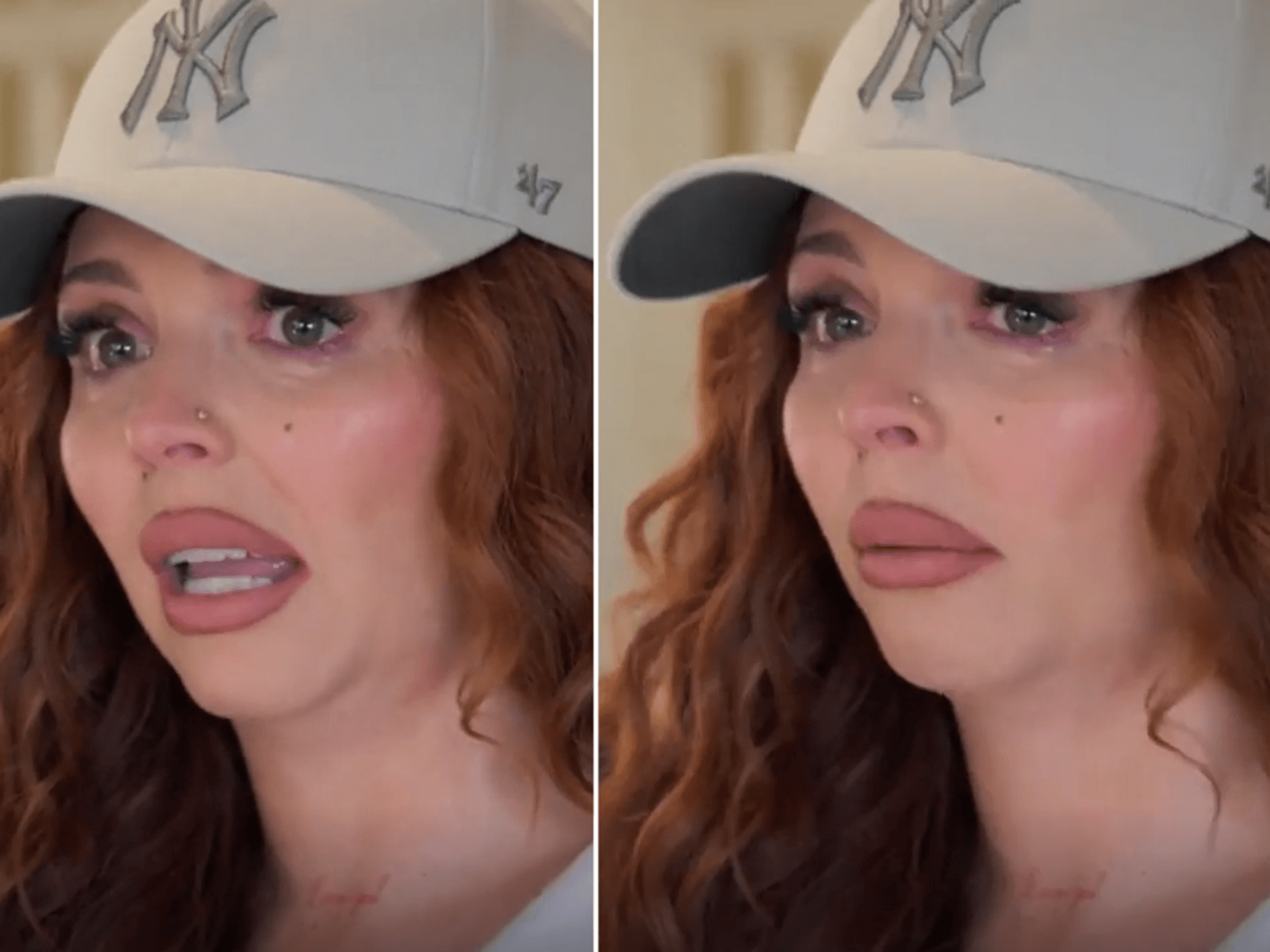

Martin Lewis

| gbnews

The Chancellor of the Exchequer met with high street lenders in Downing Street after the Bank of England hiked interest rates to five per cent

Don't Miss

Most Read

MoneySavingExpert Martin Lewis has praised Jeremy Hunt after the Chancellor of the Exchequer brokered a bank deal to ease mortgage pain to help homeowners.

The respected financial journalist celebrated Hunt for meeting with lenders to assist mortgage-holders struggling with increasing interest rates.

He said: “It looks like the Chancellor has listened.”

Lewis added: "While the Bank of England’s aim is intended to squeeze people’s disposable incomes, no one wants people’s lives to be ruined by arrears and repossessions - and that is the urgent protection we need to focus on.

Row of houses

| PA“I met the Chancellor on Wednesday and reiterated that the minimum we needed was to ensure that when people asked for help from lenders, they knew that if things changed, it wouldn’t be detrimental to their financial situation and their credit scores would be protected as much as possible.”

The Chancellor met with high street bank lenders in Downing Street earlier today.

Hunt agreed with firms to implement a 12-month minimum before repossessing homes.

He also ensured struggling borrowers will be allowed to extend the term of their mortgages or move to an interest-only plan temporarily “no questions asked, no impact on your credit score”.

People on top of a stack of pound coins

| PAThe Chancellor said: “We know getting rid of high inflation for our economy is the only way we can ultimately relieve pressure on family finances and businesses.”

Hunt added: “The most significant thing is they can pick up the phone to their bank or mortgage lender and talk about their situation without any worry it will impact their credit score.

“If they decide to make their payments easier — by extending the period of their mortgage or going to an interest-only package — they can go back to their original package without any questions asked, without any impact on their credit score.

“That’s the reassurance that people like Martin Lewis have been saying will make a big difference for families in those situations.”

Jeremy Hunt | PA

Jeremy Hunt | PAThe meeting came after it was announced that the typical two-year fixed mortgage deal reached an interest rate of more than six per cent for the first time since December.

The average rate on a two-year fix is now 6.19 per cent, up from 2.56 per cent in June 2021, according to figures provided by Moneyfacts.

The Bank of England later raised interest rates by 0.5 per cent to post-financial crash highs of five per cent to help curb inflation which failed to drop below 8.7 per cent in May.

Around 800,000 fixed-rate mortgages will end during the second half of this year and about 1.6 million deals will have run out by the end of next year.

Rachel Reeves

| GB NewsShadow Chancellor Rachel Reeves questioned Hunt’s measures.

She said: “The government must offer clarity and confidence to homeowners by putting in place requirements now to reassure households.

“Instead of shrugging their shoulders, the Tories should be taking responsibility and acting now.”