Mortgage blow for borrowers as interest rates 'jump' with Bank of England cut 'unlikely'

GB NEWS

Two-year fixed deals climb to 4.98 per cent as lenders grow cautious over inflation

Don't Miss

Most Read

Borrowers are facing fresh pressure as residential lending costs have risen for the first time in eight months.

Financial data provider Moneyfacts revealed that typical two-year fixed mortgages edged upward to 4.98 per cent at the start of October, compared with 4.96 per cent the previous month.

Similarly, five-year fixed products increased to 5.02 per cent from September’s five per cent.

These rises mark a reversal of the downward trend that had persisted since February.

The shift signals renewed caution among lenders navigating uncertain economic conditions.

Market volatility and persistent inflationary pressures have prompted financial institutions to reassess their pricing strategies, halting the steady decline in borrowing costs seen throughout spring and summer.

Product availability periods have lengthened, reaching 22 days in October from September’s 17-day average.

This is the first time since April that mortgage offerings have remained on the market beyond 20 days.

Borrowers are facing fresh pressure as residential lending costs have risen for the first time in eight months

| GETTYThe extended shelf life reflects what Moneyfacts described as "mixed moves" among lenders.

Rachel Springall, a finance expert at Moneyfacts, said: "Borrowers may well be disappointed to see fixed mortgage rates on the rise. Volatile swap rates and a cautionary approach among lenders have led to an abrupt halt in consecutive monthly average rate falls."

The combination of unpredictable market conditions and lender caution has effectively ended the period of consistent rate reductions that benefited prospective homeowners.

Persistent price pressures across the economy have dampened hopes for monetary policy relief.

Ms Springall observed that with sticky inflation, "any imminent base rate cuts by the Bank of England seem unlikely".

The central bank faces a difficult environment as inflationary forces prove more stubborn than anticipated.

LATEST DEVELOPMENTS

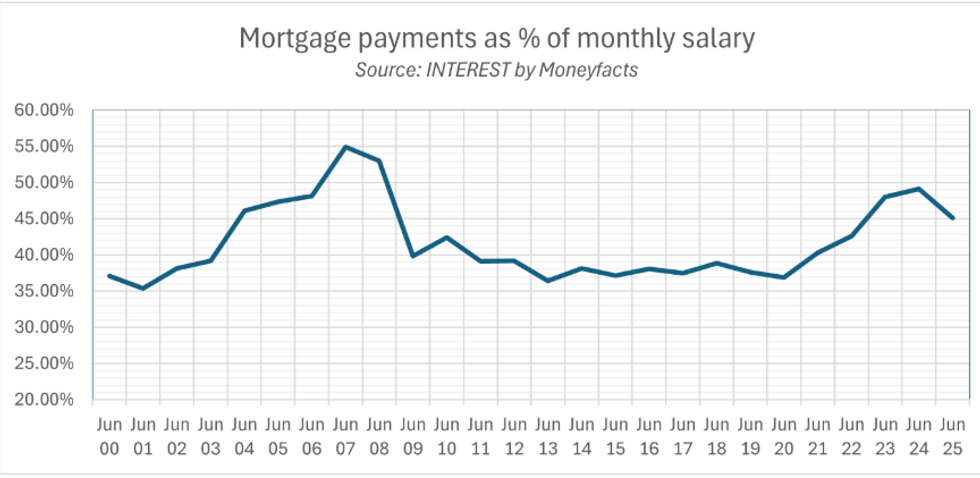

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTSThis has contributed to lenders’ reluctance to reduce rates further, disappointing borrowers who had expected more favourable lending conditions.

Market participants increasingly believe the era of rapidly declining mortgage costs may have ended.

The combination of elevated inflation expectations and cautious monetary policy suggests borrowing expenses could remain at current levels for an extended period.

This highlights the complex interplay between macroeconomic conditions and residential lending markets, with homeowners bearing the consequences of the wider fiscal pressures.

Despite the recent rise, borrowers are still better off than a year ago.

Ms Springall said: "It is not all doom and gloom for borrowers, as the mortgage market has shown how far it has improved over recent years."

Those who secured two-year fixed deals in October 2023 faced average rates of 6.47 per cent, significantly higher than today’s 4.98 per cent.

She noted that this represents "a difference of £225 per month in repayments on a £250,000 mortgage over 25 years".

Simon Gammon, managing partner at Knight Frank Finance, pointed to worrying inflation trends.

"Inflation has crept close to double the Bank of England’s 2 per cent target in recent months, and consumers’ inflation expectations have started to rise," he said.

He added that the current environment represents "a prolonged plateau while the outlook becomes clearer" rather than the start of sustained increases.

Major residential developers have introduced a new purchasing programme aimed at lowering deposit requirements.

Barratt Developments, Redrow and Persimmon unveiled their Rezide initiative on Monday, partnering with Barclays and TSB to support homebuyers.

Barratt Developments, Redrow and Persimmon launched their Rezide initiative on Monday, teaming up with Barclays and TSB to offer support for prospective homebuyers

|GETTY

The scheme enables purchasers to secure properties with a 5 per cent upfront payment.

An equity loan through Rezide covers 15 per cent of the property value, capped at £100,000, while participating banks provide standard mortgages for the remaining 80 per cent.

The programme targets first-time buyers and existing homeowners seeking newly built properties.

Initial availability applies only to homes in England constructed by the participating developers.