Martin Lewis shares top ‘stand-out’ accounts right now as saver wonders where to put £80,000 inheritance

Martin Lewis highlighted two of the best savings accounts in terms of interest rates right now

|PA

Martin Lewis highlighted some of the best savings accounts for interest rates right now

Don't Miss

Most Read

Latest

Martin Lewis has highlighted two “stand-out” savings accounts for easy access and fixed rate options.

The founder of Money Saving Expert was asked by a member of the public who has inherited £80,000 what their options were.

Explaining that he doesn’t cover investing topics, he said there were “a couple of stand-out” savings accounts, and proceeded to share details about them.

Speaking on BBC Radio 5Live’s The Martin Lewis Money Podcast, he said: “Rarely, the top easy access account right now is from a very big bank. It’s from Ulster Bank but that’s part of NatWest Group.

Ulster Bank, which is part of the NatWest Group, is currently offering 5.2 per cent interest rate on easy access savings

|GETTY

“It’s paying 5.2 per cent easy access, although you need a minimum of £5,000 in it.”

Mr Lewis said there was “another big name” offering the market-leading interest rate for fixed-rate savings accounts.

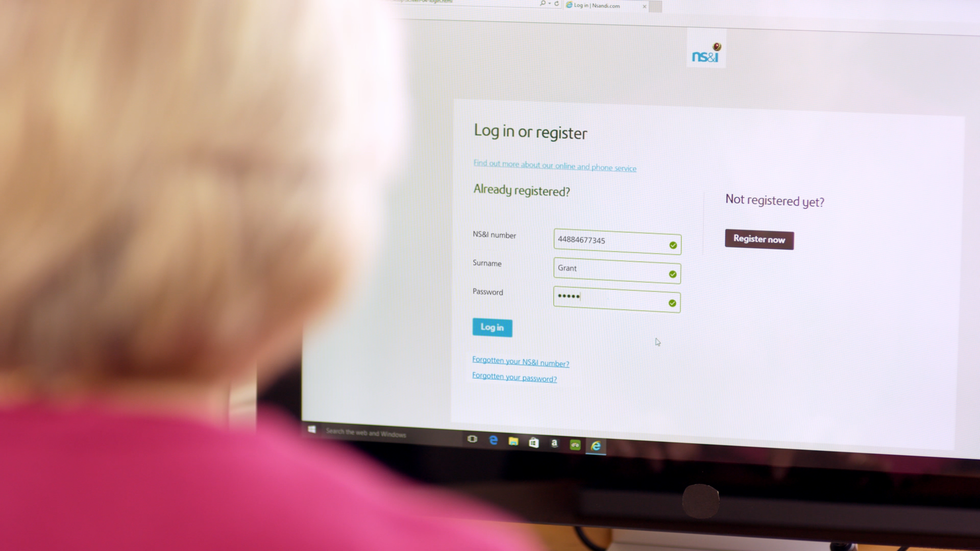

He said: “The top fix on the market for any length is the Guaranteed Equity or Guaranteed Income Bonds (they’re the same thing, one just pays you the interest at the end of the year, the other pays you it as you’re going along) from National Savings [NS&I].

“That pays 6.2 per cent and all of that money is protected by the Treasury.”

Do you have a money story you'd like to share? Get in touch with the GB News money team by emailing money@gbnews.uk.

However, Mr Lewis that the fact the beneficiary had inherited such a substantial amount of money, could mean they needed to pay tax on the savings interest they’d earn on the cash.

He said: “With £80,000 though, because you’re earning so much interest, you’ll probably pay tax on it unless you’re a non-taxpayer.

“You also probably want to make sure you’re using up your cash ISA allowance.”

The ISA allowance is currently £20,000 per tax year, and this applies across all types of ISAs.

LATEST DEVELOPMENTS:

NS&I's Guaranteed Equity or Guaranteed Income Bonds currently offer 6.2 per cent

|NS&I

“Top easy access cash ISA is NS&I,” Mr Lewis said.

“The fixed cash ISAs at the moment are moving so I can’t quote them off the top of my head.

“But that’s the type of thing I’d be looking at if you’re doing savings.”

The Martin Lewis Podcast is available to listen to on BBC Sounds.