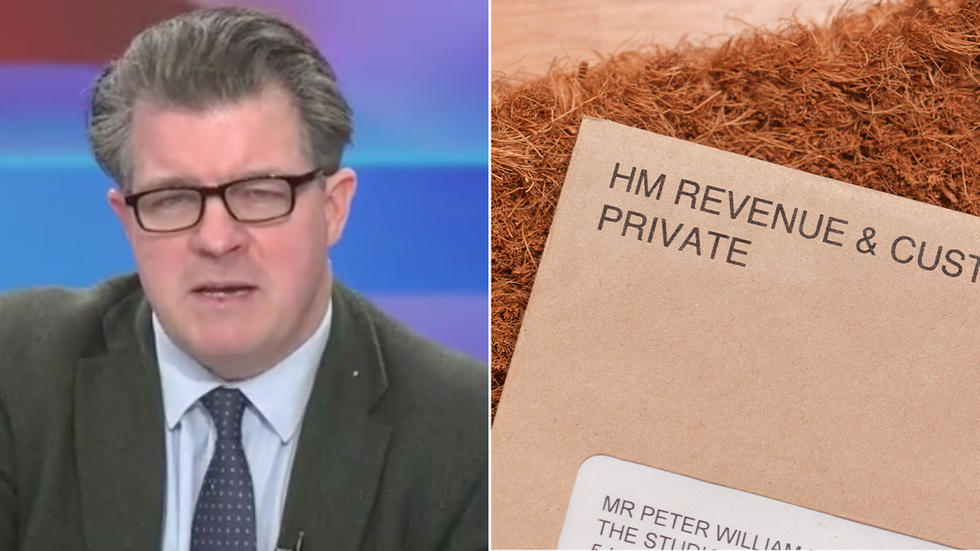

Liam Halligan offers advice as over a million Britons hit by hefty tax bill: ‘Don’t panic’

The self assessment tax return deadline is looming

Don't Miss

Most Read

GB News’s Economics and Business Editor Liam Halligan has urged Britons not to panic as HM Revenue & Customs (HMRC) cashes in.

Struggling Britons who can’t pay their tax bill on time have forked out a record £346 million in interest in the year to October 2023.

This represents a significant rise from the £159 million paid the previous year, according to a freedom of information (FOI) request by accountancy firm RSM.

Around 1.4 million self-employed taxpayers made late payments in the tax year 2020/21, according to a separate FOI by broker AJ Bell, meaning Britons are regularly falling victim to late tax payments and eye-watering interest rates.

Liam Halligan has expressed concern about where taxes are going

|GB NEWS / GETTY

GB News’s Liam Halligan offered advice to those affected, as well as an overview of those who could fall victim to the tax.

“Don’t panic. You only have to fill in a self-assessment tax return if you are self-employed or if you have a side hustle”, he said.

LATEST DEVELOPMENTS

“If you just have a side hustle, you pay your tax through what we call PAYE (Pay As You Earn), then you don’t have to do one.

“Though loads of us do, particularly if we are self-employed.”

Halligan went on to blast the tax system, saying a significant amount of revenue is going towards debt, which he brands “dead money”.

“It really is quite astonishing”, he said.

Liam Halligan joined Martin Daubney on GB News

|GB NEWS

The Self Assessment tax deadline is looming

| GETTY“This is what is eye-watering for me, debt interest. 12 per cent of tax receipts is absolutely huge.

“We spend more servicing the Government’s debt than we do on the basic state pension, which is 10 per cent of all tax revenue.

“Education is also about 10 per cent. We spend over twice as much on debt interest payments as we do on defence. This is absolutely mad.

“When you hear politicians arguing about who is spending more money, if the Government has to borrow to spend that money, and it pays debt interest, that’s dead money.

“Some people would say living beyond our means is immoral.”

Taxpayers who are struggling with repayments have been urged to set up a “Time to Pay” plan with HMRC to pay it back over time.

You will be charged interest, but setting up a plan means you won’t be hit with penalties for simply not paying on time.

You can apply online through your Government Gateway account or by visiting https://www.gov.uk/difficulties-paying-hmrc or call 0300 200 3820.

You will only be able to set up a payment plan if HMRC decides you will be able to keep up with the repayments.