Keir Starmer REFUSES to rule out taxing pension contributions in Autumn Budget

Keir Starmer refuses to rule out taxing pension contributions in Autumn Budget |

GBNEWS

The Prime Minster could face backlash after sidestepping a question on whether pension contributions could be taxed to fund spending plans

Don't Miss

Most Read

Latest

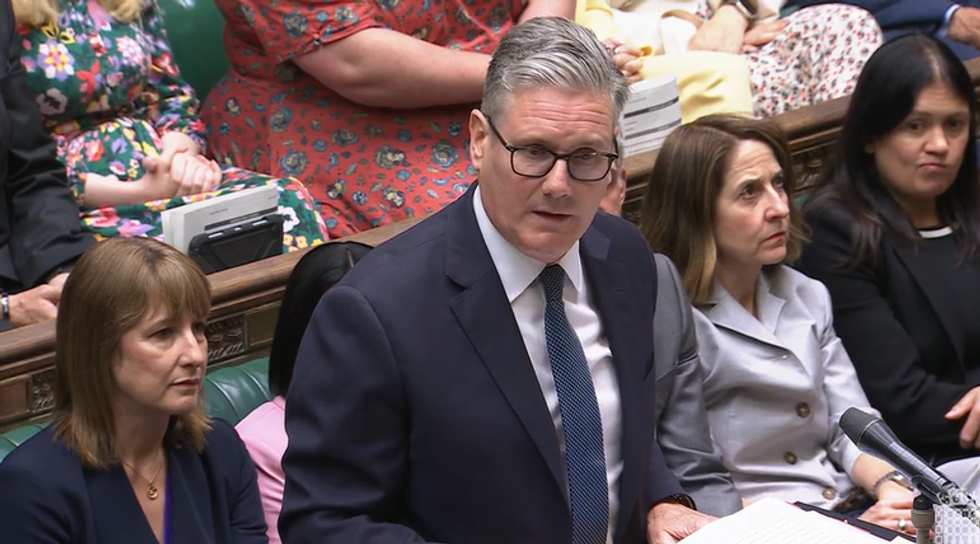

Sir Keir Starmer has refused to rule out taxing pension contributions, sparking concerns that the Labour Government could be preparing to target retirement savings in the upcoming Autumn Budget.

Speaking during Prime Minister’s Questions this afternoon, Conservative leader Kemi Badenoch challenged the Prime Minister on the Chancellor’s recently announced review into pension contributions.

She asked directly: "We know the Chancellor is launching a review into pension contributions – is it because the Government is considering taxing them?"

But Starmer refused to give a clear answer, instead stating: "We made absolutely clear manifesto promises and I'm not going to write the Budget months ahead.

"I'm proud of the decisions we have already taken to invest in our NHS and public services. It's no wonder that after a first year in Government, business confidence is at a nine year high."

The refusal to rule out pension tax reforms has could prompt fears among savers and retirees that further changes could be coming later this year, as the Government grapples with pressure to raise revenue.

The Autumn Budget is expected to be delivered in October, with Chancellor Rachel Reeves facing mounting scrutiny over how she plans to balance the books.

Badenoch continued: "I asked him [Starmer] about pension contributions, but the truth is he doesn't want to talk about it. It's alright for the PM as he has his own special law to stop his personal pension from being taxed, but let's be honest.

"My party knows that it's all about choices - we know there's an alternative to tax rises, it's cutting spending. Something that Labour is too scared and weak to do.

Keir Starmer REFUSES to rule out taxing pension contributions in Autumn Budget |

Keir Starmer REFUSES to rule out taxing pension contributions in Autumn Budget | GBNEWS

"We offered to work with them to reform welfare and make meaningful savings but his refusal sent a signal and now the cost of borrowing is rising."

Starmer spoke out in response and responded by deflecting, saying the Tories left a "mess" and "now they think that they can lecture others".

He went on and said: "I didn't hear an apology for the lowest living standards in living history. I didn't hear an apology for the £22bn black hole. I didn't hear an apology for Liz Truss, the mini budget.

"So maybe she should like to stand up and make that apology now."

This follows new figures from HMRC that shows more than 420,000 additional retirees are expected to pay income tax this financial year, as the freeze on tax thresholds continues to push pensioners above the tax-free allowance.

The number of over-65s paying tax has surged in recent years and is forecast to reach 8.7 million by the end of 2025, nearly two million more than in 2021, when income tax bands were frozen.

The rise is largely driven by a policy known as fiscal drag, which sees tax thresholds held static while incomes rise, pulling more people into the tax net over time.

Badenoch explained her party offered to work with Labour to reform welfare and make meaningful savings, but their refusal sent a signal

|GBNEWS

The personal allowance — the amount you can earn before paying income tax - remains frozen at £12,570 and is not due to rise until 2028.

As the state pension increases each April under the triple lock, more retirees find their annual income breaching the threshold, even if they have no other sources of income.

While the tax freeze was introduced by the former Conservative government as a stealth measure to boost Treasury revenues, its impact is now being felt most acutely by pensioners, many of whom are facing rising living costs and tighter household budgets.

With sluggish economic growth and the cost of public spending commitments rising, economists warn the Treasury has limited room to manoeuvre without new revenue sources.

Rachel Reeves is facing mounting scrutiny over how she plans to balance the books in the Autumn

|GBNEWS

Speculation has intensified following comments from Labour ministers refusing to rule out tax hikes, including on pensions. While the Chancellor has pledged to follow strict fiscal rules, experts say this could force her hand when it comes to increasing tax on wealthier households or adjusting allowances to generate funds.

The Office for Budget Responsibility (OBR) has already flagged concerns about the sustainability of public finances, particularly as inflation remains stubbornly above target and the UK’s debt interest payments stay elevated.

Some analysts suggest middle-income families could face the brunt of any changes, with frozen thresholds already dragging more earners into higher tax brackets.

With the Autumn Budget due in just a few months, all eyes will be on how Reeves plans to fund Labour's spending promises without breaking fiscal pledges.

More From GB News