Inheritance tax raid on pensions leaves 'millions feeling left behind' - what do you need to know

Shadow Work and Pensions Secretary Helen Whately MP shares her view on Labour's asylum system reforms |

GB NEWS

Pension assets will be made liable for inheritance tax in 2027

Don't Miss

Most Read

Latest

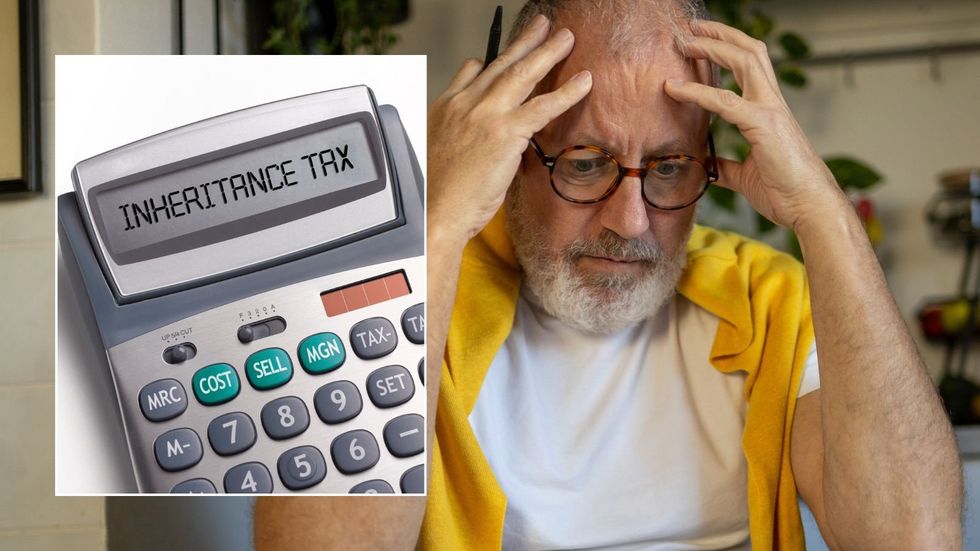

Analysts are sounding the alarm that changes to inheritance tax (IHT) rules impacting pensions are leaving millions of Britons "feeling left behind".

A majority of pension savers intend to alter their financial approach following the Government's announcement that unused pensions will fall under inheritance tax regulations from 2027, according to newly released research by PensionBee.

Polling found that more than half of participants are considering modifications to their retirement planning strategies in response to the forthcoming tax changes.

Notably, the research highlighted particular concerns about knowledge gaps and the potential for hasty financial decisions as savers grapple with understanding how the new rules will affect their retirement planning.

Inheritance tax changes will likely impact the pension planning of Britons going forward, a new survey has found

|GETTY

More than a quarter of participants indicated they would access their pension funds sooner than originally planned, while almost a quarter expressed interest in moving their savings to alternative vehicles including ISAs or annuities.

Age plays a significant role in shaping responses. Amongst those aged 55 to 64, nearly a third stated they would withdraw pension money earlier.

However, 38 per cent of respondents over 65 reported the changes would have no effect on their plans, as they had no intention of leaving their pensions as inheritance.

Understanding of the inheritance tax implications remains limited across the population, with 16 per cent of all survey participants acknowledging they do not comprehend what the changes mean for their finances.

This knowledge deficit is particularly pronounced amongst lower-income groups, PensionBee's survey found.

The proportion of people who are not up-to-date with how the tax changes will impact pensions nearly doubles to 30 per cent for those earning between £20,000 and £24,999 annually.

Income levels significantly influence preparedness for the reforms. High earners demonstrate markedly different responses, with 44 per cent of those earning above £100,000 indicating they would pursue alternative investment options such as ISAs or annuities.

This contrasts sharply with just 10 per cent of those earning between £15,000 and £19,999 who would consider similar alternatives.

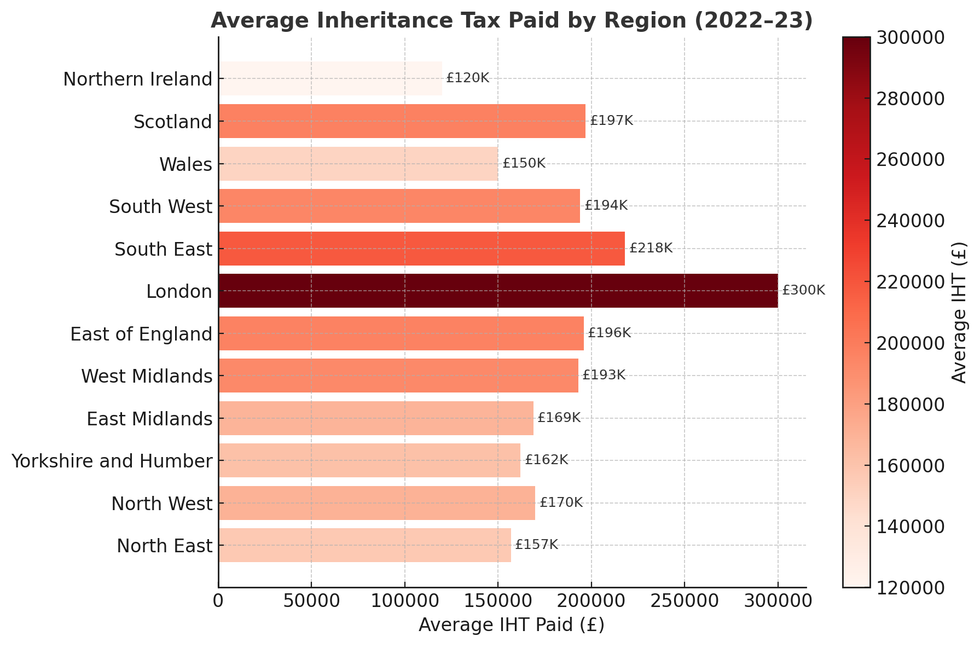

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSLisa Picardo, the chief business officer at PensionBee, expressed concern about the unsettling effect of the inheritance tax changes on savers.

"For many, financial and tax planning and pensions are already complicated enough, and these findings reveal just how unsettled people feel about the upcoming changes to inheritance tax on pensions," she stated.

Ms Picardo highlighted the knowledge gap, noting: "The fact that one in six savers admit they don't understand what these rule changes mean for them highlights the scale of the knowledge gap."

She warned that whilst affluent savers might adapt more readily, "millions of ordinary savers risk feeling even more left behind."

More From GB News