Common inheritance tax mistake can leave families ‘stung’ with ‘tough anti-avoidance rule’

Jacob Rees Mogg has called for inheritance tax to be scrapped

|GB NEWS

The standard inheritance tax rate is 40 per cent

Don't Miss

Most Read

Latest

Inheritance tax may affect less than four per cent of estates but more families are set to be hit due to a combination of inflation, rising house prices and the ongoing freeze to inheritance tax thresholds and allowances.

Planning ahead often comes recommended to make use of gift allowances and benefit from the seven-year rule.

However, those giving gifts need to ensure they don’t make a common inheritance tax mistake, or it could lead to a hefty bill.

Richard Brooks, private client tax partner at Monahans chartered accountancy firm, told GB News inheritance tax can be a “minefield” and the most frequently made error is that people give away assets but continue to use them.

Those giving gifts need to ensure they don’t make a common inheritance tax mistake

|GETTY

He explained: “If someone gifts their family home to avoid IHT but continues to live there, they might be stung with a tough anti-avoidance rule, which brings the value of the assets back into their estate at the date of their death.

“Other mistakes usually stem from individuals not taking professional advice and misunderstanding the finer details which results in people falling through the gaps.

“The Main Residence Nil Rate Band, for example, tends to catch people out and it can become convoluted and complex without the guidance of an expert.”

Care in later life, and whether or not an individual may need to move into a care home in the future, is also an important consideration when estate and tax planning.

Mr Brooks said: “If there has been a lack of planning for this, the fees can wipe someone’s estate out.

“Individuals should seek professional advice from an expert in inheritance tax specific to their circumstances and intentions.

“There are many instances of deceased individuals incorrectly planning and leaving their heirs with considerable inheritance tax problems to deal with after their death, so planning should be a priority to avoid this.”

Mr Brooks also suggested planning earlier on in life while in good health could be the best route for reducing inheritance tax bills and maximising tax efficiency.

He said: “I always recommend that people should ideally be thinking about their plans in their 50s.

“It’s a continual balancing act of ensuring you have enough wealth to live a comfortable life whilst also effectively planning for the future.

“People can consider gifting assets that are surplus to their estate early, either to heirs or a family trust, but should remember that they will not be able to continue to enjoy those assets once gifted, otherwise they will be deemed to still own them at the date of their death.

“To ensure the security of an asset, a family trust would be an appropriate option, particularly if a family is dealing with younger beneficiaries who are not yet financially astute.

LATEST DEVELOPMENTS:

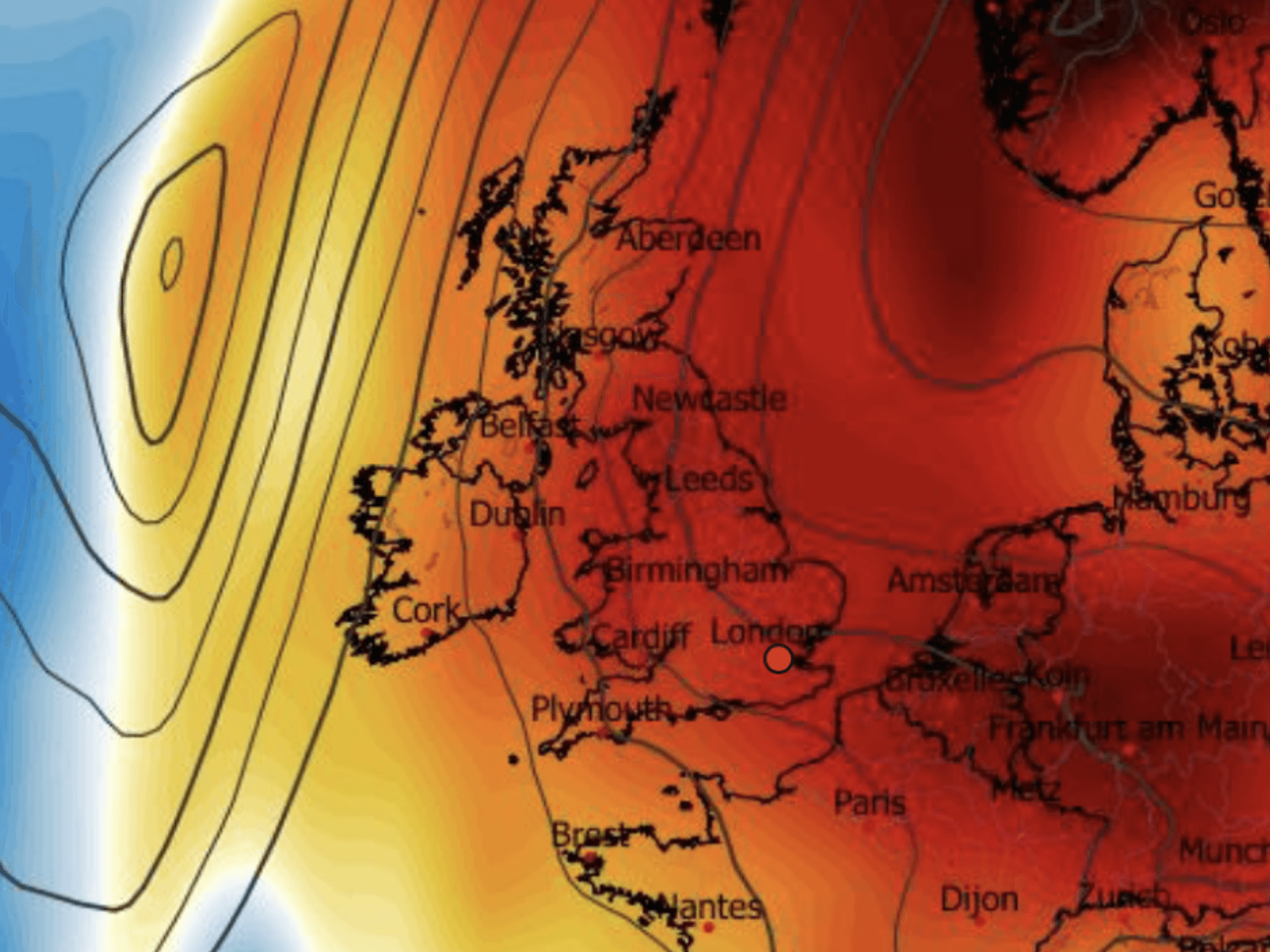

Richard Brooks is a private client tax partner at Monahans chartered accountancy firm

|MONAHANS

“Individuals should also think about gifting assets with high growth potential whilst they still have a low value, to reap the highest benefits.

“It would be worthwhile for business owners and landowners to find out if their assets qualify for agricultural and/or business property relief, as they are likely to be eligible for up to 100 per cent relief from IHT on their assets, requiring careful planning.”

Another key consideration for couples who are married or in a civil partnership is the ability to gift to a spouse or civil partnership inheritance tax-free, and for any unused threshold to be transferred to a surviving spouse or civil partner.

Mr Brooks said: “A married couple should look at their joint IHT position and the balance of their individual estates to ensure the exemption is not lost and to avoid assets being bunched into one estate in the case of elderly individuals.”

The inheritance tax expert also warned regularly gifting surplus income each year is an inheritance tax relief which is “frequently missed”.

He said: “There is no limit to the amount of the exemption so it can significantly reduce tax bills. Individuals should seek detailed advice before doing this as it can often prove to be a complicated process.”