Inflation jumps to 3.6% in blow to households - but Bank of England still tipped to cut interest rates

GBNEWS

Inflation is still well above the Bank of England's two per cent target

Don't Miss

Most Read

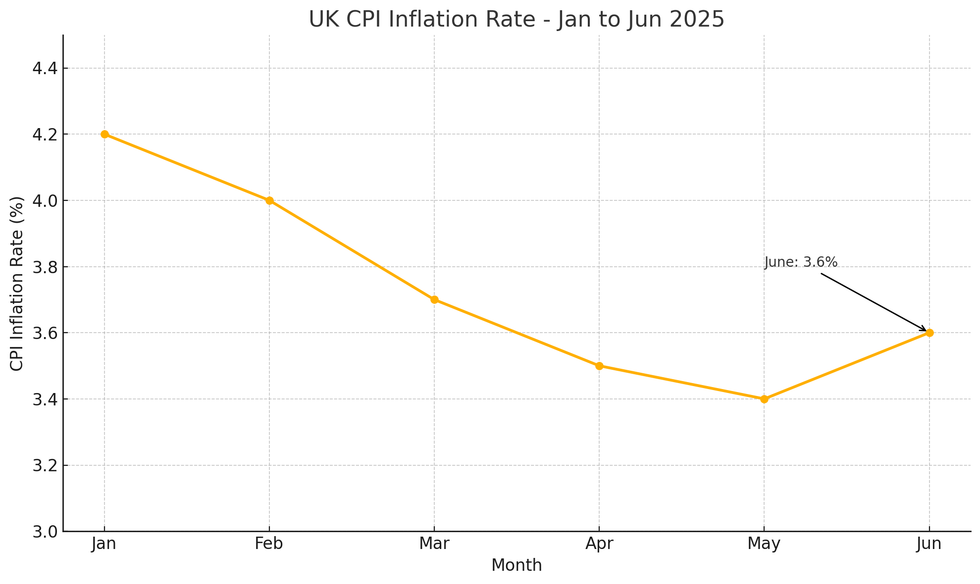

UK inflation has ticked up to 3.6 per cent in June, according to official figures released this morning.

The increase renews pressure on the Bank of England to keep interest rates elevated, but experts believe they may still be tipped to cut the rate next month.

The figure delivers a fresh blow to households already struggling with rising costs.

The Office for National Statistics (ONS) has confirmed that the Consumer Prices Index rose to 3.6 per cent in June, up from 3.4 per cent in May. The increase surprised City economists, who had expected inflation to remain unchanged.

The rise puts further pressure on the Labour Government, which is already facing questions over its handling of the economy following two consecutive months of negative growth and growing speculation over potential tax increases.

Professor Joe Nellis is economic adviser at MHA, the accountancy and advisory firm said: "This is a reminder that while price rises have slowed from the highs of 2021-23, the battle against inflation is far from over and there is no return to normality yet, especially for many households who are still feeling the squeeze on essentials such as food, energy, and services.

"However, while the Bank of England is expected to take a cautious approach to interest rate policy, we still expect a cut in interest rates when the Monetary Policy Committee (MPC) next votes on August 7."

The rise in inflation was driven by a jump in transport prices caused by a smaller-than-usual drop in motor fuel prices and sharp increases in air and rail fares.

Food prices also rose slightly as supermarkets came under pressure from escalating global tensions and economic uncertainty.

Worryingly, core inflation, which strips out the more volatile items such as food, alcohol and tobacco, also jumped in the 12 months to June to 3.7 per cent from 3.5 per cent in May, though CPI services inflation held at 4.7 per cent.

Shadow chancellor Mel Stride says the rise in inflation is "deeply worrying for families" and "well above" the Bank of England's two per cent target."Labour’s decision to tax jobs and ramp up borrowing is killing growth and stoking inflation – making every day essentials more expensive," he writes on X.

He says the Government are "too weak to take tough choices on spending" and says "more tax rises are on the way, leaving families facing ever-rising costs".

Despite energy bills stabilising, households continue to feel the pinch from high grocery prices and rising service costs. Mortgage holders, in particular, face the prospect of higher monthly repayments for longer, with around 1.6 million fixed-rate deals due to expire by the end of the year.

Political pressure is also mounting as Chancellor Rachel Reeves has pledged to grow the economy while keeping inflation in check, but the latest figures could complicate that balancing act.

Reacting to the figures Reeves explained she knows "working people are still struggling with the cost of living".

She said: "That is why we have already taken action by increasing the national minimum wage for three million workers, rolling out free breakfast clubs in every primary school and extending the £3 bus far cap."

The chancellor admits "there is more to do" but she is "determined we deliver on our Plan for Change to put more money into people’s pockets".

Nick Saunders, CEO of investment platform Webull UK said: "Creeping inflation is not what the Chancellor needs right now as she grapples with rising bond yields. Despite being largely a bystander in the tariff wars, the UK's economy feels finely balanced, ready to tip hard should the management not be effective."

"Inflation remains well above the Bank's target but this is a global rather than purely British issue. Investors will not put off joining the rallying markets but are likely to build up cash reserves against stormy weather ahead.”

Nellis continued: "The bigger question on the economic horizon now lies with the Chancellor as the road to the Autumn Budget continues.

"With economic growth still sluggish, just one per cent forecast for the year as a whole, the Government has little wriggle room for manoeuvre.

"We head towards a Budget where the Chancellor will need to reconcile tax revenues and public expenditure. If she cannot do it through spending cuts (such as to pensions) then we are very likely to see tax rises. She could always break her self-imposed fiscal rules, but her commitment to these has been steadfast."

Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group, said: "Today’s figures, along with expectations of a further inflation spike this Autumn, suggest the Bank will continue to approach any further interest rate cuts with caution, with the Monetary Policy Committee facing a tough decision when they meet again in August.

"If they do decide to cut rates, movements are likely to be incremental for the rest of this calendar year, however there are a number of factors in play - Bank of England Governor Andrew Bailey has also highlighted the job market as an area to watch, suggesting that a slowdown in employment could accelerate the pace of rate cuts."

Inflation has jumped this month

|GETTY

Deutsche Bank Research expected inflation to hit 3.5 per cent, and said in a note: "After a pulldown in headline inflation over May, we see inflation rates edging a little higher in June, commencing its ascent over summer.

"We see headline CPI peaking at 3.8 per cent, before slowing through 2026. Our forecasts for 2025 and 2026 remain broadly unchanged, with headline CPI tracking at 3.3 per cent this year and slowing to 2.4 per cent next year."

Pantheon Macroeconomics had also forecast that inflation will rise in Wednesday’s reading to 3.5 per cent.

It said the increase would be "driven by food prices".And it also says that core inflation, which excludes volatile measures like food and energy prices, will sit at 3.5 per cent, as it did last month. It thinks that inflation will peak at 3.7 per cent in September.

Not all forecasters agreed that there would be a rise though. Capital Economics expected inflation to drop to 3.3 per cent. It also thinks inflation will rise further, to 3.7 per cent, later this year.