Interest rate unchanged as experts warn of bitter blow for thousands of mortgage holders

The Bank of England (left) and Andrew Bailey (right)

|GETTY

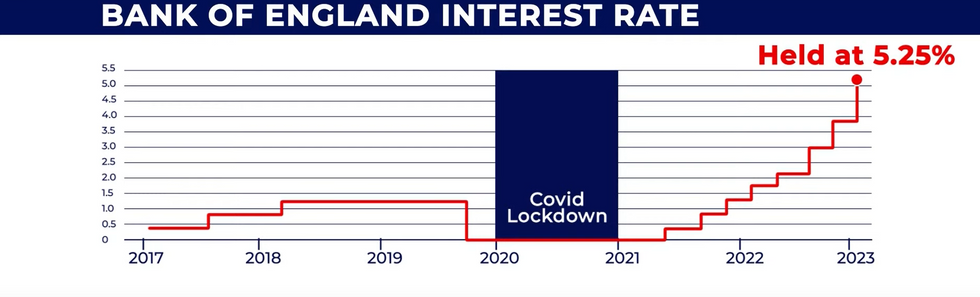

The Bank of England held its base rate at 5.25 per cent for a fourth consecutive month

Don't Miss

Most Read

The UK's interest rate remains unchanged at 5.25 per cent but experts have warned the decision still comes as a bitter blow for some mortgage holders.

The Bank of England has today announced it will hold its base rate for a fourth consecutive month after steadily increasing the charge in a bid to curb inflation.

Six members of the Monetary Police Committee voted in favour of no change, including Bank of England Governor Andrew Bailey.

However, three members voted for yet another incremental increase.

WATCH NOW: GB News' Liam Halligan addresses the Bank of England's decision to hold the interest rate

Data compiled by the Office for National Statistics last month revealed that inflation held at 6.7 per cent in September, the same rate as August.

Experts in the financial sector still hope Rishi Sunak can reach his commitment to halve the Consumer Price Index to around five per cent by the end of the year.

Inflation peaked at a 41-year high at 11.1 per cent in October 2022 following the fallout of the coronavirus pandemic and Vladimir Putin's illegal invasion of Ukraine.

But in yet another blow Saxo's Althea Spinozzi warned the Bank of England is "on the verge of losing credibility" as interest rates could stay above four per cent until 2029.

Despite homeowners benefitting from no further increase, a mortgage expert argued a 5.25 per cent base rate will continue to heap "anxiety" on British families.

LATEST DEVELOPMENTS:

The Bank of England's interest rate

|GBN

Amanda Aumonier, head of mortgage operations at Better.co.uk, said: "Keeping the base rate unchanged may leave homeowners with expiring fixed-rate deals somewhat disheartened.

"While controlling inflation is crucial, the burden of high interest rates is a source of anxiety for families who could face an extra financial strain, potentially costing them hundreds of pounds each month for mortgage payments.

“First-time buyers may also find their dreams of homeownership seemingly out of reach due to the impact of elevated mortgage costs on their hard-earned savings for a deposit."

She added: ‘"For many homeowners, the looming question is whether to find a new fixed-rate mortgage or explore the potential benefits of a variable or tracker mortgage.

"Some are sensibly pondering the option to wait and see if rates will trend downwards before making a decision.

Chancellor Jeremy Hunt

| PA“The choice you make should align with your comfort level with financial risk and your current financial stability."

Reacting to the decision, Chancellor Jeremy Hunt said: "Inflation is falling, wages are rising and the economy is growing.

"The UK has been far more resilient than many expected, but the best way to deliver prosperity is through sustainable growth.

"The Autumn Statement will set out how we will boost economic growth by unlocking private investment, getting more Brits back to work, and delivering a more productive British state."

Shadow Chancellor Rachel Reeves

| PAHowever, Shadow Chancellor Rachel Reeves warned the decision was a "damning indictment" of 13 years of economic failure by the Tory Party.

She said: "At the start of the year, Rishi Sunak and Jeremy Hunt promised to get the economy growing. These figures show we are going in the wrong direction."

"We are forecast to have gone from low growth to no growth, with working people paying the price.

"Labour's plans for growth will make working people better off by getting Britain building again, cutting energy bills, and creating good jobs across the country."

Andrew Bailey | PA

Andrew Bailey | PAHowever, Bailey warned it is too early to cut the interest rate.

He said: “Let me be clear, there is absolutely no room for complacency. Inflation is still too high.

“We will keep interest rates high enough for long enough to make sure we get inflation all the way back to the two per cent target.

“We will be watching closely to see if further increases in interest rates are needed.

"But even if they are not, it is much too early to be thinking about rate cuts.”