HSBC and first direct slash mortgage rates to sub-4% but interest rates ‘remain high’ for first-time buyers

Lenders including HSBC and first direct have confirmed they are reducing mortgage rates this week

Don't Miss

Most Read

Latest

HSBC and first direct are among the many lenders who are slashing mortgage rates this month but experts are warning that first-time homebuyers are unlikely to benefit.

Interest rates have been on the rise in the past year-and-a-half which has resulted in “higher” mortgage repayments for households.

High street banks and building societies are promoting new reductions to mortgage rates to entice new customers and keep existing ones.

Two of the lenders to do this are HSBC and first direct, which are slashing rates to under four per cent this week.

Lenders are slashing rates to kick-off the New Year

|GETTY

HSBC UK’s sister bank first direct is preparing to launch two products at 3.99 per cent from tomorrow. This includes a 10-year fixed mortgage for people with a 40 per cent deposit, with a rate of 3.99 per cent, reduced by 0.98 percentage points from 4.97 per cent previously.

For those with a 40 per cent deposit, the lender will offer a five-year fixed mortgage priced at 3.99 per cent with both products being available to new and existing customers.

In comparison, HSBC UK has reduced rates on its residential mortgage range by up to one percentage point, with several of its rates being below four per cent for the first time since April 2023.

An HSBC UK spokesperson said: “Our latest changes mean that we are able to offer our existing customers five-year and 10-year fixed-term mortgages that are below four per cent for the first time since April 2023, alongside our lowest rate of 3.89 per cent for existing customers.”

Danny Belton, the head of Lending at Mortgage Advice Bureau, described the latest reductions as a “welcome New Year’s gift” for homeowners and potential buyers.

The mortgage expert told GB News he thought the rate cuts from first direct and HSBC are a sign of “things to come” with more lenders likely following suit in the weeks ahead.

Nevertheless, Mr Belton warned that first-time homebuyers are unlikely to benefit from interest rates being lowered by lenders.

He explained: “Although this is unequivocally good news for the millions of homeowners who will be looking to remortgage or buy this year, the lowest rates, such as a sub four per cent interest rate, will mostly be for those with a larger deposit.

LATEST DEVELOPMENTS:

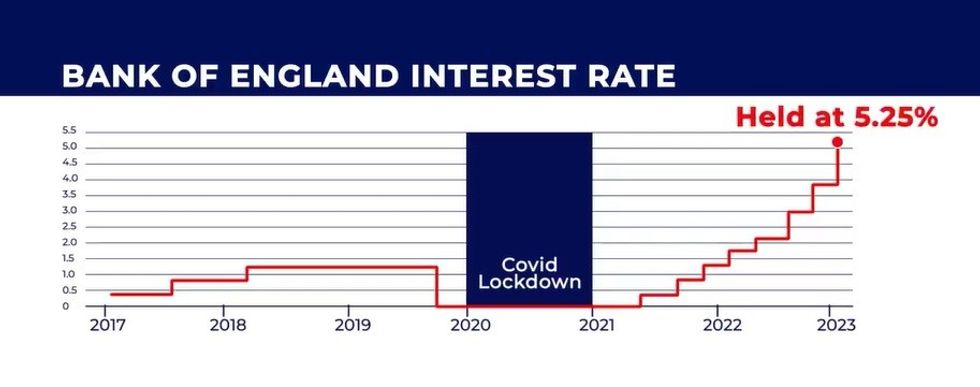

The Bank of England has held interest rates at 5.25 per cent | GB NEWS

The Bank of England has held interest rates at 5.25 per cent | GB NEWS“For first time buyers, and those with a lower amount of equity built up, rates remain high.

“As the year progresses, we’re hopeful that lenders will start to reduce these so that first time buyers can make homeownership a reality.”

The Bank of England’s base rate is sitting at 5.25 per cent with analysts predicting cuts by the central bank as soon as spring 2024.

The financial institution’s Monetary Policy Committee (MPC) is next set to make an interest rate announcement on February 2.