Falling house prices offer little relief as buyers hit with upfront £10,000 tax bill

GBNEWS

Conveyancing delays meant some buyers missed the deadline, leaving them with unexpected tax bills just as household costs surged

Don't Miss

Most Read

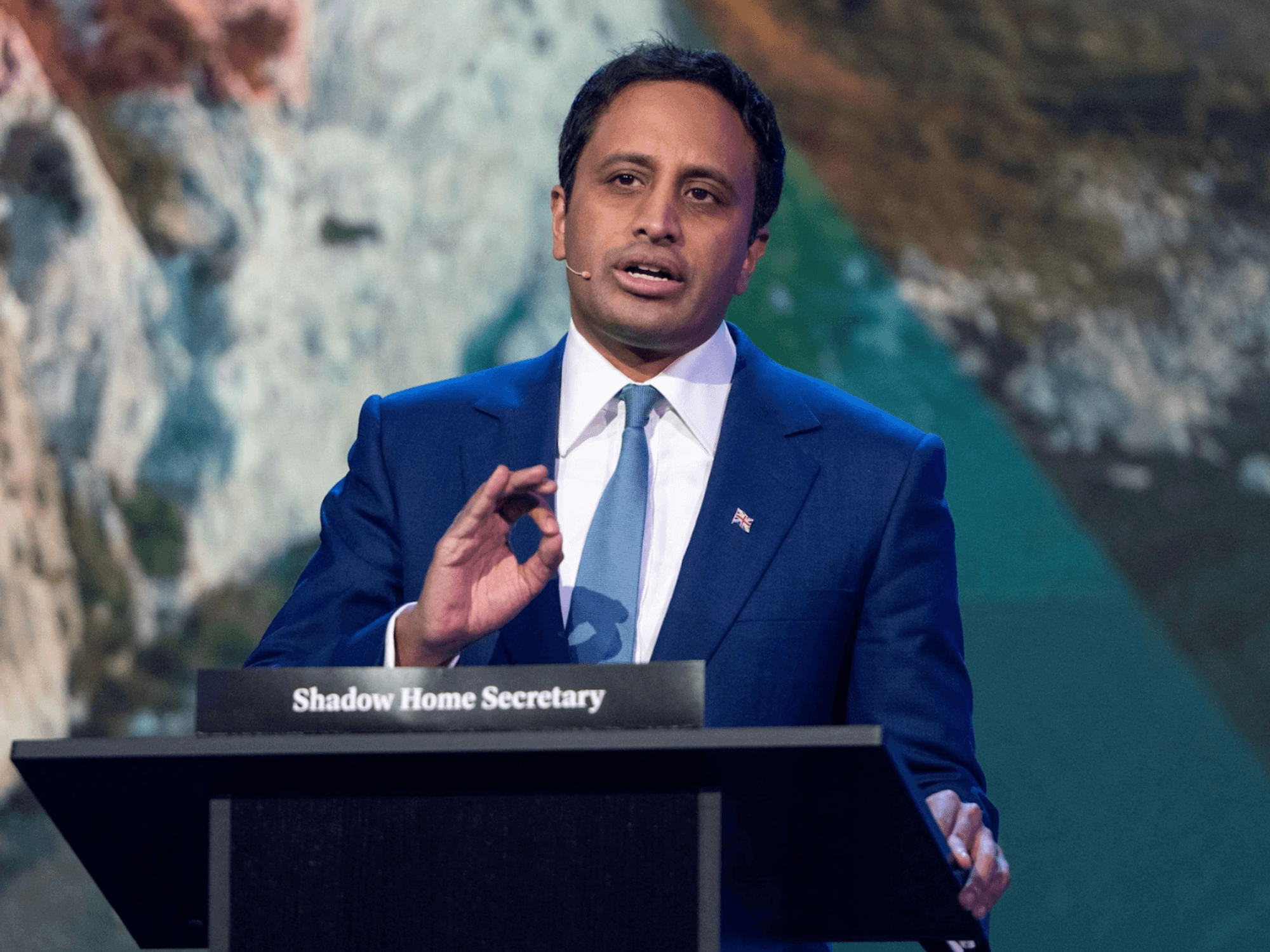

Homebuyers now face an extra £10,000 in upfront costs under a new tax regime - despite falling house prices across the UK.

The additional financial burden arrives at a particularly challenging time for prospective homeowners, with many already struggling with affordability.

The slowdown in the property market follows changes to stamp duty thresholds introduced at the start of April.

These changes have increased upfront costs for many buyers, dampening demand and contributing to the 0.6 per cent monthly fall in house prices, according to Nationwide.

Consequently, first-time buyers are now facing stamp duty bills of £10,000 on £500,000 properties, compared with just £3,750 under the previous tax regime.

The annual rate of house price growth also eased to 3.4 per cent in April, down from 3.9 per cent in March, bringing the average UK home value to £270,752.

House prices have dropped in the UK | GETTY/PA

House prices have dropped in the UK | GETTY/PAThe stamp duty changes have seen the nil-rate band for all buyers reduced from £250,000 to £125,000. For first-time buyers, the threshold has fallen from £425,000 to £300,000.

The maximum property value eligible for first-time buyer relief has also dropped from £625,000 to £500,000. These reductions have significantly increased upfront costs, particularly in higher-value areas.

Robert Gardner, Nationwide’s chief economist, said: "The softening in house price growth was to be expected, given the changes to stamp duty at the start of the month."

He noted that early signs point to a spike in transactions during March, as buyers rushed to complete purchases ahead of the new tax rules.

That surge in activity has since given way to a cooler market following the deadline, directly contributing to the price drops seen in April’s figures.

LATEST DEVELOPMENTS:

- House prices growth slows down but two UK regions see values jump by 10 per cent

- Bank of England set to cut interest rates within weeks – what it means for your savings, pension and mortgage

- Low-deposit mortgage deals are at a high but there are many pitfalls to consider before buying - here's what you must know

The annual rate of house price growth also eased to 3.4 per cent in April, down from 3.9 per cent in March

| GETTYAlice Haine, Personal Finance Analyst at Bestinvest, noted that while spring usually brings more property listings, the increase in supply hasn't been matched by stronger demand - a trend worsened by the usual Easter lull and broader economic uncertainty.

She said: "Buyers are not only facing higher upfront costs but also dealing with financial pressures from rising energy, water and council tax bills," adding that recent pay rises have been effectively wiped out for many households.

Some buyers also missed the stamp duty deadline due to conveyancing delays, leaving them with unexpected tax bills.

However, easing mortgage rates are offering some relief, thanks to three interest rate cuts since last August and growing competition among lenders. Further rate cuts remain likely amid global economic uncertainty.

Around 800,000 fixed-rate mortgages with interest rates of three per cent or below are expected to be refinanced annually until the end of 2027

| GETTYMarkets are expecting a quarter-point rate cut when the Bank of England's Monetary Policy Committee meets next week.

This trend "bodes well for first-time buyers, home movers and those looking to refinance their existing mortgage soon," according to Haine.

The market outlook remains fragile according to today's figures. Any meaningful recovery in housing activity will likely depend on more substantial falls in mortgage rates or improvements in real incomes.

Around 800,000 fixed-rate mortgages with interest rates of three per cent or below are expected to be refinanced annually until the end of 2027.

Many of these borrowers must prepare for increased mortgage costs despite recent rate improvements. Until more significant economic changes occur, the housing market appears set to continue treading water.