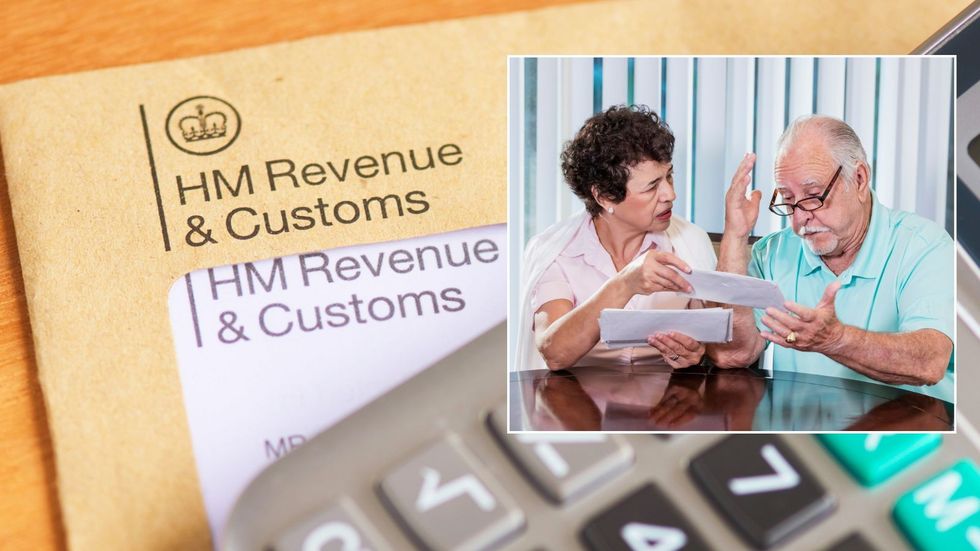

HMRC alert: Thousands less than two weeks away from receiving shock tax penalty which could 'snowball into bigger problems'

Tax refunds for work expenses

|GBNEWS

Late payments trigger 8.25 per cent interest and could raise red flags for HMRC investigations

Don't Miss

Most Read

Latest

Thousands of Britons are less than two weeks away from receiving a shock tax penalty from HMRC, which experts warn could "snowball into bigger problems".

With just under two weeks to act, the risk of financial penalties and investigations is growing fast.

Thousands of self-employed taxpayers are now at risk of £100 penalties or more, with HMRC's Payment on Account deadline fast approaching on July 31.

The rule affects those whose last tax bill exceeded £1,000, requiring them to make an advance payment toward next year’s liability.

Failure to pay on time doesn't just incur a flat fine, HMRC charges 8.25 per cent interest on unpaid tax from the day after the deadline, and penalties increase the longer the debt remains outstanding.

Claire Trott, Head of Advice at St. James's Place said: "With there now less than two weeks remaining until HMRC's second Self-Assessment payment deadline on 31st July, it's vital that taxpayers check what they owe and ensure payment is made on time to avoid facing penalties."

This deadline primarily impacts freelancers, small business owners, and those with side income, particularly individuals new to self-employment who may not yet be familiar with HMRC’s Payment on Account system.

Anyone whose prior bill was over £1,000, and who has not already paid more than 80 per cent of their tax due, is expected to make this additional payment.

Seb Maley, CEO of Qdos, warns of wider risks. He said: "Missing the Payment on Account deadline can easily snowball into bigger problems. You also run the risk of being investigated by HMRC - late payments are one of the many red flags that the tax office looks out for."

Taxpayers will face fines if they miss a crucial deadline

| GETTYTrott explained that although the payments on account are intended to help individuals spread the cost and stay on top of payments, missing the deadline can have serious financial consequences.

HMRC currently applies a late payment interest rate of 8.25 per cent on any unpaid amount after the deadline, and late payment penalties increase the longer the tax remains outstanding.

She said: "Given the potential cost of delay, it’s essential that individuals check their Self-Assessment account now and act ahead of the deadline. While long-standing self-employed individuals are likely to be familiar with these deadlines, they can easily catch out those newly self-employed who’ve submitted their first return this year."

HMRC explained that those who miss deadlines will be hit with an immediate £100 fine, then £10 daily penalties after three months (capped at £900), plus further charges of £300 or five per cent of tax due at six and twelve months - whichever is greater.

HMRC explained that those who miss deadlines will be hit with an immediate £100 fine

|GETTY

Maley explained that growing HMRC capabilities, including access to real-time data and cross-checking tools, mean compliance is no longer optional and it's central to both enforcement and Treasury planning.

In April 2025, HMRC rolled out Making Tax Digital penalties, which will hit late payers even harder.

Under the new rules:

- Three per cent of unpaid tax will be charged after 15 days

- Another three per cent at 30 days

- Plus 10 per cent annually on tax overdue beyond 31 days

A self-employed person owing £25,000 could end up paying more than £28,000 in just four months under the new regime.

These changes are part of HMRC’s strategy to close the £44 billion tax gap,

| PAThese changes are part of HMRC’s strategy to close the £44 billion tax gap, with over 500 new compliance officers being hired.

The Treasury estimates the tougher penalty structure could raise £370 million by 2030.

Trott urges those struggling to pay not to stay silent: "While it may be tempting to delay or ignore the issue, HMRC does consider reasonable excuses, and reaching out early gives you the best chance of avoiding escalating penalties."

More From GB News