HMRC's digital tax scheme cost Britons £850million after years of missed targets and exceeded budgets

The move to modernisation is costing more than £120million a year

Don't Miss

Most Read

HMRC’s Making Tax Digital programme has cost taxpayers almost £850million since it was launched in 2015, despite failing to reach most of the individuals and businesses it was designed to serve.

The initiative, which aims to modernise the UK tax system by replacing paper returns with online submissions, is currently costing more than £120million a year.

Figures obtained by The Telegraph show total spending has reached £849.91million to date.

The National Audit Office has warned that overall costs are forecast to rise beyond £1.3billion, far above the original £226million budget set out in 2016.

The overspend amounts to more than £1billion on a programme that has faced sustained criticism over its effectiveness and value for money.

Making Tax Digital was initially planned as a five year reform programme intended to be completed by 2020.

Instead, the project has been repeatedly delayed and restructured, extending its lifespan to more than a decade.

The programme was first announced in the 2015 Budget, with ministers promising a streamlined and more efficient tax system.

VAT registered businesses were eventually required to join the scheme in 2022, around three years later than originally planned.

The move to modernisation is costing more than £120million a year

|GETTY

The rollout of Making Tax Digital for income tax self assessment, which affects millions of self employed workers and landlords, has yet to be completed.

Under current plans, income tax reporting will be phased in over the coming years.

Several elements of the original scheme have been abandoned.

Plans to mandate digital record keeping for corporation tax were scrapped following concerns over complexity and cost.

HMRC also faced difficulties transferring VAT records onto the new system during 2022 and 2023, slowing progress and limiting development of the income tax platform.

LATEST DEVELOPMENTS

George Obsourne was Chancellor in 2015 when the scheme was introduced

|GETTY

In December 2022, the Government announced a fourth delay to the programme, pushing the income tax rollout back until at least 2026.

The National Audit Office has repeatedly raised concerns about the programme’s management and outcomes.

In 2018, the watchdog warned that the long term costs of Making Tax Digital would outweigh any savings to businesses by £37million a year.

When it reviewed the scheme again in 2023, following its expansion to all VAT registered businesses, it concluded that HMRC had failed to show the programme delivered value for money.

It said there was “no strong evidence to date” that Making Tax Digital had improved productivity for most VAT traders.

In a report published in June 2023, the National Audit Office warned that repeated delays and changes had “undermined its credibility and increased its cost”.

Despite these findings, the Government has committed a further £500million to HMRC’s digital services between 2026 and 2029.

Labour ministers are now pressing ahead with the next stage of the rollout.

From April 6, landlords and self-employed individuals earning more than £50,000 a year will be required to join the scheme.

Those affected will need to submit quarterly updates to HMRC during the tax year and file a final year end declaration using HMRC approved third party software.

The Institute of Chartered Accountants in England and Wales has opposed this approach.

The professional body said it was “firmly opposed to the mandated quarterly update element of the Making Tax Digital income tax requirements”.

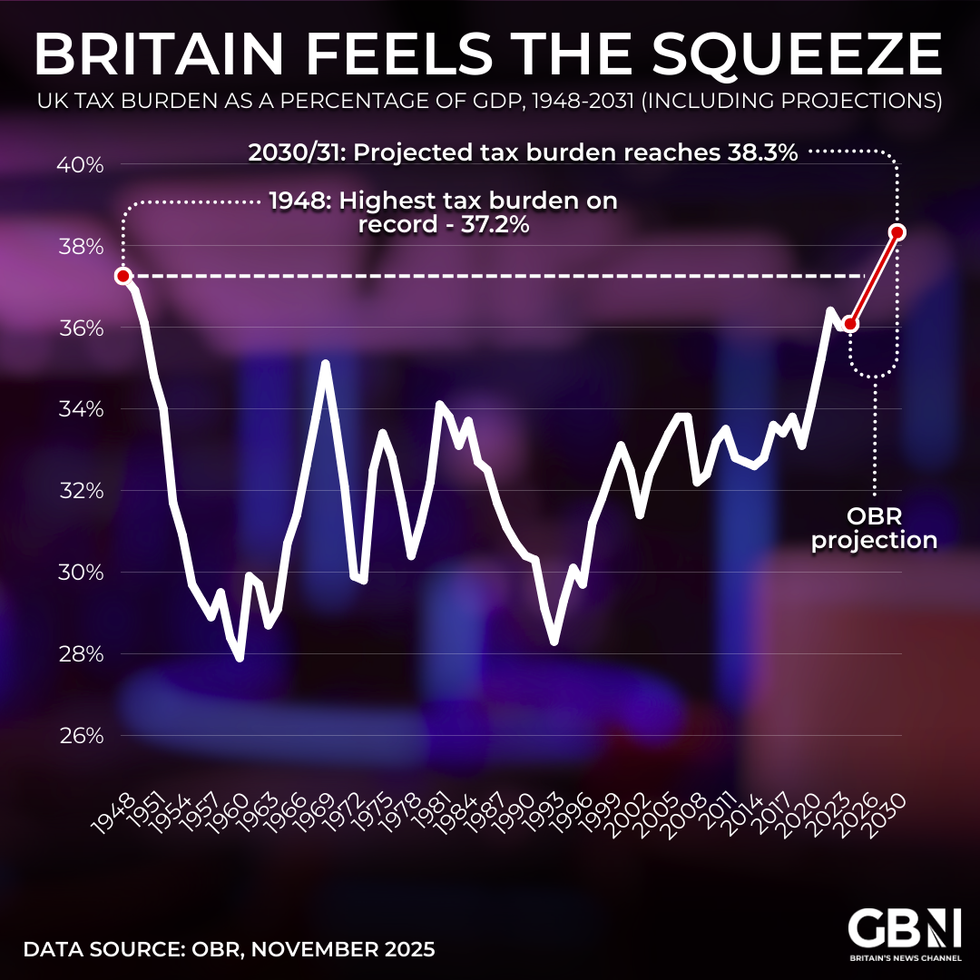

£26billion in raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030

| GB NEWS/OBRIt said quarterly updates add complexity and cost with little tangible benefit to taxpayers or HMRC.

Under current plans, the income threshold will be reduced to £30,000 in April 2027 and to £20,000 in April 2028.

With fewer than three months remaining before the first phase begins, concerns have been raised about taxpayer readiness.

Laura Cumins, from the Low Incomes Tax Reform Group, said the scale of the change was significant.

“Making Tax Digital is the biggest change to the tax system since the introduction of self assessment, so in that respect it is understandable that HMRC will be spending money to publicise these new rules and make taxpayers aware of their new obligations.”

She said it was concerning that many unrepresented taxpayers were still unsure about what they needed to do, warning that this could create problems for both taxpayers and HMRC.

Our Standards: The GB News Editorial Charter