Pension warning as 800,000 savers miss out on £1,700 tax refund and they don't even know it

Higher rate taxpayers can reclaim £1,756 on average

Don't Miss

Most Read

Latest

Approximately 800,000 pension savers across Britain are failing to collect tax refunds averaging more than £1,700 each year, with many completely unaware they are entitled to the money.

New analysis reveals that higher earners who contribute to personal pensions are leaving substantial sums unclaimed because they either omit pension details from their tax returns or do not submit returns at all.

The problem mainly affects people whose tax is dealt with through PAYE, meaning they are not required to complete a tax return.

However, by submitting one voluntarily, they could unlock a sizeable tax refund on their pension contributions.

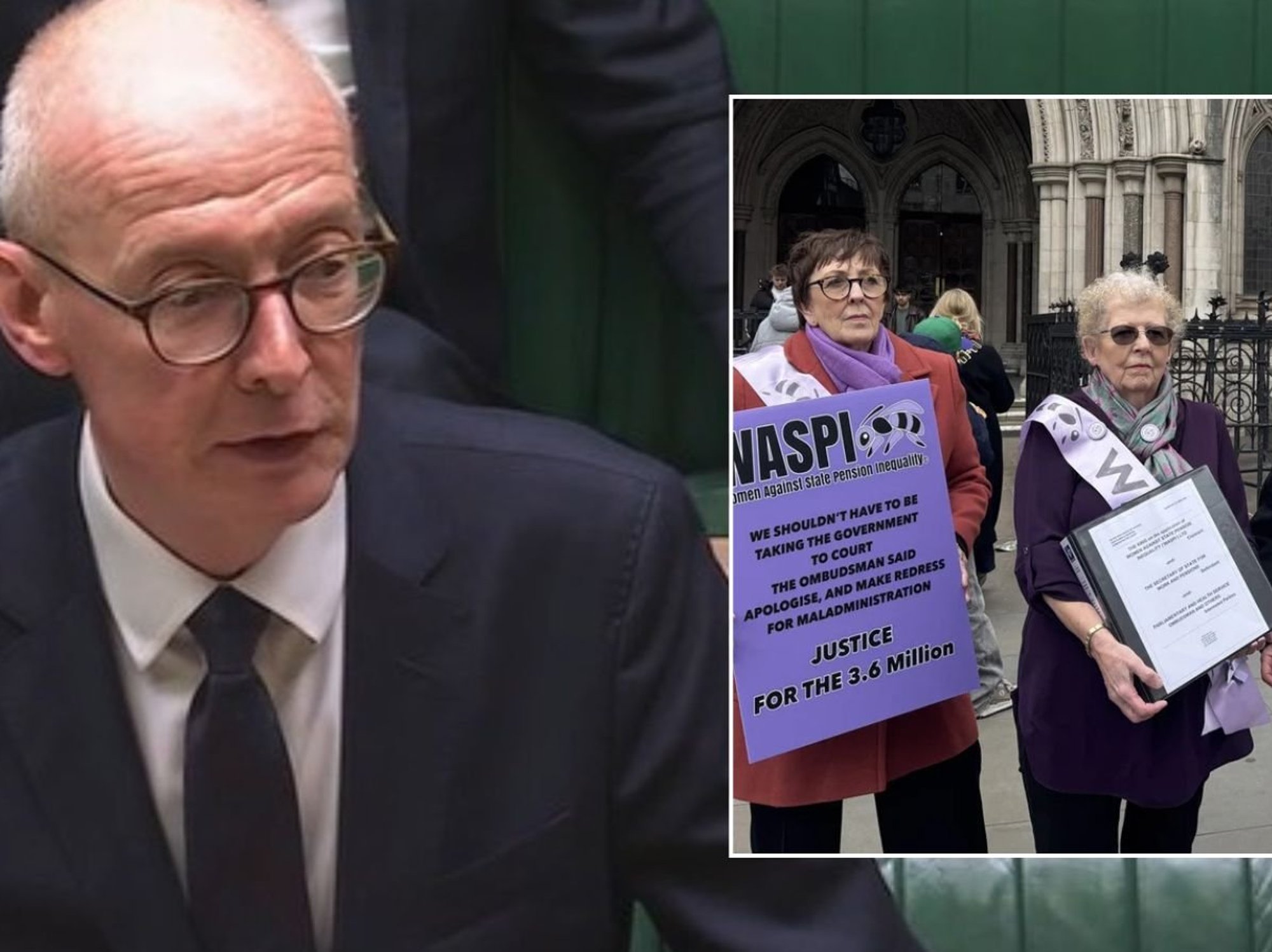

Freedom of Information data obtained by Steve Webb, a partner at pension consultants LCP, shows that more than £1billion in pension tax relief goes unclaimed each year.

This happens because many higher earners pay into pensions that use the relief at source system but never claim the extra tax relief they are entitled to.

Under this system, basic rate relief is automatically added to pension pots by HMRC. Those paying tax at 40 per cent or 45 per cent must actively claim the extra relief they qualify for, typically by declaring their contributions on a self-assessment form.

The findings emerge as the tax return deadline approaches.

The relief at source system operates by allowing savers to pay into their pension from net income, with HMRC then topping up the contribution with basic rate tax relief.

An £800 payment from take-home pay therefore becomes £1,000 in the pension pot automatically.

An £800 payment from take-home pay therefore becomes £1,000 in the pension pot automatically

| GETTYFor those taxed at the higher 40 per cent rate, an additional 20 per cent relief is available on top, but this must be claimed separately.

On a gross contribution of £1,000, this equates to an extra £200.

HMRC figures show the average pension contribution declared on tax returns stands at £8,782, meaning higher rate taxpayers can reclaim £1,756 on average.

LATEST DEVELOPMENTS

Under this system, basic rate relief is automatically added to pension pots by HMRC

| PAAccording to the FOI data, only 316,000 higher rate taxpayers actually claimed this relief in 2023/24, despite an estimated 1.1 million being eligible. This leaves roughly 807,000 people failing to collect money owed to them.

Among additional rate taxpayers, the gap is smaller but still notable, with 151,000 claiming against an expected 170,000.

The situation is set to deteriorate further as frozen tax thresholds drag more workers into higher bands.

The total number of higher and additional rate taxpayers rose from 6.9 million in 2023/24 to 8.3 million in 2025/26, with further increases anticipated.

Steve Webb, partner at pension consultants LCP, said: "With more and more people being dragged into higher rates of income tax, it is increasingly important that they claim all the tax relief to which they are entitled.

"Anyone saving into a personal pension or other 'relief at source' scheme can get higher rate relief but only if they claim it.

Pension savers are also being reminded they can submit backdated claims covering the previous four years

| GETTY"When filling in your tax return it is vital not to ignore the box for personal pension contributions but to enter the gross amount that went in to your pension.

"This should trigger a tax refund worth an average of over £1,700 for higher rate taxpayers and over £2,000 for additional rate taxpayers."

Pension savers are also being reminded they can submit backdated claims covering the previous four years.