UK high streets under pressure as Budget fears hit sales despite Black Friday deals

The figures represent a disappointing start to the crucial 'golden quarter' for retailers

Don't Miss

Most Read

UK high streets remain under pressure after retail sales fell for a second consecutive month in November, despite the Black Friday shopping period.

Official figures showed spending weakened as shoppers held back amid uncertainty ahead of the autumn Budget.

The Office for National Statistics data showed that the annual discount bonanza failed to deliver its typical boost to the sector. Economists had anticipated growth of 0.4 per cent compared with October.

Hannah Finselbach, senior statistician at the ONS, said: "This year November's Black Friday discounts did not boost sales as much as in some recent years."

The figures represent a disappointing start to the crucial "golden quarter" for retailers, with sales having now fallen in consecutive months during the key pre-Christmas trading period. October's decline was revised from 1.1 per cent to 0.9 per cent.

Consumer hesitancy ahead of the autumn Budget appears to have dampened spending appetite during the peak festive shopping window.

Retailers have pointed to the timing of the fiscal statement as particularly unhelpful, unsettling shoppers at a critical moment.

Speculation surrounding potential tax increases prompted many to exercise considerable restraint, even when faced with Black Friday bargains.

The wettest weather of the year also contributed to subdued footfall.

The wettest weather of the year also contributed to subdued footfall

| GB NewsA separate ONS household survey painted a stark picture of shifting attitudes. While some respondents indicated they intended to increase their Black Friday purchases compared with last year, nearly double that number said they planned to spend less.

Performance across retail categories varied considerably during November. Supermarkets recorded their fourth consecutive monthly decline, with sales falling 0.5 per cent as food inflation continued to squeeze household budgets and shape purchasing decisions.

Department stores fared better, reporting increased sales volumes over the period. Footwear and leather goods retailers also experienced stronger trading.

LATEST DEVELOPMENTS:

The second consecutive monthly decline was seen as a big disappointment for retailers

| PANon-food stores as a whole, encompassing department stores, clothing outlets, household goods shops and other retailers, saw volumes rise by 1 per cent month on month. The ONS attributed this partly to extended Black Friday promotional periods.

Online sales presented a mixed picture. Compared with October, internet purchases climbed 0.7 per cent, while year-on-year figures showed an 8.3 per cent increase. However, non-store retailers, primarily online operators, suffered a 2.9 per cent monthly drop.

Oliver Vernon-Harcourt, head of retail at Deloitte, described the second consecutive monthly decline as "a big disappointment for retailers, particularly with Black Friday and early Christmas shopping captured in these figures."

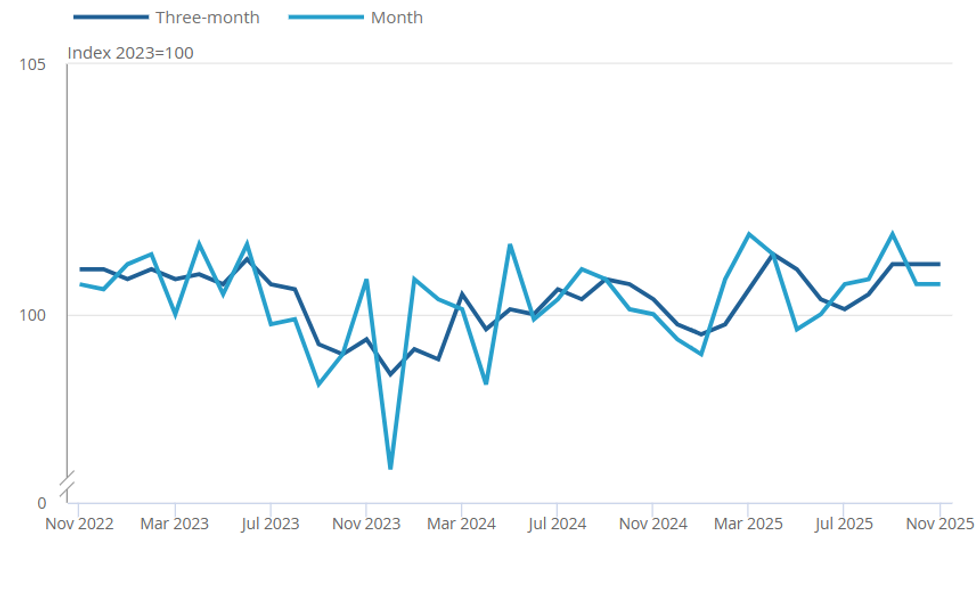

The chart shows the quantity bought in retail sales over time, for both the rolling three-month and the monthly movements.

|ONS

Danni Hewson, head of financial analysis at AJ Bell, observed that shoppers had been "bruised" by the impact of rising prices on living standards, predicting many households would have fewer presents under the tree this year.

However, consumer confidence has improved in December according to GfK survey data, offering hope of a late spending surge. Yesterday's interest rate cut may also provide encouragement for cautious shoppers.