Borrowing costs higher than expected after Winter Fuel Payment U-turn and Rachel Reeves's 'shaky gamble'

The latest figures from the ONS found UK borrowing fell to £11.7billion last month but remains higher than previous forecasts from economists

Don't Miss

Most Read

Latest

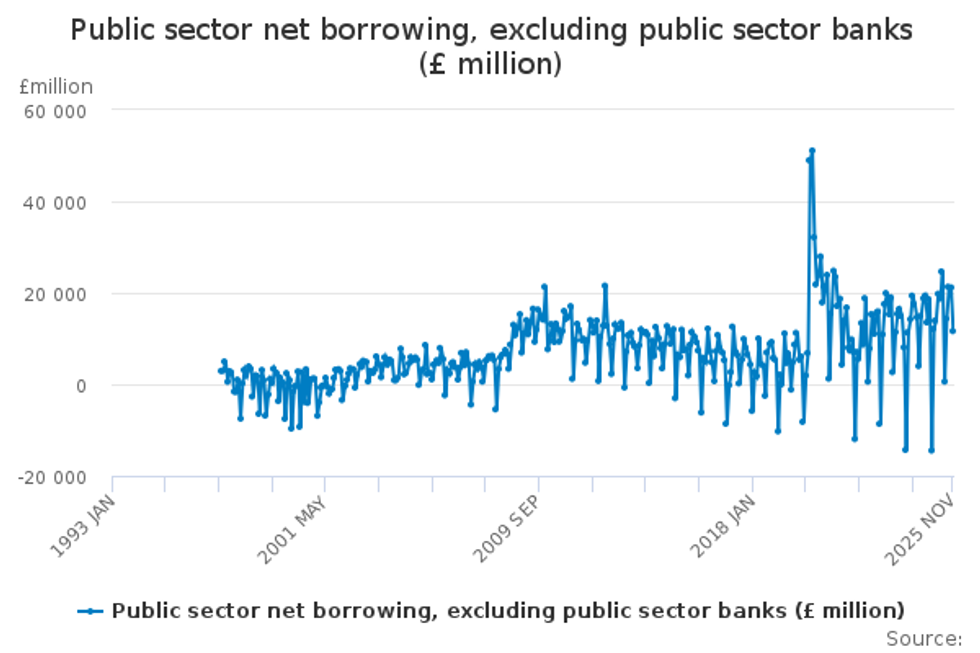

Government borrowing came in higher than expected for the 12 months to November 2025 ahead of Chancellor Rachel Reeves's Budget statement, according to the latest figures from the Office for National Statistics (ONS)

Despite this, UK borrowing figures dropped to £11.7billion last month, marking the lowest figure for over that period since 2021, official data found.

The decline of £1.9billion compared with the same period last year was driven primarily by a substantial reduction in debt interest payments, which fell by £200million to £3.4billion.

However, the figure still surpassed expectations across the board. City economists had anticipated borrowing of approximately £10.3billion, whilst the Office for Budget Responsibility's (OBR) March projection stood at just £8.6 billion.

The Chancellor's 'shaky gamble' on the economy has been called into question after today's borrowing figures

|GETTY

ONS senior statistician Tom Davies noted: "The main reason for the drop from last year was increased receipts from taxes and National Insurance contributions."

Cumulative borrowing for the first eight months of the financial year has now reached £132.3 billion, exceeding the OBR's March forecast by a considerable £16.8billion. This represents an increase of £10 billion compared with the equivalent period twelve months ago.

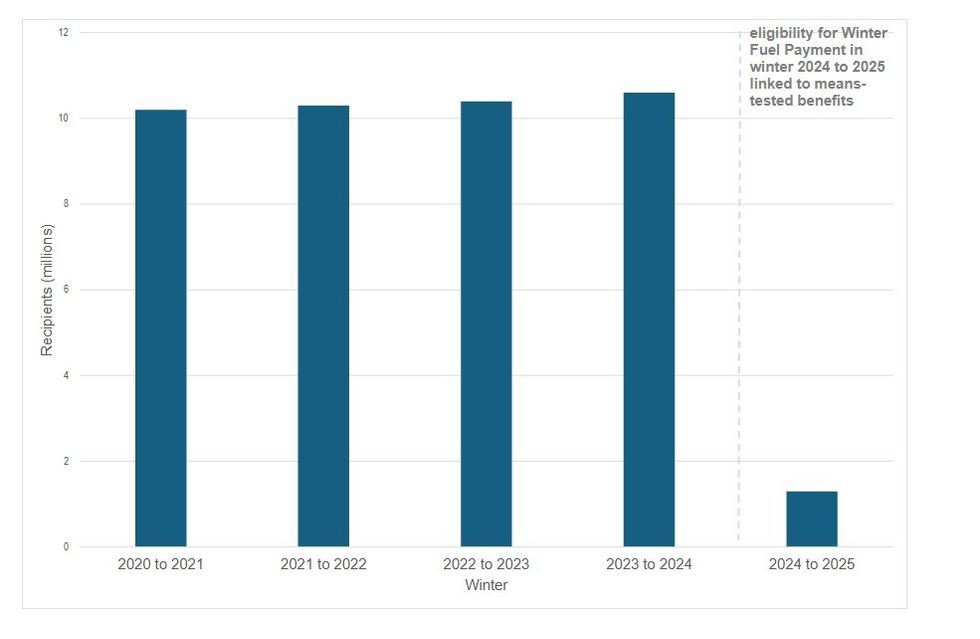

A significant contributor to this overshoot has been the Government's reversal on Winter Fuel Payments, which added £1.8billion to public expenditure.

Ministers abandoned their initial plan to restrict payments through means testing, instead extending the benefit to all pensioners with incomes below £35,000 annually.

Public sector banking continues to be issue for the Government

|ONS

This policy shift prompted an upward revision of £3.9billion to borrowing figures for the seven months ending in October.

Elliott Jordan-Doak, a senior UK economist at Pantheon Macroeconomics, offered a bleak assessment of the Chancellor's position, stating there was "very little Christmas cheer for the Chancellor" in the latest figures.

He warned that Ms Reeves had wagered considerable fiscal credibility on substantial tax rises scheduled for later in the forecast period.

"We think today's figures further illustrate the shaky foundations of that gamble," he said.

The economist expressed concern that revenues were continuing to fall short of targets, whilst the varied approach to taxation relied upon measures with unpredictable returns.

He added: "We also have serious doubts about the Government's ability to follow through on the raft of spending cuts announced in the Budget."

Chief Secretary to the Treasury James Murray emphasised that debt interest costs demonstrated the urgency of reducing borrowing levels.

He said: "£1 in every £10 we spend goes on debt interest money that could otherwise be invested in public services."

Eligibility of Winter Fuel Payment in winter 2024 to 2025 linked to means-tested benefits | DWP

Eligibility of Winter Fuel Payment in winter 2024 to 2025 linked to means-tested benefits | DWPMr Murray pointed to last month's Budget as evidence of the Government's commitment to fiscal responsibility.

Martin Beck, an economist at WPI Strategy suggested that restoring business and consumer sentiment remained crucial to improving the nation's finances.

"A clear and credible pro-growth strategy from the Government and an end to the pervasive gloom surrounding the UK economy may matter just as much for the public finances as the fine print of future tax and spending plans," he said.

Professor Joe Neill, an economic adviser at MHA, added: "For the Government, the figures offer little room for complacency. Borrowing at this level constrains future policy choices and leaves limited headroom for discretionary fiscal measures."

More From GB News