‘Think twice’: FCA warns 1.5 million Britons WASTING money on credit-boosting schemes

Savers urged to be careful of tax on savings interest |

GB News

Watchdog says unregulated services fail to improve credit scores as firms withdraw products

Don't Miss

Most Read

Latest

Britain’s financial watchdog has warned that about 1.5 million consumers could be wasting up to £25 each month on ineffective credit-boosting schemes.

The Financial Conduct Authority (FCA) found little evidence that these unregulated products deliver on promises to improve credit ratings.

The City regulator’s investigation revealed that several firms offering such services failed to show meaningful benefits for customers.

After the FCA’s intervention, five companies have already withdrawn their credit-building products from the market.

TRENDING

Stories

Videos

Your Say

These schemes, which claim to enhance creditworthiness through regular payment reporting, are under scrutiny for potentially misleading consumers about their effectiveness.

The regulator said many people are paying substantial monthly fees for services that do not produce tangible improvements to their financial position.

These products often target those with little or no credit history, promising to build a payment record by reporting transactions to credit reference agencies.

Monthly charges range from £2.50 to £25, depending on the provider and package.

The FCA’s review focused on services that only report routine payments to credit reference agencies.

Around 1.5 million consumers may be losing £25 a month on ineffective credit-boosting schemes, watchdog warns

|GETTY

These operate outside regulated credit frameworks and centre solely on boosting credit scores.

The investigation excluded other credit-building tools such as low-limit credit cards, rent reporting schemes or educational resources explaining credit files.

It concentrated instead on products sold to those trying to establish or rebuild credit histories through payment reporting alone.

The regulator identified serious risks for vulnerable customers, particularly those already facing financial strain.

It warned that these schemes could distort a consumer’s true financial picture when reported to credit agencies, giving lenders the false impression that borrowers can afford more than they actually can.

LATEST DEVELOPMENTS

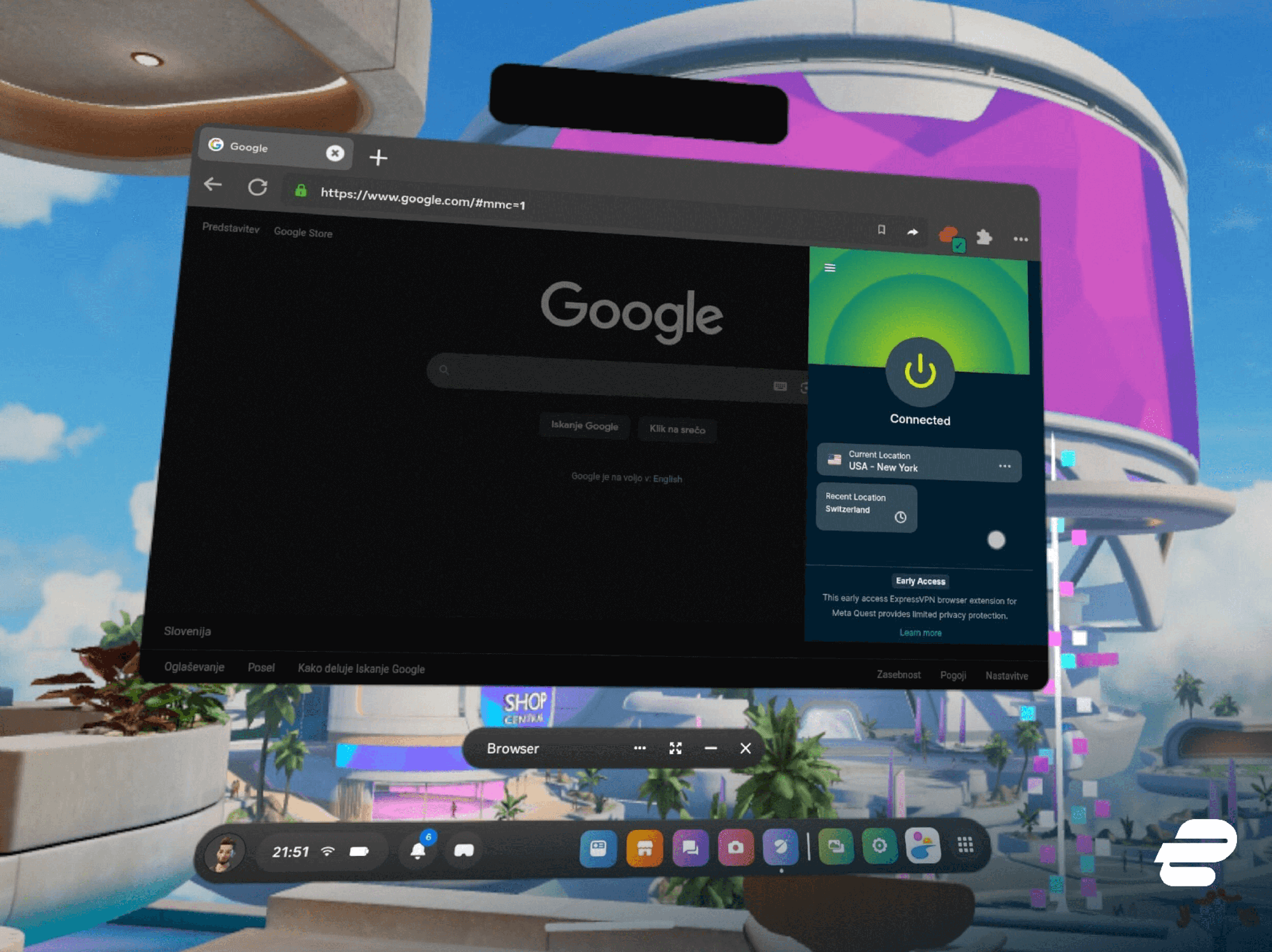

For people struggling with money, these products can worsen their situation by reducing disposable income needed for everyday costs

| GETTYFor people struggling with money, these products can worsen their situation by reducing disposable income needed for everyday costs.

The FCA said most of the products examined operate without regulatory oversight.

Many firms fail to provide clear information about limitations and risks or to explain how their services might be ineffective or even harmful.

Investigators found worrying examples where payment reporting created misleading impressions of customers’ repayment ability, leaving them exposed to greater financial harm.

The FCA’s intervention has already prompted major changes.

Five companies have stopped offering these services, while others have altered their business models, reworked products and revised marketing claims.

The watchdog continues to work with remaining providers while deciding whether further enforcement is required.

It is also collaborating with credit reference agencies to strengthen data reporting rules so that only accurate, relevant information reflecting genuine repayment behaviour is recorded.

These measures aim to prevent misleading representations of consumers’ finances and protect vulnerable people from unaffordable borrowing.

The authority said it will keep monitoring compliance with its new standards and may introduce further interventions if necessary.

FCA’s Credit Information Market Study flagged risks to consumers and the broader credit system

| PAAlison Walters, the FCA’s director of consumer finance, said: "We urge people to think twice before paying to use products that claim to boost your credit score.

"We found that certain types of credit building products don’t always deliver on their promises and there are usually better, more cost-effective ways to build up your credit, and get free and impartial guidance, such as from MoneyHelper."

The regulator recommends the Government-backed MoneyHelper website as a safer alternative for credit advice and debt support.

Recent FCA data showed that while credit score checking among adults rose from 28 per cent in 2022 to 34 per cent in 2024, many remain unclear about what their scores mean.

The concerns emerged through the FCA’s Credit Information Market Study, which identified potential harm to both consumers and the wider credit system.

More From GB News