Farmers ‘face uncertain future’ despite inheritance tax change in Chancellor's Budget

GB News

Agricultural groups say transferable relief fails to address core concerns over inheritance tax

Don't Miss

Most Read

Latest

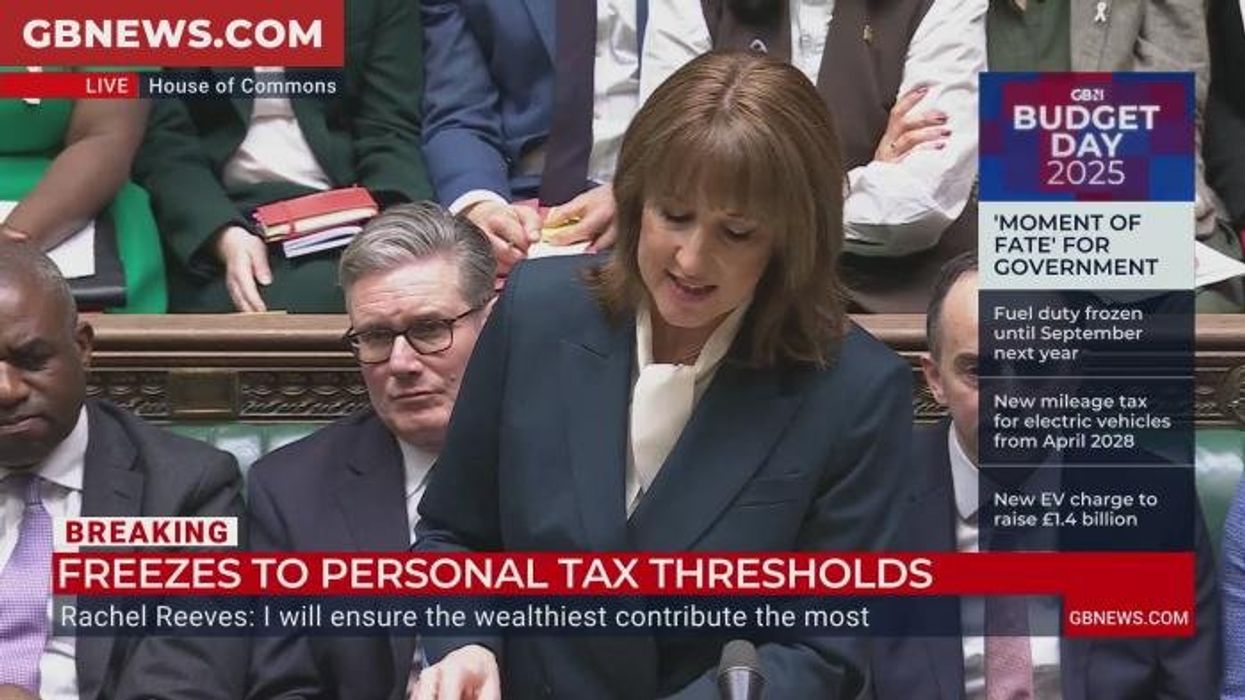

Rachel Reeves’s inheritance tax adjustments "go nowhere near far enough", agricultural leaders have warned.

They say the amendment fails to address the central concerns facing Britain’s family farms.

The Chancellor’s decision to make the £1million agricultural property relief threshold transferable between married couples represents only a minor change to the policy first introduced in last year’s Autumn Statement.

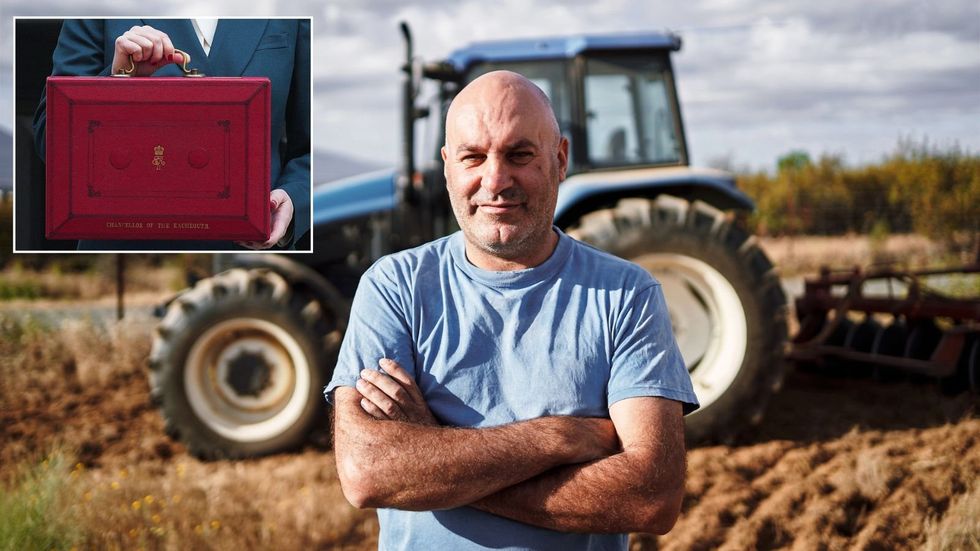

Farming representatives argue the adjustment does not provide meaningful protection for agricultural businesses.

They maintain the measure leaves rural communities exposed to financial pressures that could affect long-term succession planning and the future of working farms.

The modification was announced in Wednesday’s Budget.

It allows married farmers or civil partners to transfer any unused £1million agricultural property relief allowance to their spouse upon death.

This means a surviving partner may be able to access up to £2million in combined agricultural and business assets relief from inheritance tax, depending on individual circumstances.

The change follows sustained pressure from agricultural groups after last year’s Budget introduced a 20 per cent inheritance tax rate on farms and agricultural businesses valued above £1million.

Trade associations representing 160,000 family businesses have written to the Chancellor calling for reform.

MPs from multiple parties have also raised concerns on behalf of rural constituents and independent tax advisers have proposed alternative approaches aimed at offering more targeted support.

Agricultural leaders warn Chancellor Rachel Reeves’s inheritance tax changes “go nowhere near far enough”

|GETTY

National Farmers’ Union president Tom Bradshaw said: "It's good to see the government accepts its original proposals were flawed.

"But this change goes nowhere near far enough to remove the devastating impact of the policy on farming communities".

He noted that allowing agricultural allowances to be transferred between spouses was appropriate and something the NFU had argued for.

However, he said the adjustment does not address the wider implications for older and vulnerable farmers.

Mr Bradshaw said: "It does nothing to alleviate the burden it puts on the elderly and vulnerable".

Concerns across the sector focus on the belief that the government’s modification amounts to a limited concession rather than addressing the broader challenges facing agricultural families.

LATEST DEVELOPMENTS

Farmer's Budget protest in London

|GETTY

Industry figures argue the rules could affect long-term decisions on farming operations and future generational transfers.

Essex arable farmer Sam Pimblett said: "It is hugely disappointing that the government did not take the opportunity in this Budget to make significant changes to this cruel and damaging family farm tax policy.

The small change announced does not protect the majority of small and medium-sized family farms across Essex, many of which have fed the nation for generations and now face an uncertain future".

Andrew Blenkiron, who manages Elveden Farms near the Norfolk-Suffolk border, expressed similar concerns.

He warned the inheritance tax measures would continue limiting investment and would place added strain on the wider rural economy.

Farmers have also highlighted that the policy places older landholders in a difficult financial position while failing to address tax avoidance by non-farming landowners.

Representatives argue this imbalance could affect the resilience of domestic food production.

The National Farmers’ Union said that more than 275,000 members of the public have urged the Government to reform the inheritance tax policy.

The union said this response shows the level of national concern about the impact on rural communities.

During Wednesday’s Budget, several farmers were arrested after driving tractors into Whitehall.

Police restricted agricultural machinery from central London

| GETTYThe Metropolitan Police had restricted agricultural machinery from central London and officers took action when the ban was breached.

Norfolk farmer Gavin Lane, who leads the Country Land and Business Association, said: "This concession is the first public signal that the chancellor knows her inheritance tax reforms have been a disaster".

The NFU said it would continue calling for changes to the policy.

Mr Bradshaw said: "Public support over the past year has been incredible.

"We will need this support to continue from all sides to create the change needed to protect those people caught up in this unjust, unfair policy".

Our Standards: The GB News Editorial Charter