HMRC to clampdown on savers who dodge ISA tax-free allowance cut in 'yet ANOTHER stealth tax'

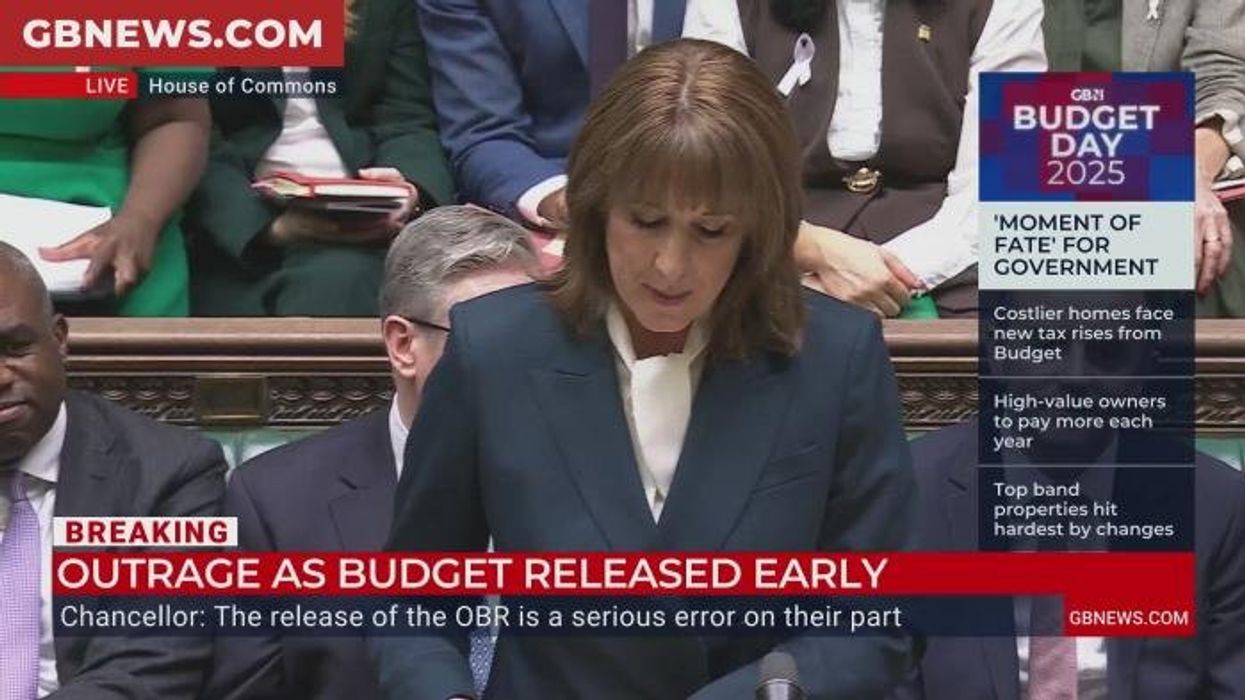

'Britain has defied the forecasts!' Chancellor Rachel Reeves discusses the OBR's latest economic report, as it increases its forecast for economic growth this year |

GB NEWS

The ISA tax-free allowance will be cut from £20,000 to £12,000 from April 2027 following the Chancellor's Budget reforms

Don't Miss

Most Read

Latest

HM Revenue and Customs (HMRC) has announced plans to clampdown on savers who attempt to bypass the forthcoming reduction in cash ISA tax-free allowance.

Earlier this week, Chancellor Rachel Reeves confirmed the savings product's threshold will be slashed from £20,000 to £12,000 for those under the age of 65.

The tax authority published guidance detailing enforcement mechanisms that will take effect when the policy change is implemented in April 2027.

It should be noted the total ISA contribution ceiling will stay at £20,000, meaning younger savers can still invest the full amount but must allocate any sum exceeding £12,000 to stocks and shares or Innovative Finance ISAs.

Savers will be targeted by HMRC if they attempt to bypass the ISA allowance rules

|GETTY

Under HMRC's enforcement framework, savers are prohibited from moving funds from stocks and shares or Innovative Finance ISAs into cash ISAs.

HMRC will implement assessment criteria to identify whether holdings qualify as legitimate investments for stocks and shares ISAs or constitute "cash like" assets that breach the new regulations.

Additionally, the tax authority will impose levies on interest generated by cash positions within stocks and shares or Innovative Finance ISAs.

These measures aim to close potential loopholes that might allow savers to circumvent the reduced cash ISA threshold.

Draft legislation will undergo industry consultation before parliamentary approval, with regulations expected to be finalised well before the April 2027 implementation date.

Jason Hollands, the managing director at online investment platform Bestinvest by Evelyn Partners, condemned the proposals as "yet another stealth tax that will impact genuine investors who sometimes decide to park money in cash for a period of time awaiting investment, or because they are nervous about the market environment."

The industry expert had previously flagged potential complications with the new system, noting that existing regulations permit transfers between different ISA types.

He highlighted that savers with funds exceeding £12,000 might attempt to shelter excess amounts by opening stocks and shares ISAs whilst keeping their money in cash holdings.

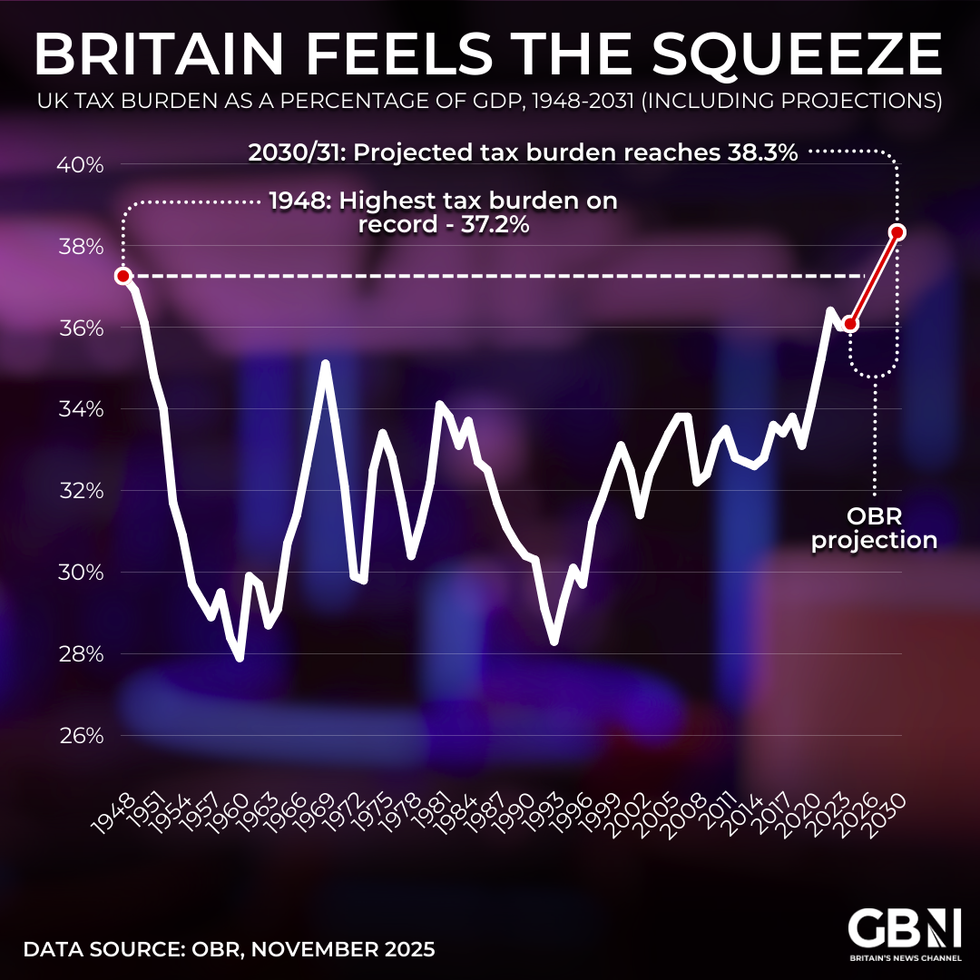

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBRThe investment management sector has expressed alarm about the scope of assets that could fall under the new restrictions. Mr Hollands warned that the criteria for identifying cash-like investments "will throw doubt about access to money market funds within stocks and shares ISAs and could even bring short-dated bonds into question."

Andrew Prosser, the head of Investments at InvestEngine, broke down what the ISA tax-free allowance cut means for everyday savers.

He shared: "Our analysis shows that almost 1.5 million basic-rate taxpayers and just under half a million (462,000) higher-rate taxpayers deposited more than £12,000 into their Cash ISA in the last financial year; now that the allowance has been cut down to £12,000 they will need to find somewhere else for this cash for anything over that amount.

"If they were to put that £8,000 - the difference between £20,000 and the new £12,000 limit - into a 4.5% savings account, after five years, a basic-rate taxpayer will have lost around £288 in tax, while a higher-rate taxpayer could lose around £1,080, or £216 a year once their total savings interest exceeds the £500 allowance."

More From GB News