How much will Rachel Reeves's mansion tax cost YOUR AREA? - Use this interactive map to find out

How could Rachel Reeves' mansion tax affect the housing market? |

GB News

High-value homes across England to face new annual charges from 2028 as Government targets council tax imbalance

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves confirmed the widely anticipated mansion tax during her Budget statement earlier this week with a new annual levy to be slapped on England's highest-value homes.

Under the Treasury's plans, owners of properties valued above £2million are set to face additional charges from April 2028 with the Chancellor claiming the measure is needed to address wealth disparities within the housing system.

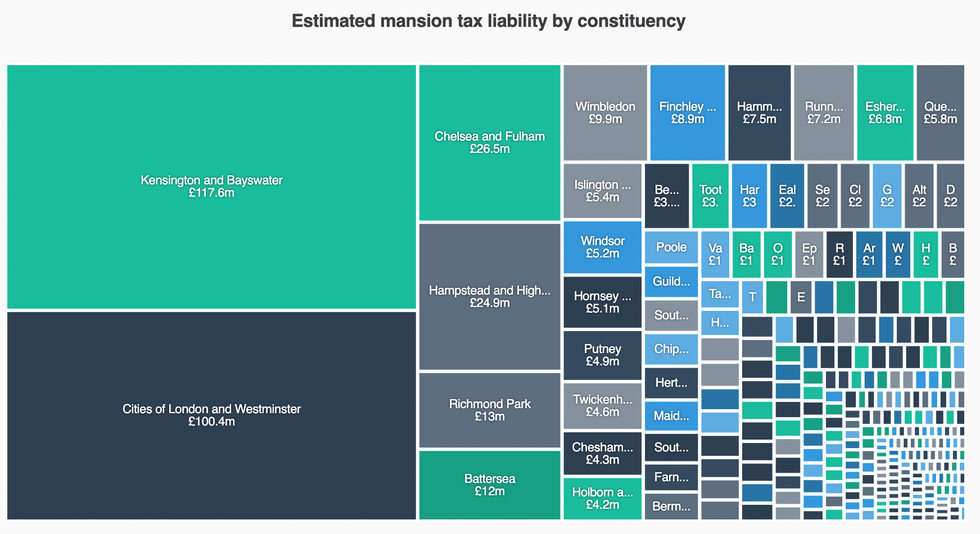

Tax Policy Associates has created and shared an interactive map with GB News, which readers can use to learn how their area and other parts of the country will be impacted by this levy.

The map has modelled the impact of the mansion tax by analysing land registry data on every property transaction since 1995, and shows postcodes, not individual properties This draws an estimate on how much each postcode and Parliamentary constituency will pay.

Use the below interactive map by Tax Policy Associates to see how your area is affected.

What is Chancellor Rachel Reeves's mansion tax?

Ms Reeves highlighted what she described as a long-standing imbalance in council tax, noting that a band D property in Darlington contributes nearly £2,400 a year, while a £10million residence in Mayfair pays about £300 less.

The new high value council tax surcharge will send revenue directly to central Government rather than local authorities. The Office for Budget Responsibility (OBR) expects the levy to deliver about £400million a year to the Treasury by 2029-30.

This latest tax from the Chancellor is expected to impact around 0.4 per cent of properties in England, according to figures from Savills. Properties valued between £2million and £2.5million will face an annual charge of £2,500, while those worth between £2.5million and £3.5million will pay £3,500 a year.

Homes valued from £3.5million to £5million will be charged £5,000 annually. The highest tier of £7,500 will apply to residences valued above £5million, and these payments will be in addition to existing council tax bills.

Who will need to pay the Chancellor's mansion tax?

|GETTY

Property owners will be responsible for meeting the levy rather than tenants. The rates will be fixed for the first year of operation, then adjusted annually in line with CPI inflation from 2029-30 onwards.

The Valuation Office Agency will carry out assessments in 2026 to determine which homes meet the criteria for the surcharge. Revaluations are scheduled to take place every five years after the initial review.

Officials estimate that about 145,000 properties across England will fall within the scope of the new charge, representing below 1 per cent of the national housing stock.

London and nearby counties will account for most of the affected homes because of sharp increases in property values above the £2million threshold.

LATEST DEVELOPMENTS

Estimated mansion tax liability by constituency

|Tax Policy Associates

On the new levy, Tax Policy Associates' founder Dan Neidle shared: "My immediate reaction is that it’s fair that expensive houses pay more council tax. The current system is inequitable – a tax that looks like this can’t be defended.

"It would have been much better to revalue council tax and add more bands. Given that is seen as politically too hard, the Government instead created a new tax working off a fresh valuation basis.

"The tax doesn’t raise much – £400million. That was the correct decision. A 'proper' percentage mansion tax would have had a much more serious impact on the property market.

"It would also have been unfair to people who happen to own property today, as they would have taken the hit. We absolutely should have a proper percentage-based property tax, but that has to be part of wholesale reform, meaning abolishing stamp duty. Having both would be inequitable, and do damage to an already very troubled property market."

Data from JLL shows that 68 per cent of homes sold for more than £2million in England are located in London, with Kensington and Chelsea recording the highest concentration. Much of the remaining high-value housing stock is found across the South East.

"This is one of the most significant changes to the UK housing market for decades", said Nick Leeming, chairman of estate agent Jackson-Stops.

He said the introduction of an annual surcharge could unsettle both purchasers and vendors by adding uncertainty to prime residential markets. The levy could create particular difficulties for homeowners whose properties have risen substantially in value over many years.

"Those hit hardest will be 'empty nesters' and people who bought their property decades ago simply as a family home, not as an investment", said Scott Clay, director at Together.

Mr Clay added that some elderly homeowners with limited incomes might face serious challenges if the tax approaches the value of an entire year's state pension. Government officials have acknowledged these concerns and confirmed that a support scheme will be established for homeowners unable to meet the annual charge.

A public consultation due early next year will consider options including deferred payment arrangements. These could allow homeowners to delay payment until the property is sold or until after death.

Property analysts expect the policy to influence market activity as April 2028 approaches. "With the threshold set at £2million, this measure directly impacts London's upper-middle classes - who are typically households with mortgages and finite resources", said Jo Eccles, founder of Eccord Buying Agency.

The mansion tax has been labelled as inconsistent

| GETTYMarc Schneiderman, managing director at Arlington Residential said the levy is likely to increase demand in the £1.5million to £1.75million range as buyers attempt to stay beneath the threshold.

He said this pattern of price clustering could reshape buyer behaviour and influence market trends. Questions remain about how valuations will be carried out and how disputes will be resolved.

"Higher-value homes are notoriously complex to assess because they lack uniformity", said Jennet Siebrits, the head of Research at Ringley Group.

She said properties positioned marginally above the threshold might see downward pressure on market value as buyers react to the new annual charge.

More From GB News