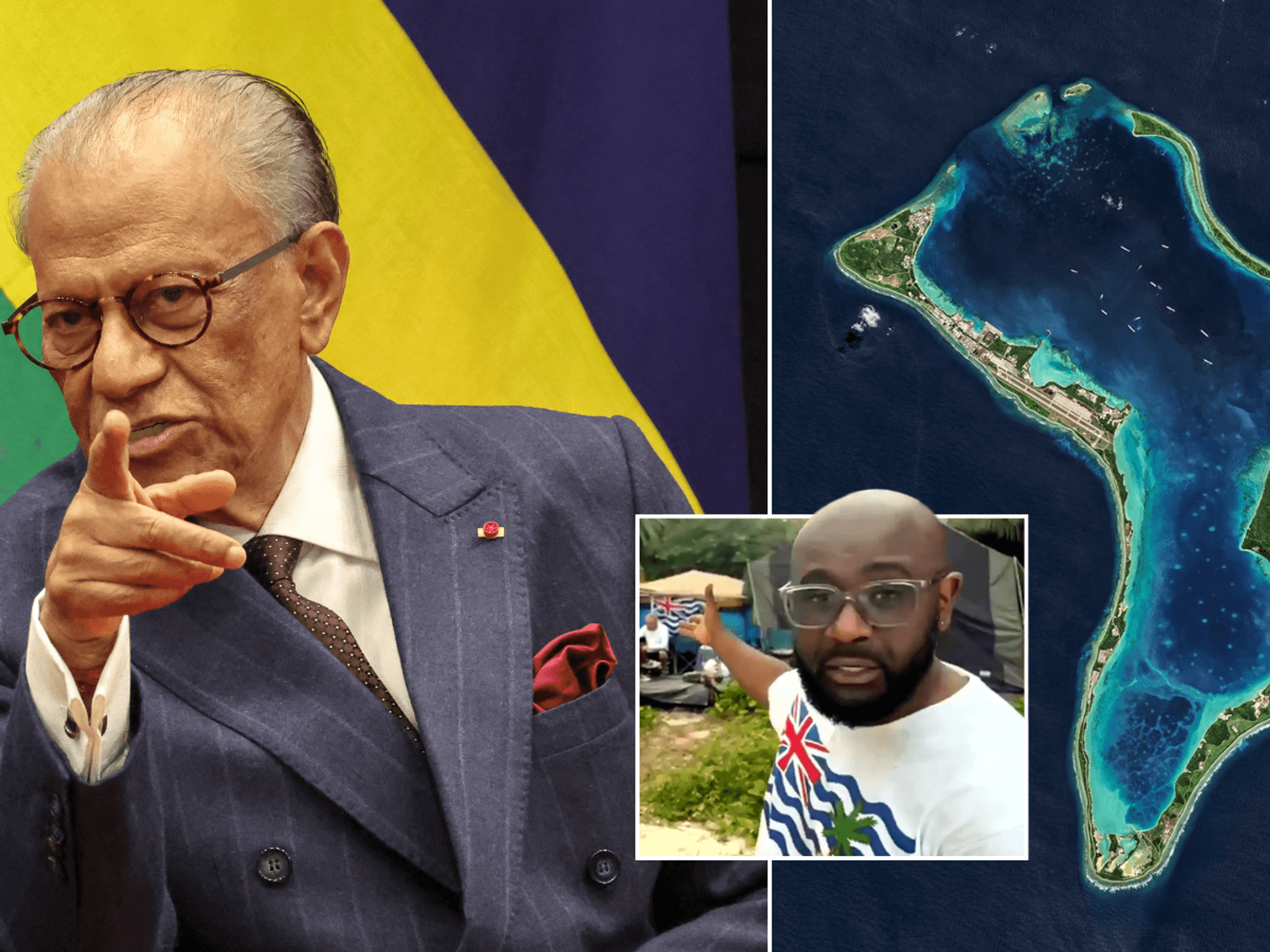

Energy bill debt hits EIGHT-YEAR HIGH as Britons 'getting less help' after Winter Fuel Payment changes

Ed Miliband risks ‘disproportionately burdening’ families with energy bills shake-up |

GB NEWS

Every pensioner was eligible for Winter Fuel Payments, which offer vital energy bill support, before a recent policy decision from Labour

Don't Miss

Most Read

Energy debt across British households has reached £780million ahead of winter, marking the highest level recorded in eight years, according to new research from comparison site Uswitch.

This finding comes ahead of the revised eligibility rules for Winter Fuel Payment, which is a tax-free payment to help with energy costs worth up to £300 for Britons of state pension age.

Previously universal, the energy bill was restricted to elderly people in receipt of means-tested benefits from the Department for Work and Pensions (DWP), such as Pension Credit.

The Labour Government partially U-turned on this decision and made the Winter Fuel Allowance more accessible to older households, but with a £35,000 taxable income threshold above which payments are recovered.

Energy bill debt is becoming a bigger issue, according to research conducted by Uswitch

|GETTY

Despite this policy reversal, experts from Uswitch have warned that "households are getting less help than they used to" after the Winter Fuel Payment eligibility changes.

These findings from the price comparison website indicate that 3.5 million households currently owe money to their energy providers, representing a sharp 46 per cent rise from 2.4 million households in the same period last year.

Average household debt has climbed to £223, showing a 29 per cent increase from the previous year's figure of £173. Credit balances have experienced a concerning decline, with the typical bill payer now holding just £98 in credit compared to £128 the previous year.

This marks the first time balances have fallen below £100 since the energy crisis began. More than two million low-income families and 10 million homes across the UK have accumulated no energy credit to cushion against higher winter bills.

Debt has becoming a major issue for households amid the cost of living crisis | GETTY

Debt has becoming a major issue for households amid the cost of living crisis | GETTYAmong the 55 per cent of households maintaining credit balances, the average has decreased from £222 last autumn to £214 currently. One in six households earning under £20,000 annually already owe their suppliers money, with average debts reaching £60.

The debt burden appears increasingly unmanageable for many, with 12 per cent of indebted households reporting they cannot afford repayments, double the six per cent recorded last year.

Another nine per cent intend to switch to prepayment meters as a debt management strategy. Communication gaps persist between suppliers and customers, with 34 per cent of those in debt reporting no contact from their provider regarding outstanding amounts.

However, among those who received communication, 57 per cent were offered assistance or guidance. Recent regulatory data from Ofgem indicates total customer debt to energy suppliers exceeds £4billion, representing an increase of more than £750million year-on-year.

Ben Gallizzi, energy spokesman at Uswitch, said: "It's deeply concerning to see that household energy debt has soared to an eight-year high, which suggests that many homes may face a bill shock soon as direct debit levels are updated.

"The cost of living squeeze and the end of many Government support schemes means that households are getting less help than they used to, causing many to fall behind.

"Households use more energy over the winter, so for those paying via direct debit it’s ideal to have a cushion of about two months’ worth of energy credit at this point in the year.

"If your energy account is going into debt, or you are behind on your bill payments, speak to your supplier as soon as possible." An Ofgem spokeswoman said: "The current levels of energy debt are unsustainable, and this is a challenge that requires action from everyone the regulator, Government and industry alike.

LATEST DEVELOPMENTS:

Ofgem has declared the UK's level of energy debt as being 'unsustainable'

| GETTY"It’s important we target support at the customers that need it most, while also ensuring people who are able to pay are supported to do so. If a customer is struggling they should speak to their supplier about the options that could help them get back on track.

"These could include tailored repayment plans, which can help households regain control and avoid falling further behind. We’re also working at pace on plans to introduce a debt relief scheme that could help struggling households get back on track and rectify some of the debt that built up as a result of the crisis.”

A government spokesperson said: “We are delivering reforms that put consumers first, with stronger protections including automatic compensation when energy companies mistreat billpayers.

"We are working with Ofgem to drive debt out of the energy system. To help people with the cost of living, this winter we are expanding the £150 Warm Home Discount to over six million households."

More From GB News