Economy in line to win £220bn investment 'prize' with disposable incomes to jump by £330 a year

Legal & General research suggests the Labour Government's policy promises could pay off for the economy if they are stuck too

Don't Miss

Most Read

Latest

The UK economy could earn a £220billion financial boost and 0.7 per cent jump in gross domestic product (GDP) over the next 10 years, new analysis suggests.

Research commissioned by Legal & General and conducted by Oxford Economics reveals that implementing six targeted policy changes could generate up to £220billion in additional UK investment over the coming decade.

The analysis demonstrates these reforms would permanently increase the nation's GDP by 0.7 per cent by 2035. Beyond the headline investment figure, the modelling indicates British households would see their annual disposable incomes rise by an average of £330 in 2024 prices.

Benefits are projected to accumulate progressively as pension and insurance capital flows into productive assets across the economy.

Rachel Reeves unveiled multiple reforms in her Autumn Budget | PA

Rachel Reeves unveiled multiple reforms in her Autumn Budget | PAThe report, titled A Blueprint for Growth, identifies policy levers designed to expand the pool of institutional and pension capital available for deployment into productive UK assets.

L&G selected the six growth-focused measures drawing on its position as one of Britain's largest investors. Oxford Economics examined the potential impact of four pension and insurance sector reforms currently being implemented by the Government.

The analysis also tested two additional opportunities relating to pension contribution policies and Solvency UK regulations, where further action could drive substantial investment.

UK pension assets stood at an estimated £3.2trillion in 2024, underscoring the sector's existing significance in funding domestic investment.

The reforms could deliver £8.8billion in extra revenue for the government if fully enacted.

Channelling long-term savings into productive assets such as new housing developments, renewable energy generation and digital infrastructure would strengthen the broader economy whilst providing wider societal benefits.

Their modelling how effective policy implementation could enhance the UK's appeal to institutional investors.

L&G's research emphasises the growing importance of pension funds and insurers in supporting the Government's Plan for Change by directing capital toward sustainable growth opportunities.

The collective impact of the six measures demonstrates the potential gains available from expanding Britain's investment environment.

António Simões, the group chief executive of Legal & General, stated: "Delivering long-term growth must be at the heart of economic strategy and the UK has the fundamentals to deliver it – deep capital markets, strong institutions and a financial sector that is trusted at home and respected abroad.

"Pensions capital is central to that effort. With more than £3trillion in long-term savings, even a modest shift towards productive assets can finance the homes, infrastructure and innovation the country needs.

"This research shows what is possible when conditions are aligned.

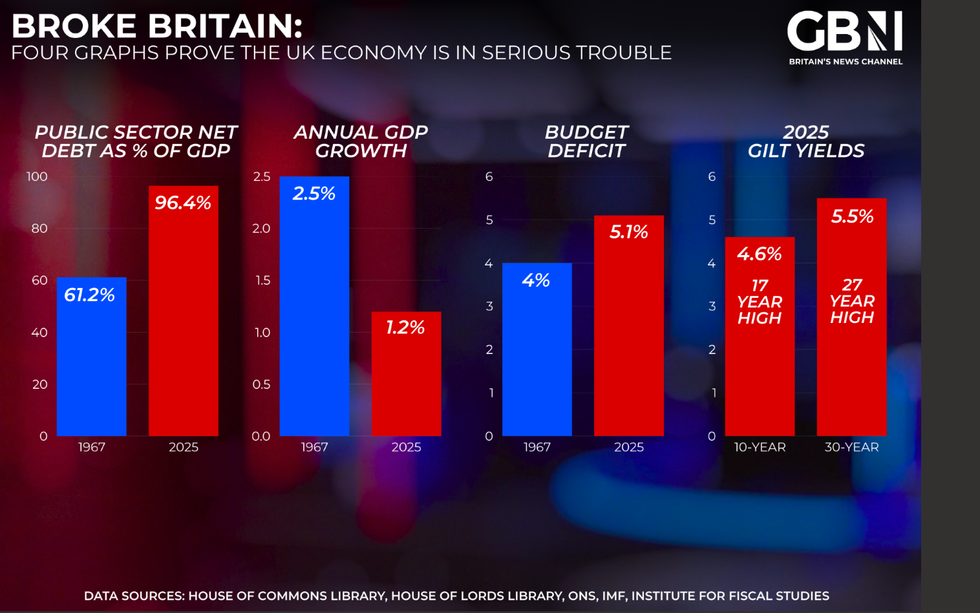

Four graphs prove the UK economy is in serious trouble | GB NEWS

Four graphs prove the UK economy is in serious trouble | GB NEWS"The right policy framework could unlock up to £220billion of additional investment over the next decade, strengthening public finances and increasing household incomes.

He added: "The prize is clear if Government, investors and industry embrace the challenge: a more resilient, more competitive economy where long-term savings support long-term prosperity."

L&G has already demonstrated its commitment through a £2billion programme announced earlier this year for housing, infrastructure and urban regeneration.

The initiative is expected to generate approximately 24,000 jobs and deliver 10,000 social and affordable homes.

More From GB News