Economy alert: Ftse 100 PLUMMETS again as Donald Trump doubles down on tariffs

President Trump's tariff threat has spooked investors and the stock market

Don't Miss

Most Read

The Ftse 100 plummeted once again this morning, after reaching record highs, as President Donald Trump doubled down on his threat of imposing tariffs on imports from European nations, including the UK.

Stock markets worldwide suffered further hefty drop one year on from Mr Trump's second term inauguration as tensions remained high after the US ramped up its demands to annex Greenland from Denmark.

The UK's primary stock market Index slipped by more than 120 points soon after opening earlier today, down 1.3 per cent at 10068.4, after a 0.4 per cent fall yesterday.

European indices also remained heavily in the red, with the Dax in Germany down one per cent and France’s Cac 40 off 0.9 per cent in early trading, after sharp declines in Asian markets overnight.

The Ftse has fallen again as President Trump demands Europe bows to his demands

|GETTY / GOOGLE

Over the weekend, President Trump threatened to slap up to 25 per cent tariffs, which are taxes on imports, on countries that do not support his plans to take over Greenland.

The UK has also been targeted in this latest tariff threat from the White House, with the President currently travelling to Davos, Switzerland, on Tuesday for the World Economic Forum (WEF0.

Last night, Mr Trump continued to call on European accept his demands; posting private text messages with French President Emmanuel Macron and Prime Minister Keir Starmer's plan to sell the Chagos Islands to Mauritius.

Gold prices jumped to another new record as investors went on the hunt for a safe haven asset, hitting 4,728 US dollars (£3,507) per ounce during morning trading today.

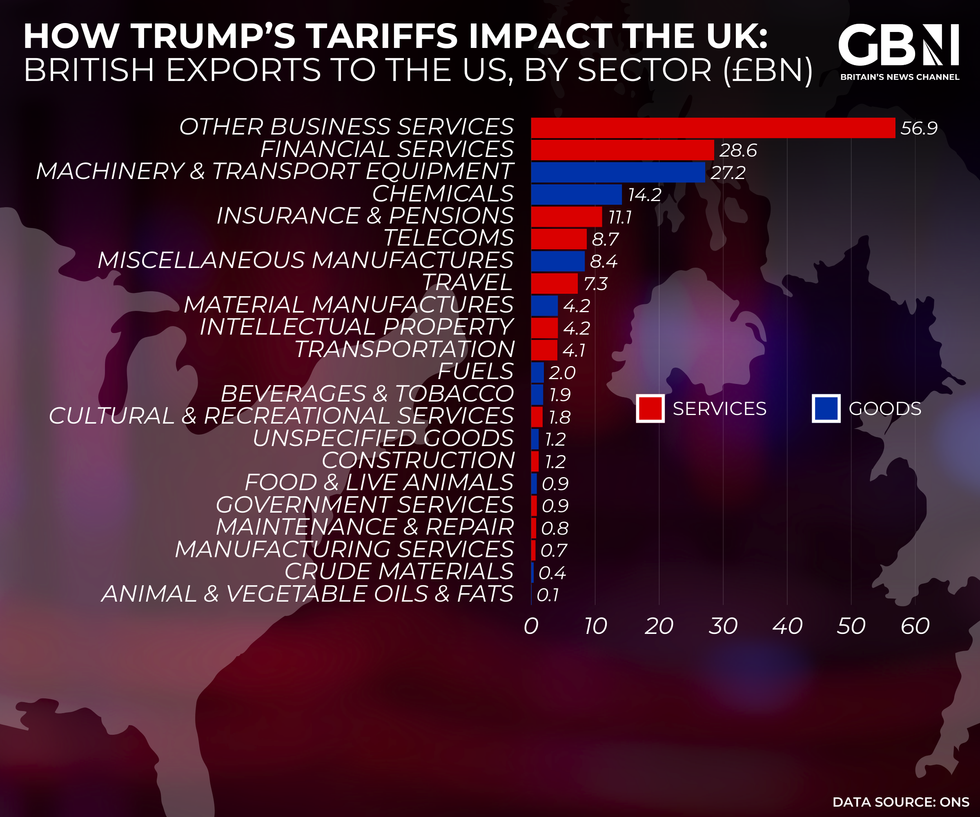

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWS

IN DEPTH: How could Trump's tariffs impact Britain? British exports to the US ranked | GB NEWSwrite at least 4 paragraphs

LATEST DEVELOPMENTS

President Trump introduced sweeping tariffs on a huge amount of countries | Reuters

President Trump introduced sweeping tariffs on a huge amount of countries | ReutersKathleen Brooks, a research director at XTB, said: “What happens next for financial markets will ultimately depend on President Trump’s actions in the coming days. The president posted a picture of himself holding a US flag on Greenland, suggesting that the territory will be owned by the US this year.

"However, he also said that he will hold a Greenland meeting at Davos, after a good conversation with the Nato secretary general and former Dutch PM Mark Rutte. For now, Trump is sticking to his guns and said that there is ‘no going back’ on his Greenland pledge. Thus, the meeting in Davos later this week will be critical."

Dannie Hewson, AJ Bell's head of financial analysis, added: "London’s blue-chip FTSE 100 was cushioned from the full impact of investor nerves over Donald Trump’s tariff threats, after shares in insurer Beazley hit a record high on news that Swiss rival Zurich had tabled an offer to snap up the company.

"But fears that a hard-fought trade deal between Europe and the US might now be off the cards contributed to significant falls across European indices. It’s hard to know which approach is the right one to take when dealing with a US president still harbouring a grudge after not being awarded with last year’s Nobel Peace Prize.

Prime Minister Keir Starmer backed a major initiative to make Adolescence available for free to all UK secondary schools | X/KEIR STARMER

Prime Minister Keir Starmer backed a major initiative to make Adolescence available for free to all UK secondary schools | X/KEIR STARMER"It has often been said that Donald Trump is all about the transaction, but when a perceived slight is added to the mix, it introduces another level of complexity. The UK Prime Minister has again sought to keep his balance on a tightrope which must feel awfully precarious, but an ability to tread softly when it comes to negotiating with the White House has reaped dividends before.

"Uncertainty is the biggest dampener on sentiment, and the timing of the IMF’s latest forecast could be seen as ironic. It may have been forecasting better global growth for 2026 following tariff negotiations and AI gains, but those negotiations might as well never have taken place if they can be ripped up so easily.

"Twenty-four hours is a long time in this volatile world and tomorrow could bring another huge upset if the Supreme Court rules the president did not have the power to impose reciprocal tariffs in the first place.

"Whilst that might be seen by many as a good outcome, it would also create massive instability with questions about how levies could be repaid and how Donald Trump’s administration may seek to overturn or get around the decision."