Ftse 100 surges to 10,000 mark for first time ever in boon for Britain

The Ftse 100 has hit a new milestone in a major win for the UK economy

Don't Miss

Most Read

The Ftse ( Financial Times Stock Exchange) 100 stock market index has surged above 10,000 points for the first time on record in a major win for Britain's economy going into 2026.

Earlier this morning, the blue-chip index hit a new all-time intraday trading high, after jumping as much as 0.8 per cent to 10,018.5, within the first hour of trading after markets opened for the first time this year.

In recent months, the Ftse 100 has inched closer to the milestone mark after an impressive performance in 2025 that has seen the index rise by 21.5 per cent.

This is the Footsie's best performance since 2009, in the aftermath of the financial crisis, and comes after an extended period of financial uncertainty post-Covid and Brexit.

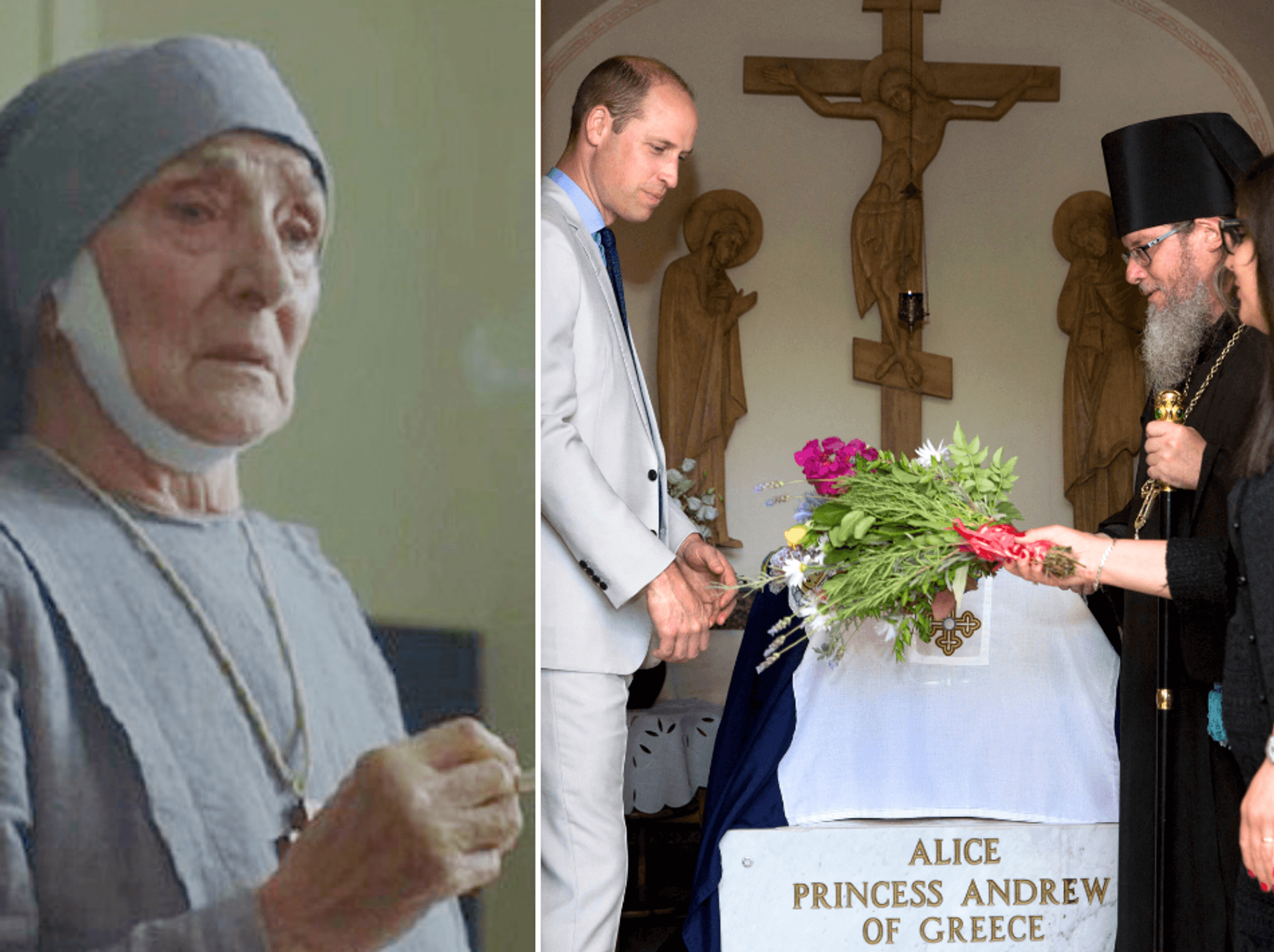

The Ftse 100 has hit a 10,000 landmark

|GETTY / GOOGLE

Economists note that this surge towards stocks globally is primarily due to the rally in support for artificial intelligence (AI) companies but UK stock markets are not as exposed to the tech sector.

Over 2025, the Ftse 100's best performers include miners, such as Fresnillo which benefited from the rush in need for precious metal prices, and defence firms amid the Russia-Ukraine war.

Engine-maker Rolls-Royce was the top Ftse performer with a three per cent gain, followed not far behind by sector peers Babcock International and BAE Systems, both just under three per cent higher.

Oil firm BP lifted two per cent as it continued to stride higher after confirming Meg O’Neill will become its new chief executive in April, replacing Murray Auchincloss, who stepped down last month after less than two years in the role.

The City has received a major win

| PADanni Hewson, head of financial analysis at AJ Bell, said: "Miners have once again done a lot of the heavy lifting, with Fresnillo leading the way, and Airtel Africa also enjoyed a last-minute surge.

"Both stocks have experienced a stratospheric rise in 2025 and considering both the ongoing demand for gold and silver and an increasing need for connectivity in emerging markets, investors will be hoping for more fair weather in 2026.

"The global nature of the inhabitants of London’s top-flight index has helped it avoid the doldrums which have held back the more domestically focused FTSE 250 – although even it was experiencing that end of year phenomenon often referred to as a ‘Santa rally’ today."

In reaction to this morning's rally, Dan Coatsworth, head of markets at AJ Bell, added: "It’s time to break out the champagne as UK stock markets have delivered a New Year’s treat.

LATEST DEVELOPMENTS

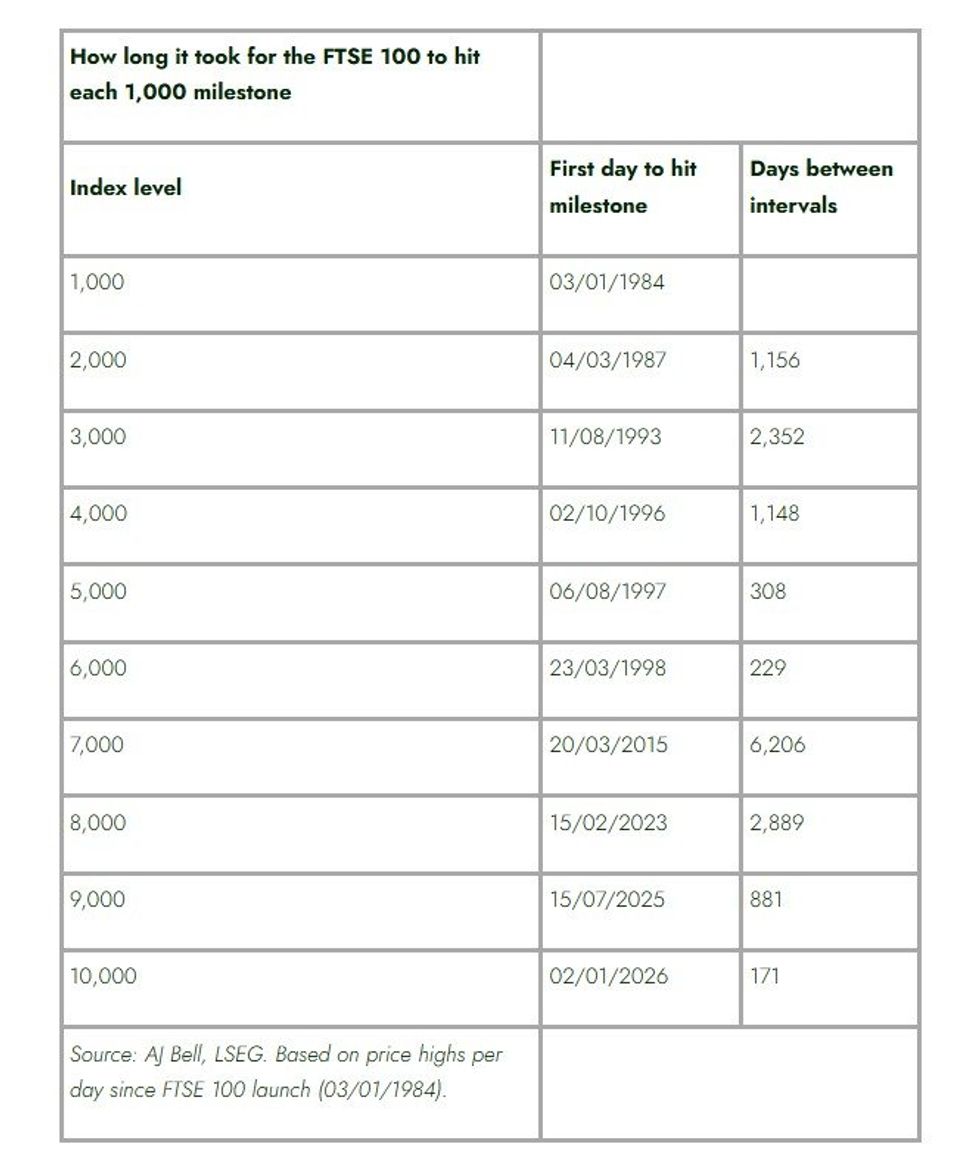

How long has it taken for the Ftse to reach every 1,000 mark?

|AJ BELL

"The Ftse 100 hit the 10,000 jackpot level immediately after rounding off a tremendous year for UK shares. This is a historic moment and already makes 2026 one of the most significant years for the blue-chip index since its launch in 1984.

"Breaking through the 10,000 level is the best New Year’s present Chancellor Rachel Reeves could want.

"She has been banging the drum about the merits of investing over parking cash in the bank, and the FTSE 100’s achievements just go to show what’s possible when buying UK shares. It also proves to cynics that the UK market is not stuck in the mud, and that the US stock market is not the only place to make money."

Jackie Bowie, a managing partner and tead of EMEA, Chatham Financial, shared: "UK equities entered the year trading at a significant discount to US and European markets. As global investors sought value and income, the Ftse100 became increasingly attractive.

"While global equity performance was heavily concentrated in a small number of US mega-cap technology stocks, the FTSE 100 offered diversification and arguably lower valuation risk.

"Despite the negative outlook for the UK economy and the uncertainty generated around the various political decisions and events – the FTSE100 derives most of its revenues overseas. Resilience in global demand supported earnings, even as UK domestic growth remained subdued."