Economy warning: UK trapped in 'debt doom loop' as borrowing hits 101% of GDP

GBNEWS

These fiscal pressures risk pushing wealthy individuals to leave Britain

Don't Miss

Most Read

Britain is heading down a dangerous financial path, according to one of the world's most influential investors.

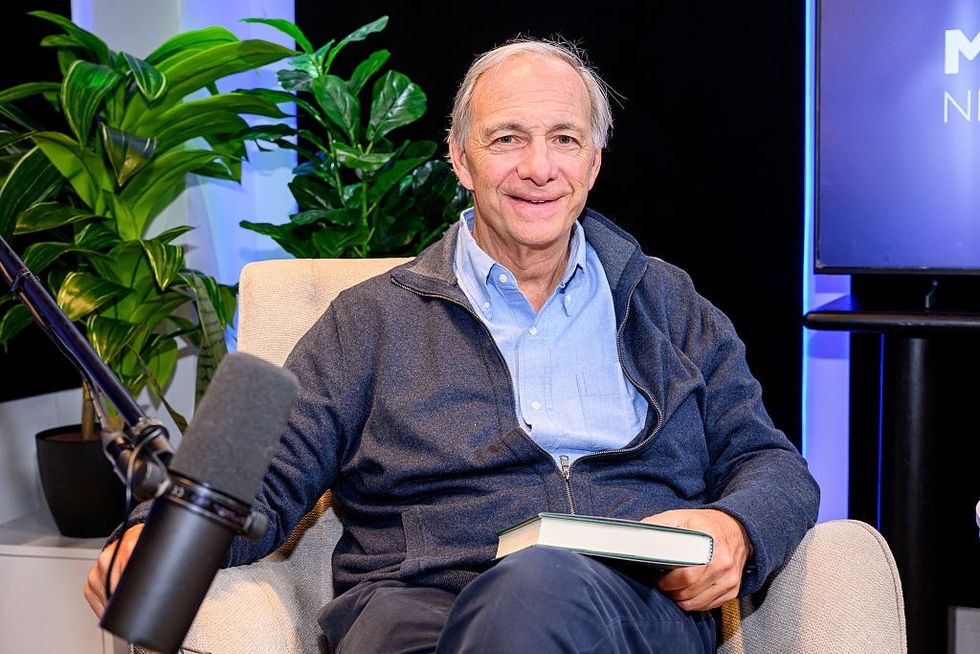

The founder of the world’s largest hedge fund has warned that the UK is now caught in a "debt doom loop" with mounting economic risks.

Ray Dalio, the billionaire behind Bridgewater Associates, raised the alarm as UK government debt hit 101 per cent of GDP and long-term borrowing costs surged to two-decade highs.

Speaking on The Master Investor Podcast with Wilfred Frost, Dalio said worsening public finances were fuelling a self-reinforcing cycle of instability.

"The debt doom loop is affecting capital flows. So the necessity for creating taxations that then drive people away," he said.

He cautioned that fiscal pressures risk pushing wealthy individuals to leave Britain, noting that in comparable economies like America, the wealthiest 10 per cent contribute three-quarters of income tax revenues.

To protect against potential currency devaluation, Dalio advocates holding a minimum of 15 per cent of investments in either gold or bitcoin.

This allocation far exceeds conventional financial advice, given that neither asset generates income and bitcoin remains untested during major financial crises.

Dalio warned that fiscal pressures risk pushing wealthy individuals to leave Britain

|GETTY

The hedge fund veteran expressed a clear preference for the precious metal over the cryptocurrency. "I'm strongly preferring gold to bitcoin, but that's up to you," he stated during the podcast interview.

He pointed to historical precedents, urging listeners to examine the fate of sterling and the Dutch guilder during previous debt crises. "In all such periods [of currency devaluation, gold] is an effective diversifier," he noted.

Gold has surged 28 per cent this year to $3,335 per ounce, whilst bitcoin recently exceeded $120,000 for the first time.

Dalio outlined specific measures needed to address Britain's fiscal challenges, with the deficit currently standing at 5.1 per cent of GDP.

LATEST DEVELOPMENTS:

High interest rates and inflation have impacted Britons ability to navigate the economy | GETTY

High interest rates and inflation have impacted Britons ability to navigate the economy | GETTY He argued that sustainable public finances require reducing this figure to approximately three per cent, achievable only through balanced action. "They have to do it equally in spending cuts and taxation," he stated.

The Treasury faces annual interest payments of £110 billion on existing government debt totalling £2.87 trillion. Chancellor Rachel Reeves has limited options, with borrowing costs constraining her ability to fund expenditure through additional debt.

Dalio warned that without decisive action from what he called "strong leadership of a strong middle", the financial deterioration would accelerate, potentially triggering social and economic decline that has driven migrations globally.

The hedge fund veteran expressed a clear preference for the precious metal over the cryptocurrency

| PADespite these warning signals, Dalio believes financial markets remain dangerously complacent about sovereign debt risks.

When asked whether bond markets had adequately priced in the mounting dangers, his response was unequivocal. "No, it is not priced into the markets," he told podcast host Wilfred Frost.

The veteran investor, who stepped down from Bridgewater in 2021, has documented the mechanics of national financial collapse in his latest book, How Countries Go Broke.

His concerns echo those voiced by Goldman Sachs leadership last week regarding Britain's fiscal trajectory. The US faces similar challenges with a 6 per cent deficit, though Dalio reserved his most pointed criticism for the UK's predicament.

He characterised the situation as one where warning indicators were "beginning to flash and flicker" for Britain's economy.