Coventry Building Society launches 'innovative' savings accounts as savers can 'protect up to £20k from tax'

How can savers best protect themselves from scams? |

GB NEWS

Savers are looking for the best deals with Coventry Building Society offering competitive rates

Don't Miss

Most Read

Coventry Building Society has introduced a pair of savings accounts featuring restricted withdrawal options, as households grapple with inflation running at nearly twice the Bank of England's two per cent objective.

Savers are being reminded that they can "protect up to £20,000 from tax" thanks to the building society's latest offering ISA offering, ahead of a rumoured savings raid from Chancellor Rachel Reeves.

The mutual unveiled its 4 Access Saver and 5 Access ISA accounts today, providing variable returns with interest rates of 4.30 per cent and 4.15 per cent, respectively. These products arrive as British savers face diminishing purchasing power, with price increases outstripping returns on most deposit accounts.

Furthermore, the building society's latest offerings permit several penalty-free withdrawals annually while maintaining attractive interest rates, addressing demand for both competitive yields and access to funds when needed.

Coventry Building Society has launched new savings products

| COVENTRY BUILDING SOCIETYThe non-ISA product permits deposits up to £1 million and includes four cost-free withdrawals during the initial twelve months.

Additional withdrawals trigger a penalty equivalent to 50 days' worth of interest.

Notably, the tax-free option provides five penalty-free withdrawals over the same period.

Customers can remove funds, including earned interest, and subsequently restore them within the same tax year whilst preserving their £20,000 annual ISA contribution limit.

MPs suggested the Lifetime ISA might be offering unnecessary help to higher earners | GETTY

MPs suggested the Lifetime ISA might be offering unnecessary help to higher earners | GETTYPrevious years' ISA holdings can be transferred into the account. Both products require just £1 to open and are accessible via branch visits, telephone, post, online platforms or the society's mobile application.

Bethaney Cozens, the savings product manager at Coventry Building Society, said: "The extra flexibility of our 5 Access ISA makes it one of the most innovative tax-free savings options available.

"Savers can withdraw funds and top up their account multiple times without affecting their annual allowance.

"And with all eyes on whether the Chancellor will make changes to the tax-free cash ISA, this could be the last chance savers get to protect up to £20,000 from tax."

Britons are looking for the switch deals | GETTY

Britons are looking for the switch deals | GETTYShe noted that customers who have exhausted their current year's ISA contribution limit might consider the 4 Access Saver as an alternative.

Despite this latest offering, analysts note the broader savings landscape presents significant challenges for British households.

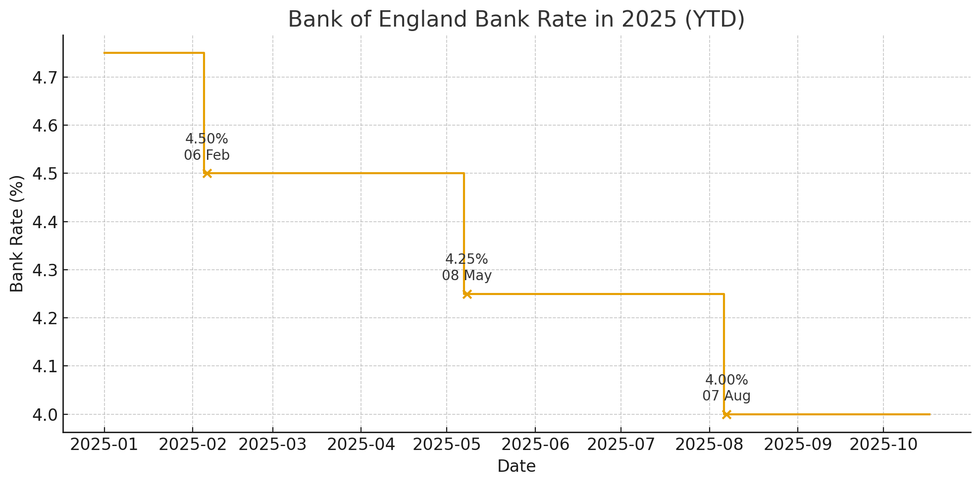

Savers have been able to benefit from a prolonged period of hiked interest rates as the Bank of England continues to grapple with inflation.

In recent months, the central bank has begun to slash the base rate, which determines the cost of borrowing

LATEST DEVELOPMENTS:

The Bank of England base rate has fallen in recent months | CHAT GPT

The Bank of England base rate has fallen in recent months | CHAT GPT Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk, said: "Inflation is almost double the Bank of England's two per cent target, but despite continued pressure from the rising cost of living, the UK's household savings ratio remains above 10 per cent, which reflects continued caution among consumers."

She warned that typical returns fail to match price rises, leaving deposits vulnerable to erosion.

"Even the most competitive rates are struggling to outpace inflation, with less than half able to keep ahead of rising prices," the savings expert added.

Ms Eastell advised immediate action for those holding underperforming accounts, suggesting switches to better-paying alternatives or fixed-term bonds for guaranteed returns.

More From GB News