Everything you need to know ahead of Rachel Reeves's Autumn Budget

Labour plans 'UNLIMITED' council tax HIKE as MILLIONS of Brits may be HIT amid Rachel Reeves Budget |

GB News

The Chancellor is expected to increase taxes on November 26

Don't Miss

Most Read

Britons face potential tax increases across multiple areas as Chancellor Rachel Reeves prepares to deliver her Budget to the House of Commons on Wednesday.

The Chancellor has said she is ready to make what she calls “necessary choices” to help reduce NHS waiting lists, bring down national debt and ease living costs, with both tax rises and spending cuts under consideration.

Ms Reeves requires additional revenue to meet the Government's fiscal rules, which she has described as “non-negotiable”.

These require ministers not to borrow for day-to-day public spending by the end of this parliament and to ensure national debt falls as a share of national income within the same timeframe.

TRENDING

Stories

Videos

Your Say

What tax rises could be in the Budget?

The Government is examining a wide range of options to raise extra money ahead of the statement.

The Chancellor has confirmed higher taxes and reduced spending are both “on the table”.

Income Tax and National Insurance

According to Government sources, Ms Reeves has decided not to raise income tax rates, despite widespread speculation that an increase had been under review.

However, there remains a strong expectation that the Chancellor could extend the freeze on income tax and National Insurance thresholds beyond the current 2028-2029 deadline.

Freezing thresholds means that as salaries rise, more workers enter tax bands where they begin paying income tax and National Insurance. It also results in additional earners moving into higher tax bands over time.

Ms Reeves has stepped back from proposals to raise income tax rates directly.

Britons could see tax hikes as Chancellor Rachel Reeves readies her Budget on Wednesday

|GETTY

What are UK National Insurance and income tax rates?

Personal allowance: first £12,570 earned taxed at zero per cent.

Basic rate: £12,571 to £50,270 taxed at 20 per cent.

Higher rate: £50,271 to £125,140 taxed at 40 per cent.

Additional rate: above £125,140 taxed at 45 per cent.

Scotland sets its own rates and bands.

The personal allowance is reduced by £1 for every £2 earned between £100,000 and £125,140.

LATEST DEVELOPMENTS:

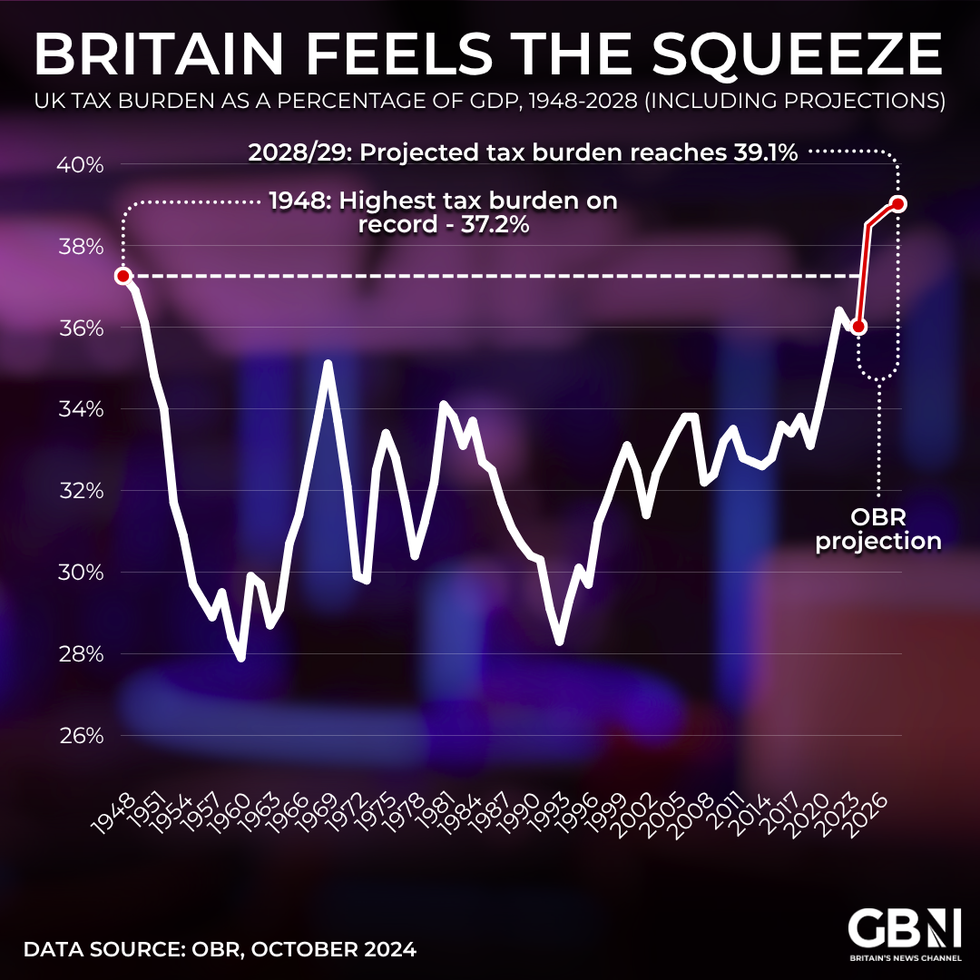

UK tax burden as a percentage of GDP | GB News

UK tax burden as a percentage of GDP | GB NewsPensions

The Chancellor is expected to raise around £2billion by limiting a tax break on pension contributions, according to The Times.

The measure under review would place a £2,000 cap on the amount employees can save into pensions through salary sacrifice without paying National Insurance.

There is currently no limit.

Any contributions above the cap would attract National Insurance payments from both employers and employees.

People receiving the full rate of the new state pension are expected to see an increase of more than £550 a year from April.

The state pension rises in line with the triple lock, meaning it increases by either 2.5 per cent, inflation or average earnings, whichever is highest.

Property taxes

The chancellor is examining plans to introduce a new tax on high-value homes in England, according to The Times and The Telegraph. Approximately 2.4 million properties in council tax bands F, G and H are expected to be revalued for the first time since April 1991.

Homes worth more than £2million would face an additional charge. Reports suggest around 100,000 households could be affected, with an average surcharge of £4,500.

Council tax bands

Band A: up to £40,000

Band B: £40,001 to £52,000

Band C: £52,001 to £68,000

Band D: £68,001 to £88,000

Band E: £88,001 to £120,000

Band F: £120,001 to £160,000

Band G: £160,001 to £320,000

Band H: above £320,000

There are also suggestions that more landlords should pay National Insurance.

At present, many landlords do not pay it if property income is not their main source of earnings.

The Resolution Foundation has proposed that all landlords pay National Insurance at 20 per cent, rising to twenty eight per cent for rental earnings above £50,270 a year.

Electric Vehicles taxes

The Chancellor is considering a new levy on electric vehicle drivers to compensate for declining fuel duty revenues as motorists shift away from petrol and diesel.

According to The Telegraph, electric vehicle owners could be charged 3 pence per mile in addition to existing road taxes.

A London to Edinburgh journey could cost an extra £12.

A Government spokesman said: "Fuel duty covers petrol and diesel, but there's no equivalent for electric vehicles. We want a fairer system for all drivers."

Cycle to Work scheme

Reports suggest the Government may introduce a new cap on the amount employees can spend on a bicycle through the Cycle to Work scheme.

According to the Financial Times, limits on salary sacrifice purchases could be reinstated.

Higher rate taxpayers currently save around 42 per cent on the cost of a bike, while basic rate taxpayers save around 30 per cent.

The previous £1,000 cap was lifted in 2019.

ISA reform

In July, Ms Reeves ruled out immediate reforms to cash ISAs.

However, she may reduce the annual tax-free allowance from £20,000 to £12,000.

MPs on the Treasury Select Committee have questioned whether cutting cash ISA limits would successfully encourage more investment into stocks and shares.

Business taxes

The Trades Union Congress (TUC) has called for higher taxation on banks and online gambling companies.

Rachel Reeves told ITV News in September that “there is a case for gambling firms paying more”.

The Government may also close a tax loophole allowing overseas retailers to send packages worth less than £135 to the UK without import duties.

UK companies say this gives foreign retailers such as Shein an unfair advantage.

Two-child benefit cap

Parents can only claim universal credit or tax credits for their first two children, unless the third child was born before April 6, 2017.

Ms Reeves has said it is “not right” that larger families are “penalised”, suggesting reforms are under consideration. Options could include removing the cap entirely or extending benefits to all children at a lower rate.

Many Britons are waiting in fear of the tax announcements

| GETTYEnergy bills

The Government may attempt to lower household gas and electricity bills by cutting the five per cent VAT charged on domestic energy or reducing certain regulatory costs that suppliers currently pass on to customers.

The chancellor has indicated she will take “targeted action” on energy bills.

How is the UK economy performing?

The International Monetary Fund (IMF) forecasts the UK will be the second fastest-growing major economy in 2025, but also predicts the highest inflation rate among G7 nations in 2025 and 2026.

The latest data shows the economy grew by 0.1 per cent between July and September, below expectations of 0.2 per cent.

Government borrowing reached £20.2billion in September, the highest level for that month in five years.

Inflation stands at 3.8 per cent in the year to September, well above the Bank of England’s two per cent target.

Our Standards: The GB News Editorial Charter

More From GB News