OBR to cut UK growth forecasts EVERY YEAR until 2030 in pre-Budget blow to Rachel Reeves

Labour MP says 'just wait and see' in Budget grilling |

GB News

Productivity downgrade expected to widen £20billion gap as Chancellor prepares major tax rises

Don't Miss

Most Read

Britain's fiscal watchdog is expected to deliver a major setback to the Government's economic plans as growth projections are set to be downgraded for every year until 2030.

The Office for Budget Responsibility's (OBR) updated outlook follows changes to productivity trend estimates, which have been reduced to one per cent.

The downgrade presents a significant challenge for Labour's central pledge to boost economic growth nationwide.

It comes as Chancellor Rachel Reeves completes preparations for Wednesday's Autumn Budget, where substantial revenue-raising measures are expected.

TRENDING

Stories

Videos

Your Say

The watchdog's reassessment reflects growing pressure on the public finances after earlier indications that weaker productivity trends could leave a £20billion shortfall that must be addressed through tax changes.

The OBR's growth forecasts have frequently been higher than those produced by City analysts, making the expected reductions more striking.

The watchdog had previously estimated growth of 1.9 per cent for 2026.

This contrasted with private sector projections ranging between 0.9 and 1.4 per cent, based on Treasury surveys of analysts.

The Bank of England's forecast of 1.2 per cent growth for next year highlights the gap between official estimates and market expectations.

It is understood the OBR may reduce its forecasts by up to 0.3 percentage points across the five-year period, Sky News reports.

Growth remains the Government’s "number one priority", a spokesman said amid reports that the Office for Budget Responsibility has downgraded its forecasts.

Asked about the prospect of downgraded forecasts, the Prime Minister’s official spokesman said: "I’m not going to get ahead of Wednesday. There’s only a couple of days to wait for that.

"This is a Budget that will build a fairer, more prosperous Britain with an economy that works for everyone… growth remains our number one priority."

Downing Street said the welfare system "isn’t fair or sustainable" but declined to be drawn on whether the benefits Bill would be reduced at the Budget.

Asked whether cuts would be made, the spokesman said: "We will stick to our tough spending plans, clamp down on Government waste, and on welfare specifically we’ve been clear that the current welfare system isn’t fair or sustainable and we’re delivering reforms to change that."

Britain’s fiscal watchdog set to downgrade growth forecasts, dealing a major blow to Government plans

|GETTY

In March, the watchdog predicted real GDP growth of one per cent for 2025, down from two per cent projected the previous October, before rising to 1.9 per cent in 2026 as interest rates eased and energy costs fell.

Ms Reeves is preparing to introduce tax increases exceeding £30billion as part of Wednesday's Budget.

The measures are intended to create additional fiscal space while addressing the pressures on the nation's finances.

The tax burden is already at its highest level since the post-war era, prompting warnings from City economists about the potential impact of further rises.

Reports indicate the Chancellor may prolong the freeze on income tax thresholds as part of her strategy.

The planned increases are designed to provide the Government with more headroom and address what officials describe as a substantial fiscal gap.

LATEST DEVELOPMENTS

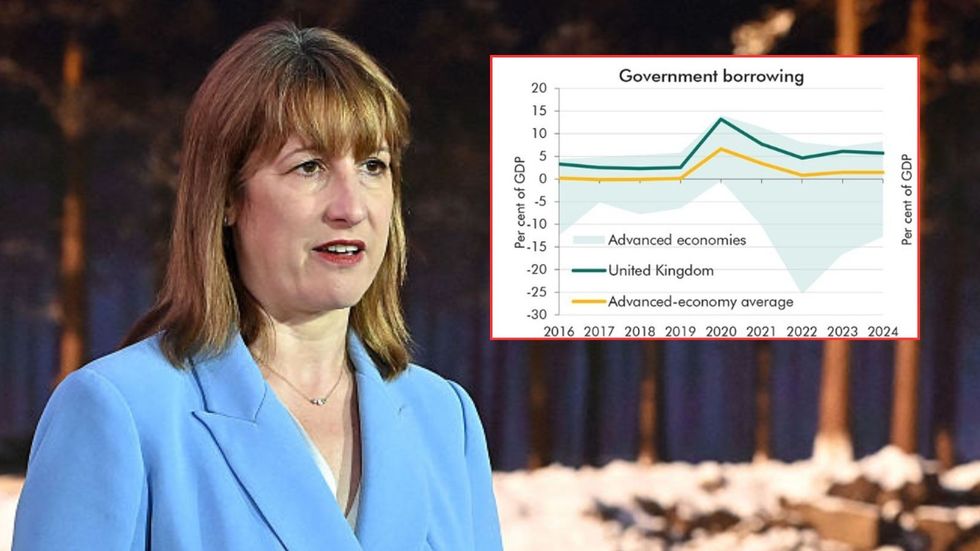

Rachel Reeves has previously called for the OBR to be scrapped | GETTY / OBR graph

Rachel Reeves has previously called for the OBR to be scrapped | GETTY / OBR graph However, concerns have been raised about the timing and execution of these measures across the forecast period.

Neil Shearing, group chief economist at Capital Economics, said there was "no coherent, fully-fleshed out strategy for lifting long-term growth".

He argued that Labour remained "light on the politically difficult trade-offs required to make [reforms] stick".

Mr Shearing added: "Ministers have ignored the uncomfortable truth that in an economy already operating at full capacity, higher investment requires someone, somewhere, to consume less."

He said either households or the state, or both, would "need to tighten their belts".

He warned that relying on overseas borrowing would "bloat an already large current account deficit and is not a sustainable alternative".

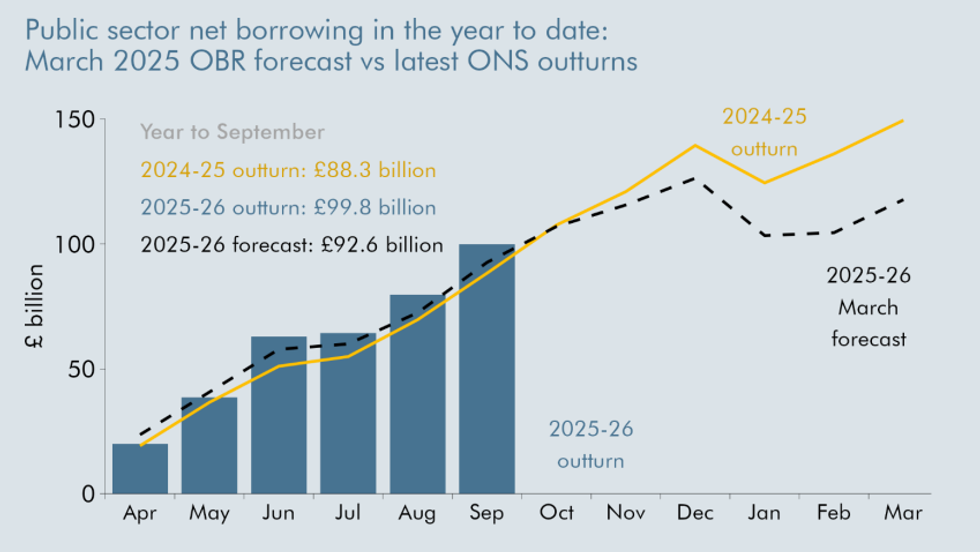

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBR

Borrowing is set to fall in late 2025–26, driven by higher tax receipts, lower interest costs, and slower benefit growth | OBRHetal Mehta, chief economist at St James's Place, said: "GDP growth has been lacklustre", reflecting broader concerns about the country's economic outlook.

Financial markets are showing increased nervousness ahead of the Budget, particularly over suggestions that revenue increases might be concentrated in later forecast years, potentially allowing higher borrowing in the near term.

Evangelia Gkeka, senior analyst for fixed income strategies at Morningstar, said controlling spending would be a "better long-term solution" from the perspective of bond investors.

Andrew Wishart, UK economist at Berenberg Bank, warned: "[A] smaller, messier, backloaded fiscal tightening risks a negative market reaction."

Morgan Stanley economist Bruna Skarica expressed similar concerns, saying traders might question whether delayed tax rises would ultimately be delivered.

These concerns follow reports that the Chancellor plans to rely on future revenue generated through maintaining the income tax threshold freeze, raising doubts about the credibility of deferred fiscal consolidation.

More From GB News