Rachel Reeves 'mansion tax' to slap households with £4,500 council bill in Budget overhaul

How could Rachel Reeves' mansion tax affect the housing market? |

GB NEWS

The Chancellor is understood to be planning a surcharge on wealthy properties as part of her Budget reforms

Don't Miss

Most Read

Chancellor Rachel Reeves is understood to be considering reforms in her upcoming Budget which could slap households with an average £4,500 "mansion tax" bill.

The Treasury is said to be exploring a surcharge on more than 100,000 of the UK's most expensive homes to help balance the books, however Ms Reeves appears to be watering down her initial property tax reforms to ease the blow on those affected.

Reports suggest the levy will now target approximately 150,000 properties valued above £2million, rather than the originally planned 300,000 homes worth more than £1.5million.

Ministers have reportedly scaled back the proposals due to worries about the impact on homeowners who possess valuable properties but lack liquid assets.

The Chancellor is understood to prepping her 'mansion tax'

|GETTY

The tax aims to generate between £400million and £500million as the Labour Government attempts to address a £20 billion deficit in public finances.

Ms Reeves is anticipated to reveal the "mansion tax" measure in November 26's fiscal statement, alongside various other revenue-raising initiatives.

This new levy will be incorporated into council tax charges, with properties in bands F, G and H undergoing revaluation to identify eligible households.

Despite this move, implementation remains distant, with the tax unlikely to take effect before 2028 once the revaluation process finally concludes.

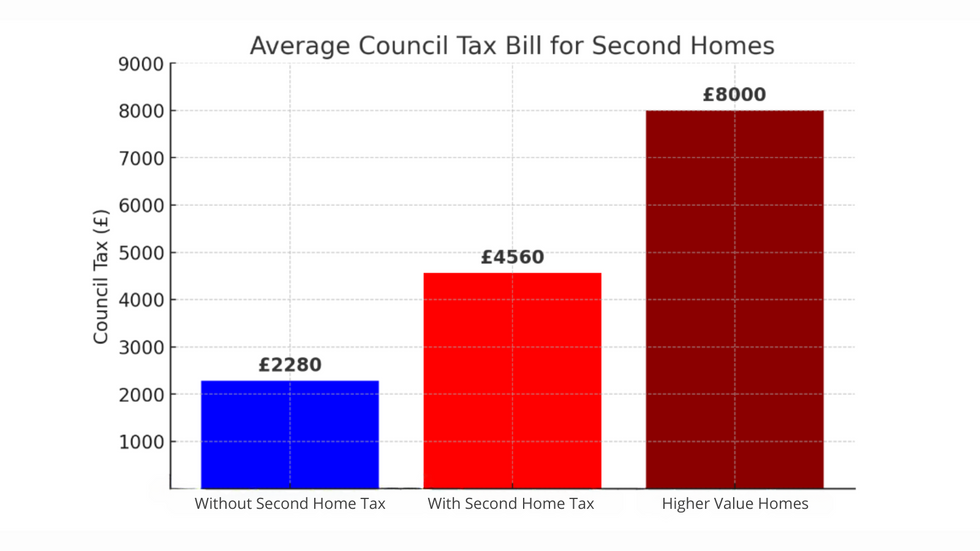

Council tax bills before and after second home tax | GBN

Council tax bills before and after second home tax | GBNTo prevent British homeowners from being forced to sell their properties to meet the tax obligations, the Government will reportedly permit deferrals.

It is understood that property owners in the UK will be able to postpone payment of the "mansion tax" until they either sell their homes or pass away.

The Office for Budget Responsibility (OBR) has indicated that the such as levy could decelerate property market activity, according to the fiscal watchdog's assessment.

A Whitehall source stated: "The OBR has factored in a behavioural response to this with a knock-on effect on the housing market. It has a wider impact."

Notably, property industry observers argue the measure could jeopardise Labour's ambitious target to construct 1.5 million homes during this parliament.

The potential market slowdown represents a significant challenge to the Government's housing objectives, which has been a central aim since Prime Minster Keir Starmer entered Number 10 Downing Street last year.

Property market experts have voiced concerns about the proposals' potential consequences on the wider market, and prospective buyers and sellers.

Lucian Cook, head of UK residential research at Savills, told The Times: "You don't want to undermine the housing market at a time you're trying to build 1.5 million homes.

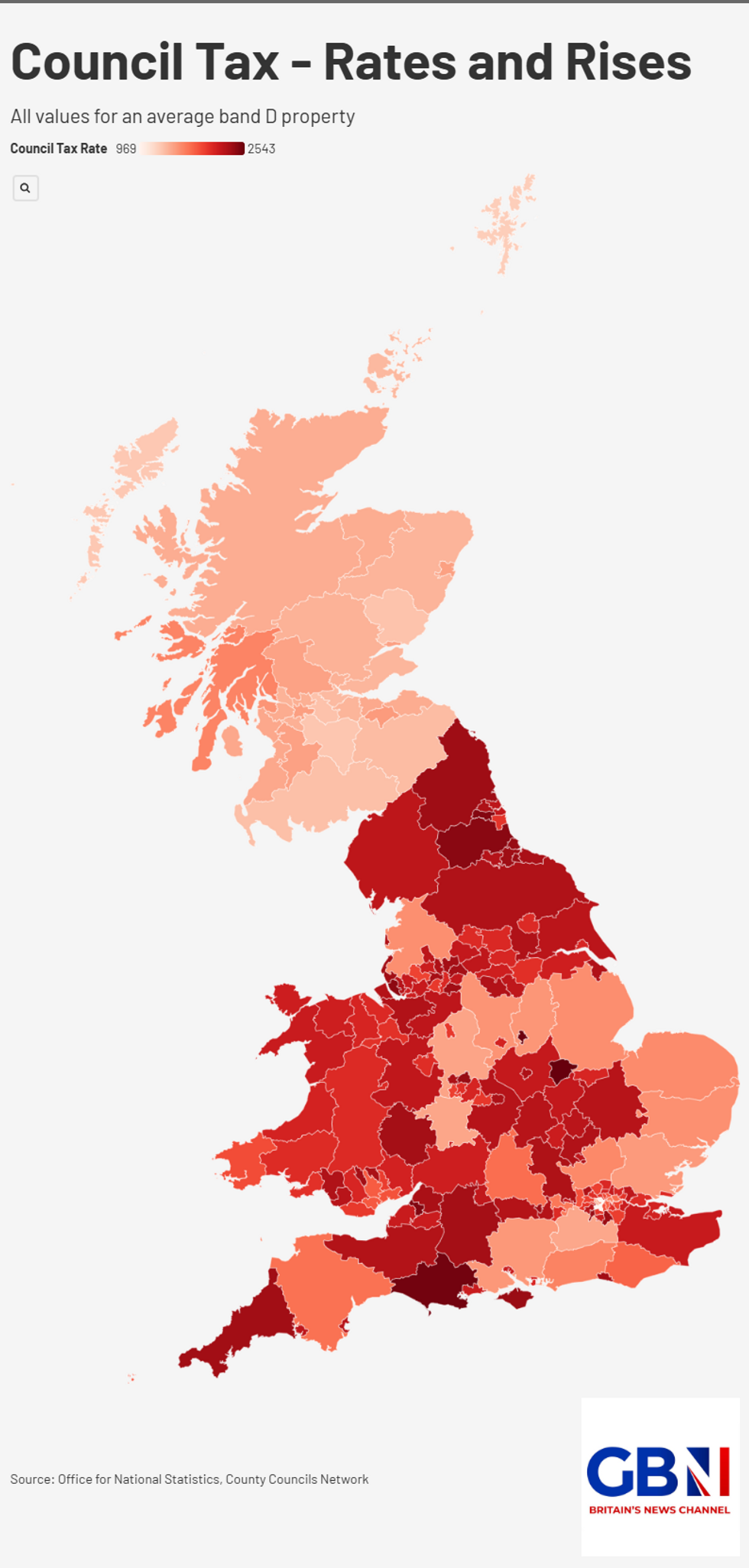

Council tax rates across Britain | GBN

Council tax rates across Britain | GBN"There is a risk there will be a trickle down from the top of the market. If they went too punitive there is also a risk of more capital flight.

"This is a compromise measure which looks much more about righting the perceived wrongs of the existing council tax system rather than looking to raise significant revenue."

Tom Bill, the head of UK residential research at Knight Frank, warned of prolonged uncertainty during the revaluation period.

He shared: "Initially while the revaluation process takes place there will be uncertainty around particular price points for buyers and sellers. It will throw a spanner in the works of those sorts of negotiations."

More From GB News