Best Lifetime ISAs available right now: Savers can get £1,000 boost plus 4.25 per cent interest rate

Lifetime ISAs are a type of tax-free savings account which offer a 25 per cent government bonus

|GETTY

Lifetime ISAs can be a helpful way for people to save for their first home or retirement tax-free

Don't Miss

Most Read

Lifetime ISAs are a type of tax-free savings account, which offer a 25 per cent government bonus worth up to £1,000 a year.

As well as meeting ISA allowance rules, there are specific restrictions to be aware of before savings with a Lifetime ISA.

For instance, a saver needs to be aged 18 or older but under 40 to open a Lifetime ISA, and savers can only put money into the account until they turn 50 years old. Lifetime ISA holders must make their first payment before turning 40.

People can put up to £4,000 into a Lifetime ISA each tax year, although this falls within the £20,000 annual ISA limit.

Lifetime ISAs may be used by first-time buyers, provided they and their purchase are eligible

|PA

The government adds a 25 per cent bonus to the savings of up to £1,000 per tax year.

As this tax-free savings option is intended to help people save for their first home or retirement, there are restrictions regarding withdrawing money from a Lifetime ISA.

People can withdraw the money if they’re buying their first home and it’s a qualifying purchase, aged 60 or older, or terminally ill with less than 12 months to live.

Otherwise, the Lifetime ISA saver must pay a withdrawal charge of 25 per cent – which intends to recover the government bonus that has been applied but it means savers can lose some of their original deposit.

People with a Help to Buy ISA should note they can only use the Government bonus from one of the two accounts to buy their first home.

Lifetime ISA savers can also earn an interest rate on the money in their account, and there is currently an option which pays more than four per cent AER.

Moneybox’s Cash Lifetime ISA offers a 4.25 per cent AER, which includes a bonus.

In second place is Nude Finance Ltd’s Cash Lifetime ISA, paying 3.80 per cent.

Bath Building Society’s Lifetime ISA (LISA) pays 3.79 per cent.

LATEST DEVELOPMENTS:

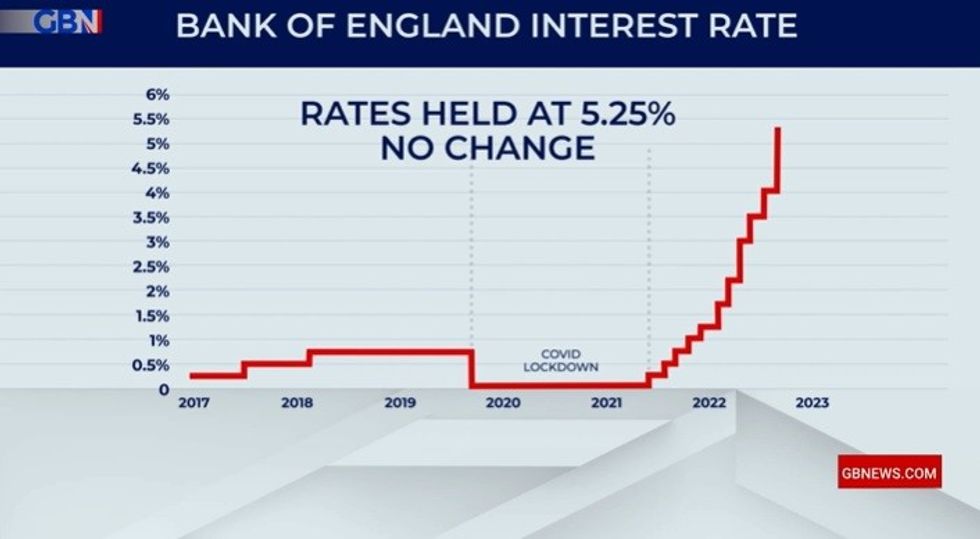

The Bank of England Base Rate has increased 14 consecutive times

|GB NEWS

GB News has listed the top seven Lifetime ISA options based on interest rates, according to the seven products Moneyfactscompare.co.uk found to compare.

Best interest rates for Lifetime ISAs

- Moneybox Moneybox Cash Lifetime ISA – 4.25 per cent AER

- Nude Finance Ltd Cash Lifetime ISA – 3.80 per cent AER

- Bath Building Society Lifetime ISA (LISA) – 3.79 per cent AER

- Paragon Bank Cash Lifetime ISA – Issue 3 – 3.51 per cent AER

- Beehive Money Online Lifetime ISA – 3.50 per cent AER

- Skipton Building Society Online Cash Lifetime ISA Issue 4 – 3.25 per cent AER

- Newcastle Building Society Newcastle Cash Lifetime ISA (Issue 3) – three per cent AER