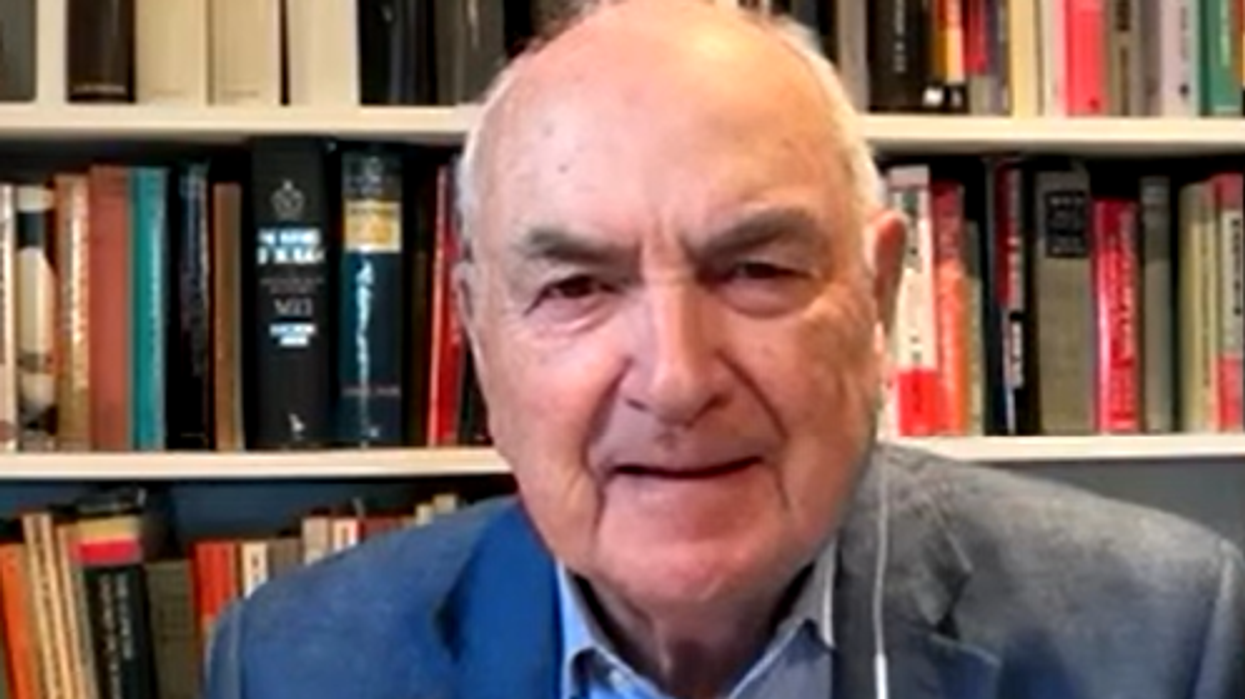

GB News Economics and Business Editor Liam Halligan has spoken out on an investigation revealing the extent of debanking in the UK.

It comes after MPs raised concerns over the treatment of small businesses by major banks after figures showed more than 140,000 accounts were shut down by lenders over the past year.

An inquiry into access to finance saw the Treasury Committee gather information from eight banks, including the so-called big four, on the number of business accounts being shut down.

Liam says GB News will be investigating the issue closely as he fumed at big banks not being “bothered” to deal with “smaller companies that are less profitable”.

“We all remember when Nigel Farage was debanked by Coutts, owned by NatWest and the CEO of NatWest ended up standing down”, he said.

“It seems that some of the big clearing banks, the big High Street banks are also now debanking small and medium size businesses.”

He added: “We're going to be looking at that here on GB News.

“We're going to be investigating because we don't like the idea that lots of companies are losing their bank accounts simply because the big banks can't be bothered to deal with smaller companies that are less profitable.

“These are the companies that are the lifeblood of the British economy. These are the companies that make our economy work, generating all kinds of services, all kinds of goods and indeed tax revenue that pays for our public services.

“So we will be on the money looking at this issue on the behalf of you, GB news viewers and listeners.”