DVLA warns drivers of huge fines for car tax issue ahead of major rule change

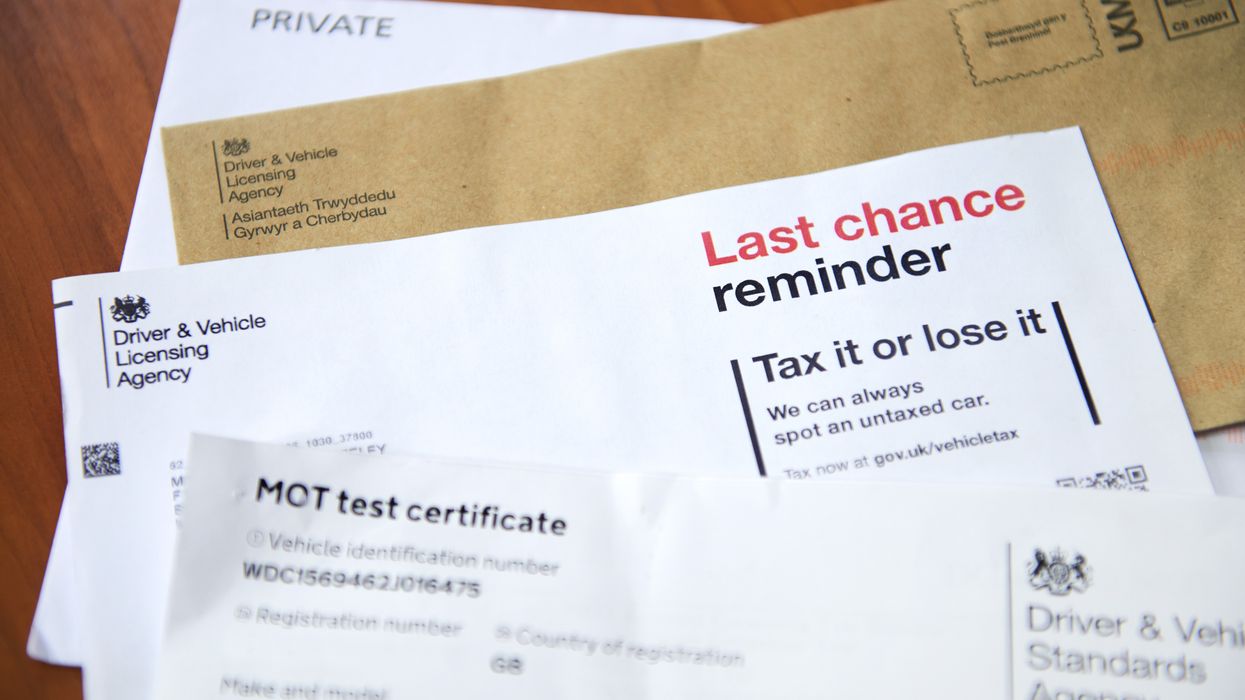

Drivers will receive a DVLA "last chance" letter if their car tax is running out soon

|GETTY

Electric vehicles will be required to pay car tax from 2025 after an announcement last year

Don't Miss

Most Read

The Driver and Vehicle Licensing Agency (DVLA) has issued an important warning to drivers across the UK, urging them to renew their vehicle tax with major changes set to be introduced in just over a year.

The DVLA frequently reminds drivers to renew their car tax, saying that it is easy to tax and hard to hide, with motorists potentially being fined for not renewing.

Posting on X, formerly known as Twitter, the DVLA wrote: “Remember to pay your vehicle tax before it runs out.”

This was accompanied by the GOV.UK website link to renew their car tax and the hashtag #TaxItDontRiskIt.

WATCH NOW: Labour on the future of electric cars

If a driver does not renew their car tax and gets flagged, they will receive an automated letter and a fine of £80, although they will not get any points and the fine will be reduced if paid within 28 days.

If they fail to pay the fine, the case could go to court, with motorists risking a £1,000 fine if prosecuted.

The DVLA also has the power to clamp people’s vehicles until the correct amount of tax is paid to cover the car.

Drivers wanting to tax their vehicle again will need to take a reference number from a “last chance” warning letter, their V5C vehicle log book or the green “new keeper” slip from a log book if the vehicle has just been purchased.

Even if a vehicle does not have to pay any car tax, it must still be taxed to make it road legal.

Vehicles like zero emission cars and classic cars over 40 years old do not pay any Vehicle Excise Duty (VED), although drivers still have to tax them.

Owners of vehicles that cost more than £40,000 must pay an extra £390 a year thanks to the “luxury vehicle tax”, which applies for five years.

New rules are set to be introduced in the coming years with changing car tax rates, as well as the Government starting to charge electric cars.

In the Autumn Statement in November 2022, Chancellor Jeremy Hunt announced that electric vehicles would be eligible to pay car tax.

He stated this move was being done after the Office for Budget Responsibility forecasted that half of all new vehicles would be electric by 2025.

The MP for South West Surrey said: “To make our motoring tax system fairer I have decided that from April 2025 electric vehicles will no longer be exempt from Vehicle Excise Duty.

“Company car tax rates will remain lower for electric vehicles and I have listened to industry bodies and will limit rate increases to 1ppt a year for three years from 2025.”

From this point, new zero emission vehicles registered on or after April 1, 2025, will be liable to pay the lowest first-year rate of tax which costs £10 a year.

Under the new rules, drivers would pay £180 a year after the second year of registration, when they will be moved to the standard rate.

LATEST DEVELOPMENTS:

Drivers could see their vehicles clamped if they do not pay car tax

|PA

Speaking at the time, Nicholas Lyes, head of policy for the RAC, said it was “probably fair” for EV drivers to start getting taxed, adding that it likely wouldn’t affect the uptake of electric cars.