HMRC update could see 100,000 fewer petrol and diesel cars on UK roads amid major tax overhaul

Changes to Employee Car Ownership Schemes have been pushed back to April 2030 following backlash from drivers

Don't Miss

Most Read

Latest

HMRC has come under fire after ministers were forced to delay a controversial clampdown on Employee Car Ownership Schemes (ECOS) following a backlash from the British car industry.

The changes, first announced in July, would have hit thousands of workers with new tax bills and threatened jobs across the automotive sector.

But after pressure from firms and unions, the Government has now delayed the reforms until April 2030, with a transition period running to 2032.

Speaking in the House of Lords, Labour's Lord Woodley said the delay raised serious questions about HMRC's original assessment of the damage the plans would cause.

He warned: "These proposals would reduce production by 100,000 vehicles a year, cost 5,000 automotive jobs and hardly put a penny extra into the Treasury's coffers. This begs the obvious question: what assessment was made when these proposals were mooted?"

He also urged ministers to consider scrapping the plans altogether rather than simply postponing them. Responding for the Government, Business and Treasury Minister Lord Stockwood confirmed the climbdown.

He told peers: "We have listened carefully to these concerns, which is why we have delayed the proposed changes until 2030, with a transitional period to 2032."

He also admitted the policy would hit parts of the car industry, saying: "After April 2030, it is expected to have some economic impact on businesses and employers… This impact is predominantly concentrated on the motor manufacturer and motor dealerships industries."

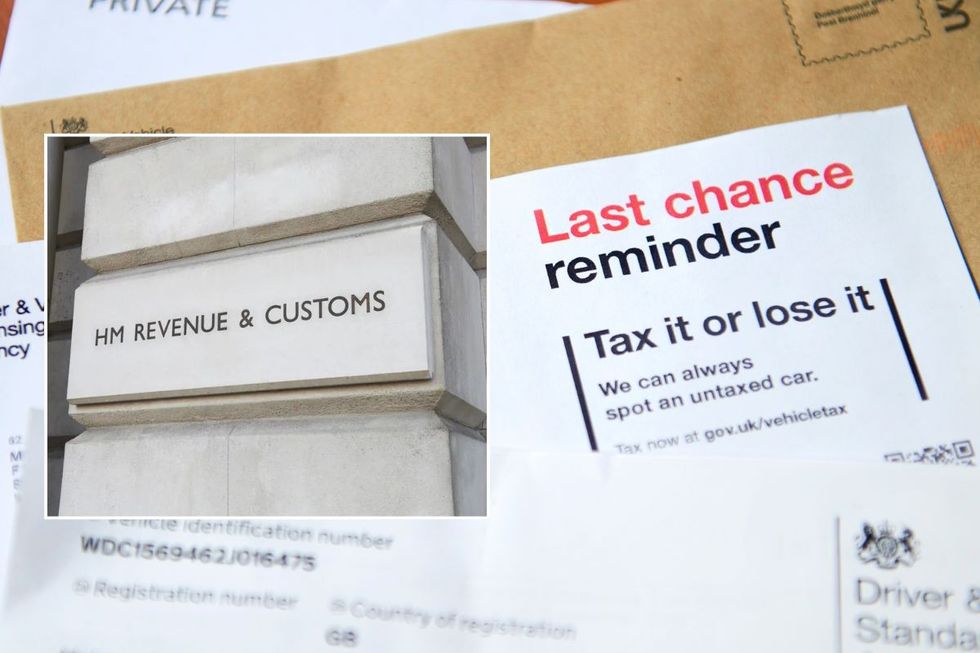

Motoring organisations have challenged HMRC on its car tax decision | PA/GETTY

Motoring organisations have challenged HMRC on its car tax decision | PA/GETTYLord Stockwood insisted ministers were still backing the industry, pointing to "an additional commitment of £2.5billion for automotive investment into R&D", more flexibility in electric vehicle targets and a funded rollout of new charging points. He added that electricity costs for energy-intensive factories would be cut.

Despite the delay, HMRC has not dropped the plan. Official documents show that around 76,000 people will eventually be forced to pay income tax on cars currently provided under ECOS, with around 1,900 companies directly affected.

The Treasury previously claimed the measure would raise £275million in its first year, followed by £220million, £195million and £175million in later years — figures now expected to be revised because of the delay.

The debate also triggered a wider row over electric vehicle policy and the future of Britain's car industry. Conservative peer Lord Forsyth of Drumlean accused the Government of waging war on traditional car manufacturing.

LATEST DEVELOPMENTS

Ministers warned that the HMRC update would impact around 76,000 people

| PAHe told the chamber: "The car industry in our country is being destroyed by this determination to prevent it from manufacturing vehicles with internal combustion engines beyond a particular date."

He warned ministers they were "creating a market for cheap Chinese electric vehicles, at the expense of some of the best engines in the world."

Lord Stockwood pushed back, insisting he was "in constant conversation" with colleagues and claiming ministers were "firmly committed to the automotive sector" while meeting climate targets.

The row expanded to electric vehicle taxes. Tory peer Lord Harlech asked how plans to tax electric cars "per mile" would work in practice.

The Labour minister called on the Government to scrap the ECOS tax altogether

|PARLIAMENT UK

Lord Stockwood replied: "Motoring taxation is a critical source of funding" and insisted that "all vehicles shall contribute fairly to the wear and tear of the roads."

Hybrid drivers also raised concerns. Lord Sentamu asked whether they would face double taxation.Lord Stockwood said: "Hybrid vehicles are going to be taxed at half the rate, which is 1.5p a mile, as opposed to 3p a mile."

Conservative Baroness Neville-Rolfe welcomed the delay but warned of hidden costs, saying there were industry claims of "a substantial loss to the Exchequer" once job losses and lost VAT were counted.

Asked whether the Treasury's sums were right, a newly appointed Lord Stockwood admitted: "Some three months into a new role, I am as confident as I can be about anything."

He insisted current projections showed "it should not have a negative impact" and that the Government have a commitment to "our climate goals, while balancing fairness in our tax take".