Driving law changes to hit the UK within days impacting owners of petrol, diesel and electric vehicles

The advisory fuel rate is monitored by HMRC and changes every three months

| PA

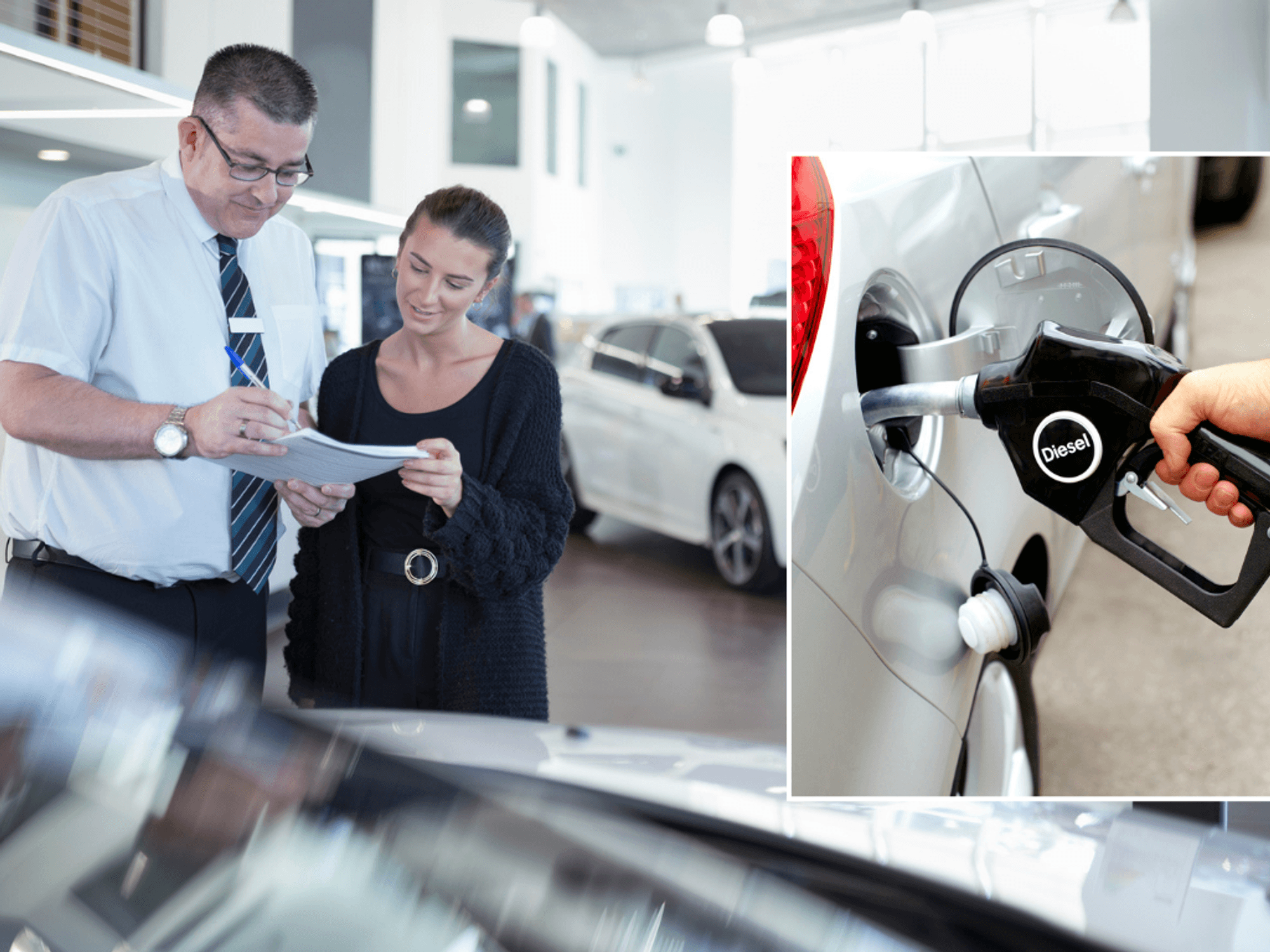

The advisory fuel rate changes on a quarterly basis

Don't Miss

Most Read

Latest

Major motoring changes are set to come into force in a few days affecting drivers across the UK who drive petrol and diesel cars.

The advisory fuel rate used as guidance by businesses paying for mileage on company cars will increase from June 1 later this week.

The "per mile" rate is currently set at 13p meaning employees can claim back this amount every time they travel for work.

However, as drivers continue to be hit with high petrol and diesel prices, they are spending more on filling up, with the new rate aiming to give motorists more value for their pay.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Electric vehicles will have a 1p cut to the advisory fuel rate

| PAFrom June 1, the new rate will increase to 14p per mile for petrol cars with a 1,400cc or less engine, 16p for engines between 1,401cc to 2,000cc and 26p for engines over 2,000cc.

As for diesel cars, the price per mile also increases by 1p. Engines with a size of 1,600cc or less will pay 13p, engines between 1,601cc and 2,000cc are charged 15p and motorists over this limit will pay 20p.

As for electric cars, the rate has dropped by 1p from 9p in the last three months to just 8p from June. It follows another drop between September and the end of November when costs were 10p.

Hybrid cars, however, will be treated the same as either petrol or diesel cars for advisory fuel rates.

Commenting on the new rates, Darren Miller, car expert at BigWantsYourCar.com, explained that the advisory fuel rates play an important role in managing the costs associated with company car use.

He stated that these rates, which are reviewed quarterly by HMRC, provide a “standardised framework” for reimbursing employees for business travel or calculating repayments for private fuel use.

By aligning with these rates, employers can ensure compliance with tax regulations while also managing company car expenses.

Coupled with the introduction of an advisory electric rate for fully electric cars, Miller said the new rates mark a “significant development in fuel reimbursement practices”.

The hybrid car guidelines also help make sure cars are “consistent and compliant” with tax regulations while still accommodating the growing popularity of hybrid vehicles, Miller added.

Mille commented: “It is clear that the rates need significant revisions to ensure fair compensation for everyone affected.

“Employers and employees should adapt to these changes and incorporate electric rates into their reimbursement policies to encourage the use of eco-friendly transportation solutions.

"Understanding and following the rates is important for managing tax liabilities and expenses associated with company car use.”

LATEST DEVELOPMENTS:

Drivers were overcharged by £900million at the pumps last year | PA

Drivers were overcharged by £900million at the pumps last year | PAHMRC detailed how the rates only apply to employees using a company car who should use them when reimbursing employees for business travel in their company cars.

They should use the rates when repaying the cost of fuel used for private travel but are warned not to use these rates in any other circumstances.